TABLE OF CONTENTS

MARKET RECAP: Former Fed President Jeff Lacker on Trump tariffs

EQUITIES: Trivariate Research’s Adam Parker on the market crash

EQUITIES: Michael Gayed on what to buy when the market bottoms

EQUITIES: Clem Chambers says “there is no bottom” in this market

GEOPOLITICS: Former CIA agent Ray McGovern on why Iran is not a threat

What To Watch

MARKET RECAP

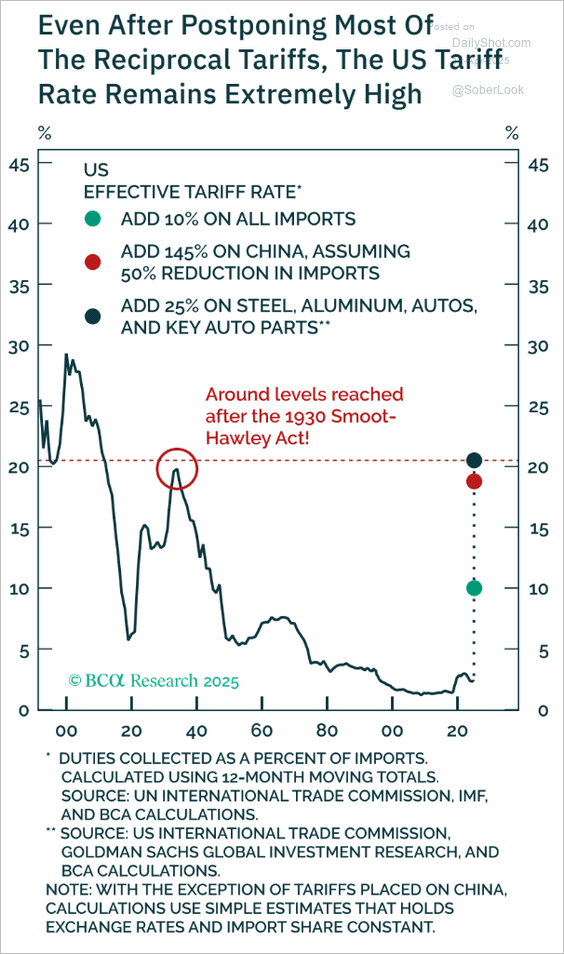

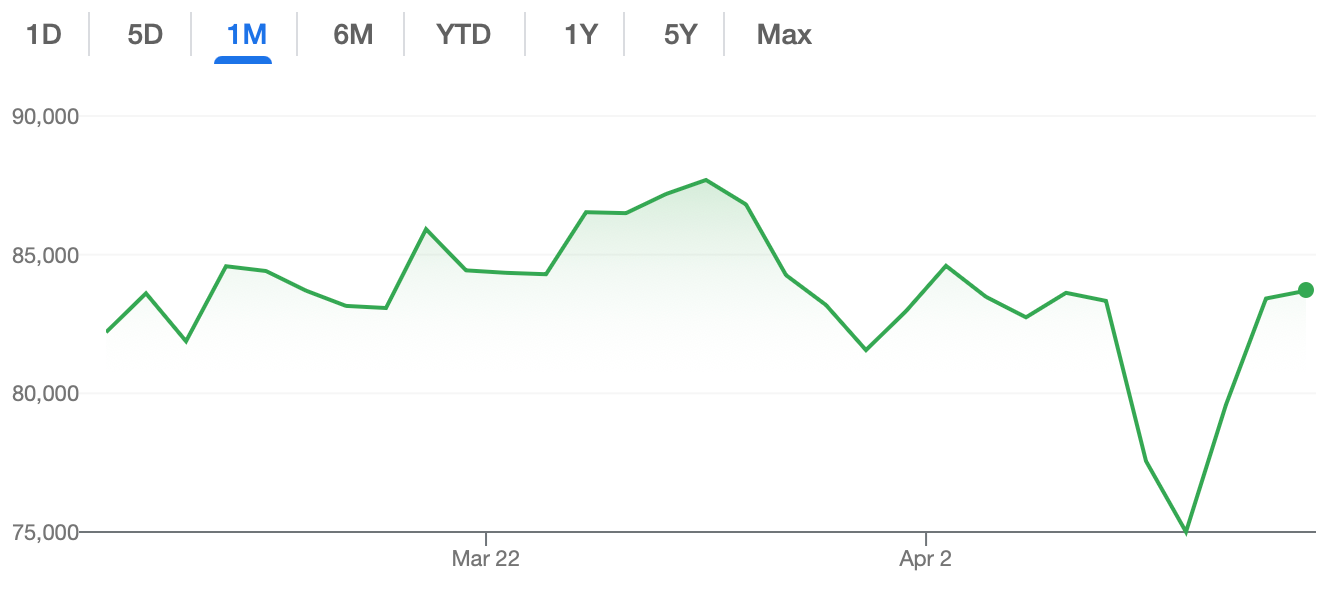

Latest News. The past week was one of the most volatile for markets in American financial history. The Nasdaq, the S&P 500, and the Dow Jones ended the week up 5 percent or higher, after having shed trillions of dollars in market capitalization in the prior week.

All three indices fell after President Trump increased tariffs on over 180 countries on April 2nd. The S&P alone erased $6 trillion in value.

Thanks for reading! Subscribe for free to receive new posts and support my work.

On April 9th, Trump abruptly paused tariff increases for 90 days. Most countries will continue to be charged 10 percent duties, but this is a significant decrease from Trump’s previously-proposed tariff rates.

After Trump’s tariff pause, markets rallied, ending the week higher. Treasury Secretary Scott Bessent praised the president’s move, saying that more countries are now willing to negotiate trade deals.

One exception to the tariff pause is China, which will continue to be charged a 125 percent tariff, according to the White House.

Jeff Lacker, Senior Affiliated Scholar at the Mercatus Center and Former President of The Richmond Fed, said that The White House’s trade policy has hampered its economic objectives.

“Either the administration has had a secret plan to do this in order to induce negotiations, or… to reduce trade deficits,” he said. “Now that they’ve sort of revealed that they’re going to negotiate after having said, well no, they’re not going to negotiate… they’ve sort of undercut their own credibility.”

Lacker said that Trump’s trade policy could adversely affect long-term trade relations with the U.S.’s partners.

“[This is] bound to lead other countries, that still favour lower trade barriers, to combine with each other into trading blocs,” he explained. “They’re going to want to find partners to trade more freely with, I think.”

Although Lacker said that the U.S. dollar’s role as world reserve currency is not currently under threat, further market volatility could undermine the dollar’s status.

“The widespread invoicing in U.S. dollars, I think, is going to continue to bolster the value of the dollar as a reserve currency,” he said. “Threats to its [are] kind of a little distant still, but yeah if this… whipsawing of markets persists I think that that could erode it more rapidly over time than it would otherwise erode.”

Market Movements

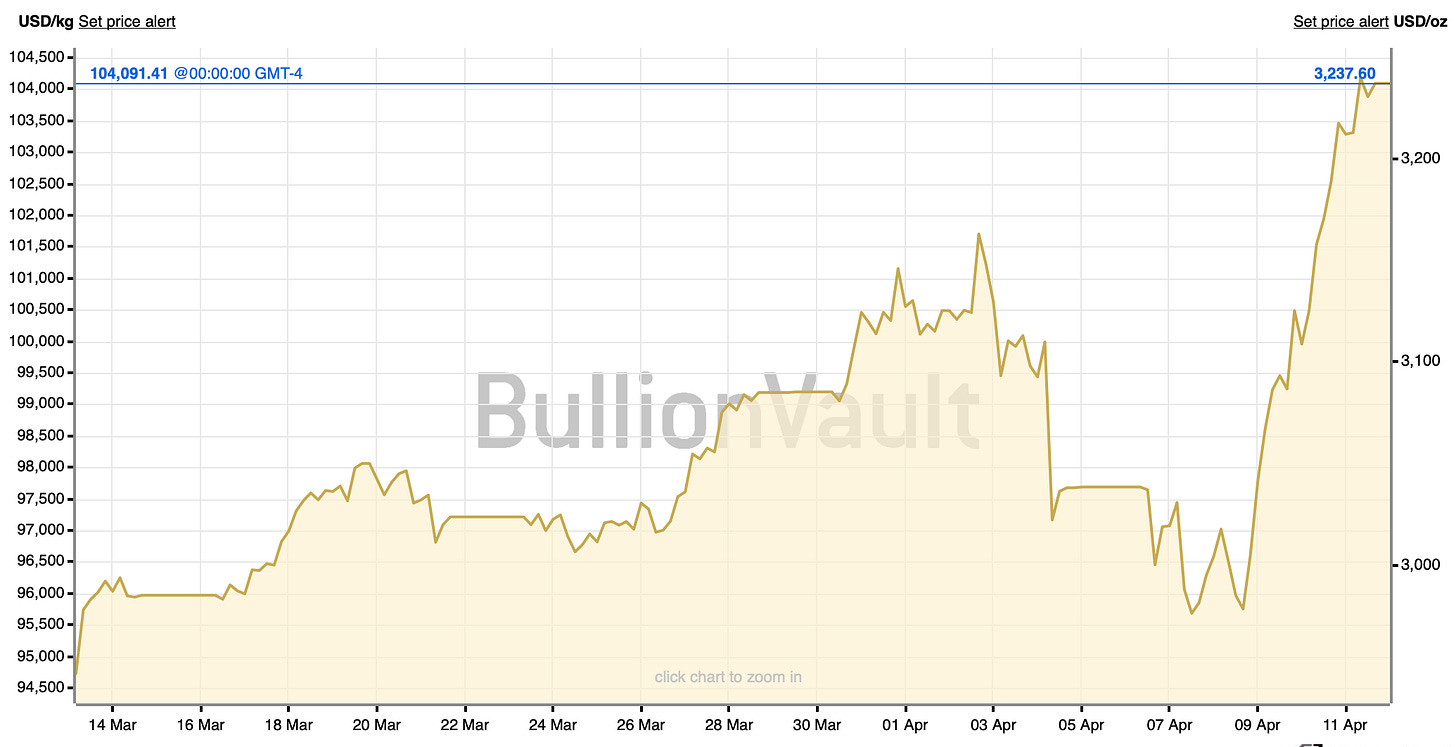

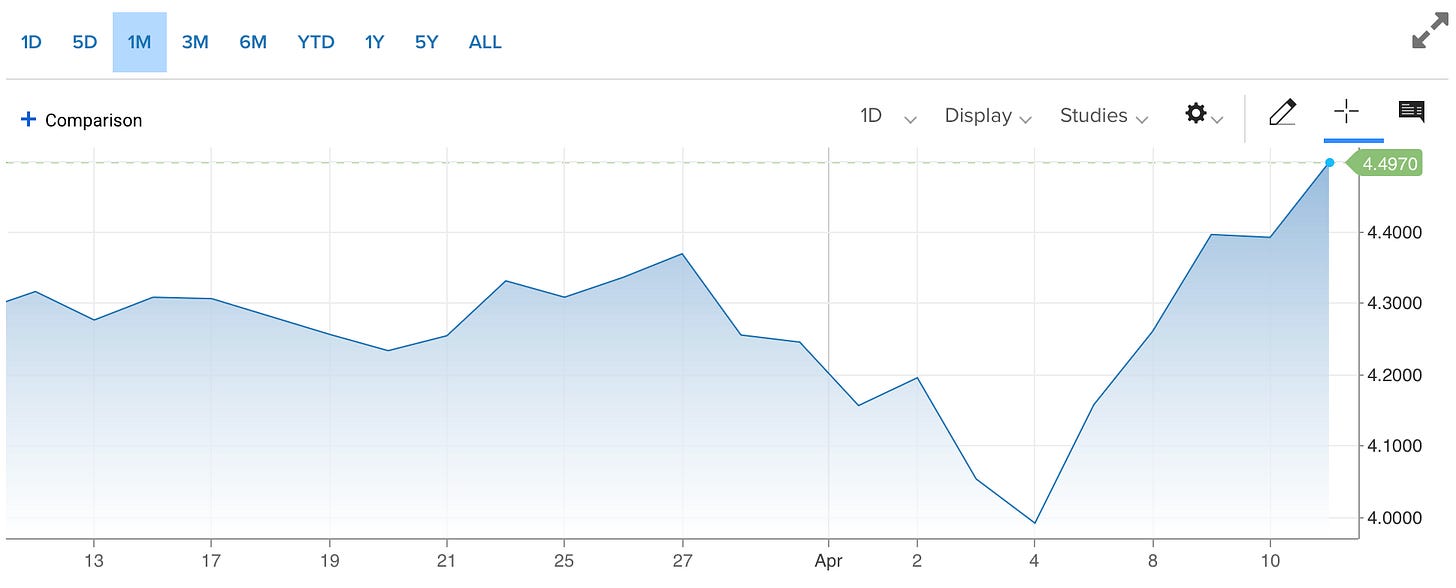

From April 4th to April 11th, the following assets experienced dramatic swings in price. Data are up-to-date as of April 11th at 9pm ET (approximate).

Newsmax — down 49.2 percent.

Papa John’s — down 12.3 percent.

Palantir Technologies — up 19.6 percent.

Newmont — up 21.2 percent.

Hecla Mining — up 22.5 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — down 3.1 percent.

Bitcoin — up 1.2 percent.

Gold — up 4.1 percent.

10-year Treasury yield — up 12.8 percent.

S&P 500 — up 5.7 percent.

Russell 2000 — up 1.8 percent.

USD/yuan — up 0.4 percent.

EQUITIES:

MARKET CRASH STARTING, HERE’S WHAT’S NEXT

Adam Parker, April 7, 2025

Adam Parker, Founder of Trivariate Research, said that the damage from The White House’s tariffs may prevent a bullish outlook on markets for the rest of the year.

“At this point it just feels very skewed to the negative, in terms of GDP is worse than people thought, the earnings haven’t come down that much, and stocks aren’t acting great when they miss,” he said. “That cocktail makes me still cautious about taking a lot of risk for the next two or three weeks at least.”

Parker said that earnings growth is slowing, suggesting that markets could still reach a bottom for this year.

“I don’t think the low is in,” he said. “It’s always hard to make a short-term call. The administration could say something that changes course here pretty soon… but right now, I think the consensus is the Trump puts a lot lower.”

In terms of sector recommendations, Parker said that healthcare looks promising.

“If you look out, medium to long term, there are a lot of inefficiencies in the U.S. healthcare system,” he said. “In the U.S., when you go to a doctor, they still hand you a clipboard with a pen. That should be melting your motherboard on technological inefficiency… The ability to predict customer behaviour, predict employee behaviour, and drive up higher margins should be really high for this sector.”

If a recession occurs, Parker said that healthcare, staples, and utilities do well on a relative basis. He added that a market rally would favour the tech sector over others.

“We analyzed the last twenty times the S&P went down 10 percent or more, and then we looked at the 20 recoveries three months after that,” he said. “In 19 of the 20, technology was up, and on average tech performed best in those recoveries.”

EQUITIES:

BLACK MONDAY 2.0? BLOODBATH IN MARKETS

Michael Gayed, April 7, 2025

Michael Gayed, Publisher of , said that the recent market crash would cause a flight to treasuries, which could in turn allow the U.S. government to refinance its debt at lower yields.

“When you look at major declines in equities, long-duration treasury yields drop, because there’s this moment of panic among investors,” he said. “If you want to get yields lower to refinance these trillions of dollars of U.S. government debt, one way to do it is to make the S&P suddenly look like it’s crashing.”

Gayed said that market lows are difficult to identify, but that there are telltale signs in credit market data.

“I think typically you can identify when you’re close to [a market low] when credit spreads are going through a multi-standard deviation spread widening… which then forces the Fed to act, step in, and liquify,” he said. “You’re not there yet. Credit spreads are still very much disconnected from the magnitude of the S&P 500’s decline.”

Gayed said that small caps would be the next “generational buying opportunity” when markets crash.

“They’ll crash stocks to save bonds,” he said. “The next phase of that is, you save bonds, you save small caps… I think small caps, coming out of this, will be saved, because small caps have been held back by higher rates.”

EQUITIES:

’THERE’S NO BOTTOM TO THIS’ MARKET CRASH

Clem Chambers, April 5, 2025

Clem Chambers, Founder of ANewFN, said that “there’s no bottom” to the latest market crash sparked by Trump’s tariffs.

“A revolutionary American government, that’s the worst possible thing you could possibly have for the market,” he said. “There’s no bottom to this at the moment.”

Chambers said the White House’s hints at leaving NATO threatened the U.S.’s role as a global superpower.

“Nobody’s going to be buying America,” he said. “It’s going to be difficult to spend billions on American equipment in Europe when you’re being cut loose… Europe is now going to be forced to become the definitive superpower, because there are more Europeans than there are Americans, and the GDP per head is very similar.”

Given the tumultuous markets, Chambers said that investors who want to “surf in the hurricane” should allocate to cash, defence stocks, agricultural equities, banks, and precious metals.

“Precious metals… will probably get hurt in the next week or two, because money is just going to come out of the market, and everything is going to fall,” he said. “You sell your gold to make your margin calls… But after that, then I think the precious metals will do very well, and defence stocks will do very well, and banks will do very well weirdly enough — and agricultural stocks will do really well.”

However, Chambers warned that luxury goods and tech would fare poorly.

“Anybody selling Ferraris is going to have a hard time,” he predicted. “You wouldn’t want to be in Louis Vuitton, for example. That’s the sort of thing that’s going to come down like a lead balloon. And all the Mag 7, they’re going to get crushed.”

GEOPOLITICS:

MORE DANGEROUS THAN WORLD WAR 3?

Ray McGovern, April 9, 2025

Ray McGovern, former CIA analyst and Chair of the National Intelligence Estimates, warned that if the United States gets embroiled in a war with Iran, it could lead to World War 3.

“You have a regional capability of this thing blowing out of all proportion,” he said. “Israel, of course has… about 200 nuclear weapons, some of them really small ones. And so the nuclear genie could be let out of the bottle in a last resort because there’s no way that the Israelis, even with U.S. help, can subjugate Iran in the way that the two of them did Iraq back in 2003.”

McGovern said that Iran does not pose a national security threat to the United States. He said that Iran lacks a nuclear weapon, and is not currently developing one.

“The annual threat assessment, barely a week old, by all U.S. intelligence agencies, reads this way: Iran has continued to avoid and has stopped its work on a nuclear weapon as of 2003,” explained McGovern. “The [Iranian] Supreme Leader has also said that the Iranians are not going to reverse that decision that he himself made in 2003.”

The only threat Iran potentially poses is to Israel, added McGovern.

“The Israelis perceive that Iran might pose a threat to them, and so they’re trying to eliminate that threat,” he said.

If a war with Iran occurs, McGovern said that Iran has the ability to both shut down The Strait of Hormuz, an economically important seaway, and to use hypersonic missiles.

“These are missiles that there is no air defence or missile defence against,” said McGovern. “U.S. troops in Iraq [and Syria]… are extremely vulnerable, and I would say they will probably be hit as well [in case of war], if not directly by Iran then by Iran’s surrogates.”

WHAT TO WATCH

Wednesday, April 16, 2025

Thursday, April 17, 2025

Thanks for reading! Subscribe for free to receive new posts and support my work.