$3 Trillion Wiped Out As Stocks Sell Off

TABLE OF CONTENTS

Market Recap: Bill Smead on why the S&P 500 is in a ‘doomed position’

EQUITIES: Jim Bianco on whether the market downturn is just starting

ECONOMY: The economy is ‘going off the cliff,’ says Steve Hanke

ECONOMY: Warren Mosler uncovers the biggest lie about public debt

CRYPTO: The path to $1 million Bitcoin, according to Arthur Hayes

MARKET RECAP

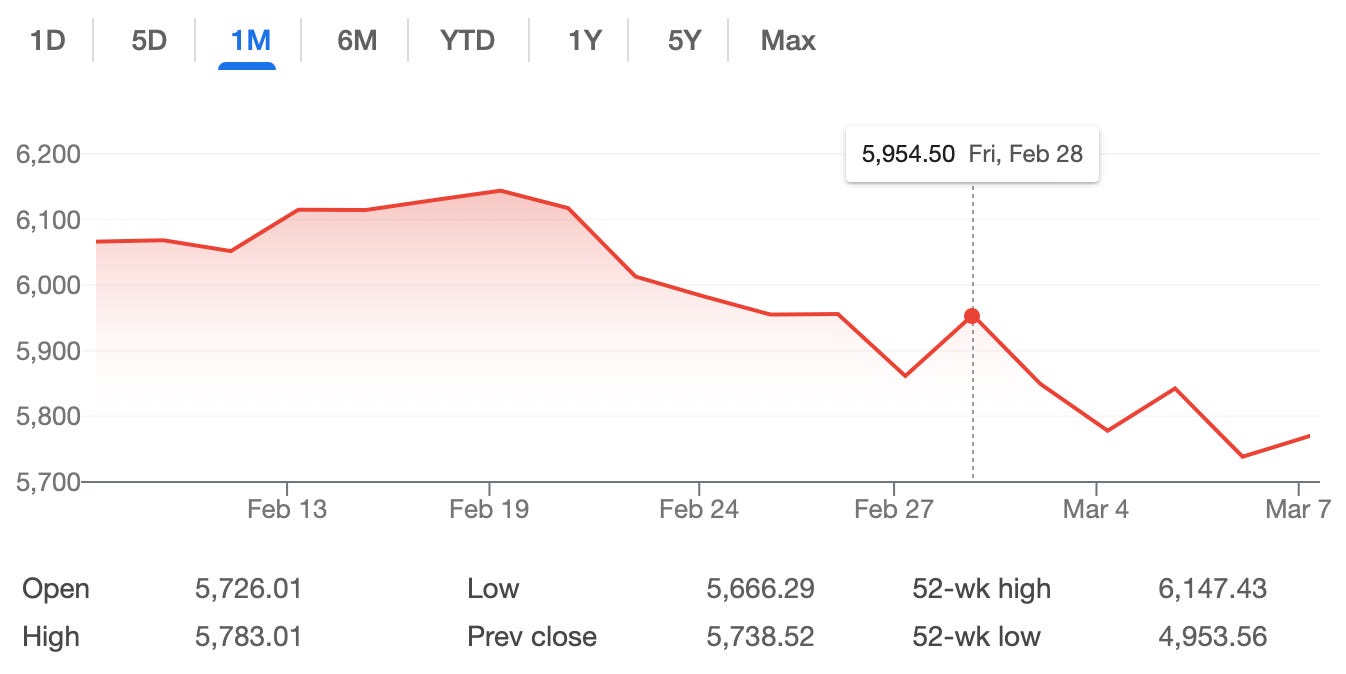

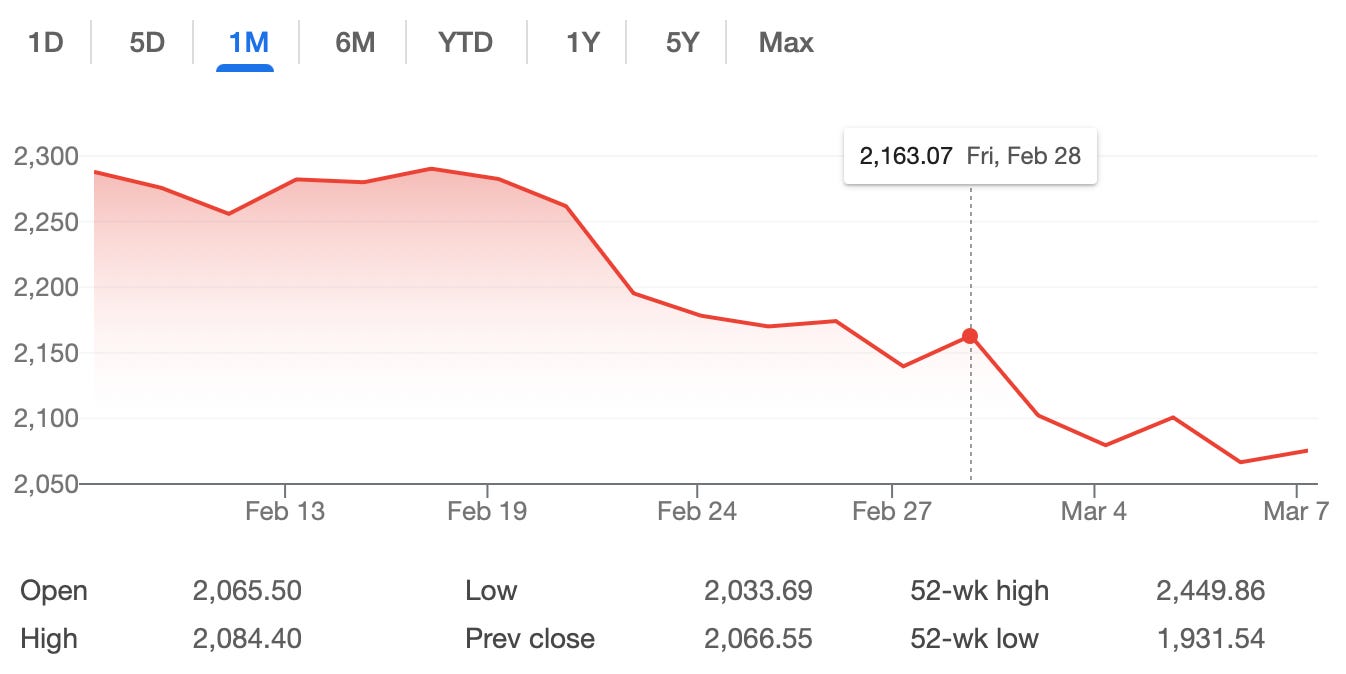

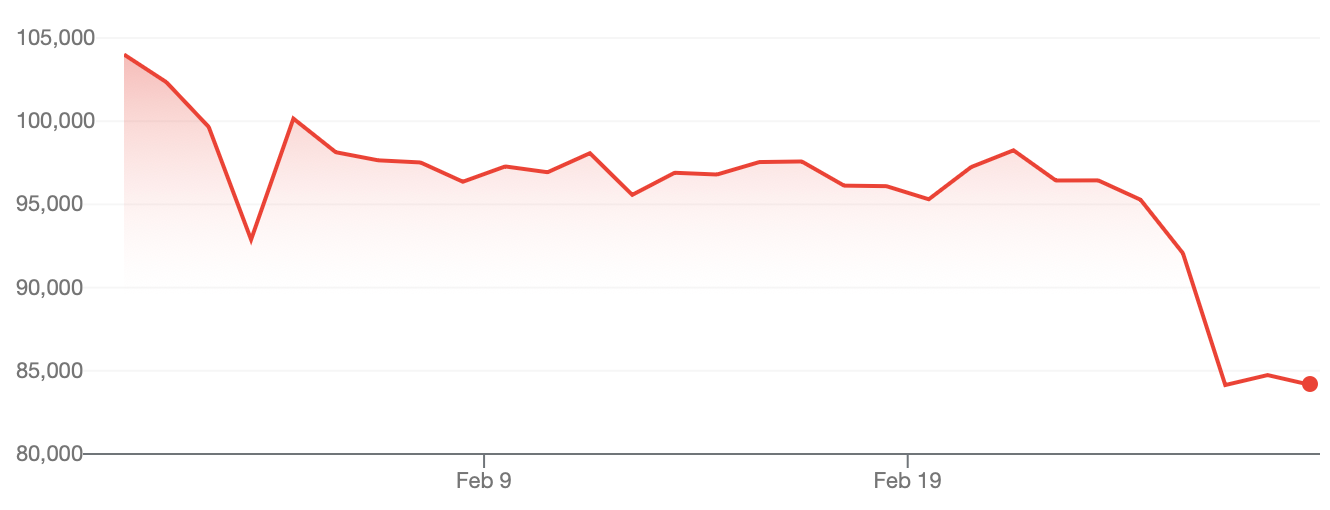

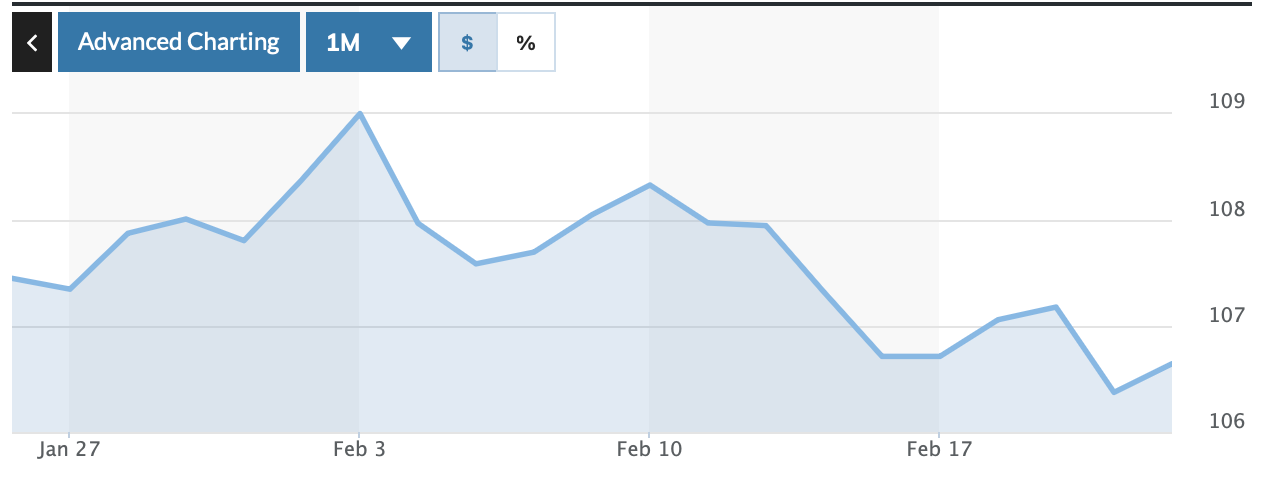

Latest News. The S&P 500 saw its worst week since September 6th, with the index down 3.1 percent since last Friday. The Dow Jones was down 2.4 percent, its worst week since February.

Markets were skittish due to President Donald Trump’s flip-flops on trade. On Tuesday, March 4th, Trump imposed 25 percent tariffs on Canada and Mexico, only to roll back most of the tariffs on Thursday.

Thanks for reading! Subscribe for free to receive new posts and support my work.

The president has said that this tariff pause will be in place until April 2nd.

More than $3 trillion has been wiped out from the S&P since its February 19th all-time high. Tech giants Tesla and Nvidia are driving the loss, losing $322 billion and $712 billion in market cap, respectively.

Bill Smead, Chairman and CIO of Smead Capital Management, said that the S&P 500 is in a “doomed position.”

“[The S&P] got over-concentrated in very aggressive, very popular… common stocks,” he said. “We have been concerned… that we are going to have a lost decade, like we did from 1999 to [2009].”

Smead added that he was concerned about President Trump’s trade policies.

“The President of the United States is violating David Ricardo’s theory of comparative advantage,” said Smead, referring to the 19th Century economist’s theory that free trade is beneficial for all who participate in it.

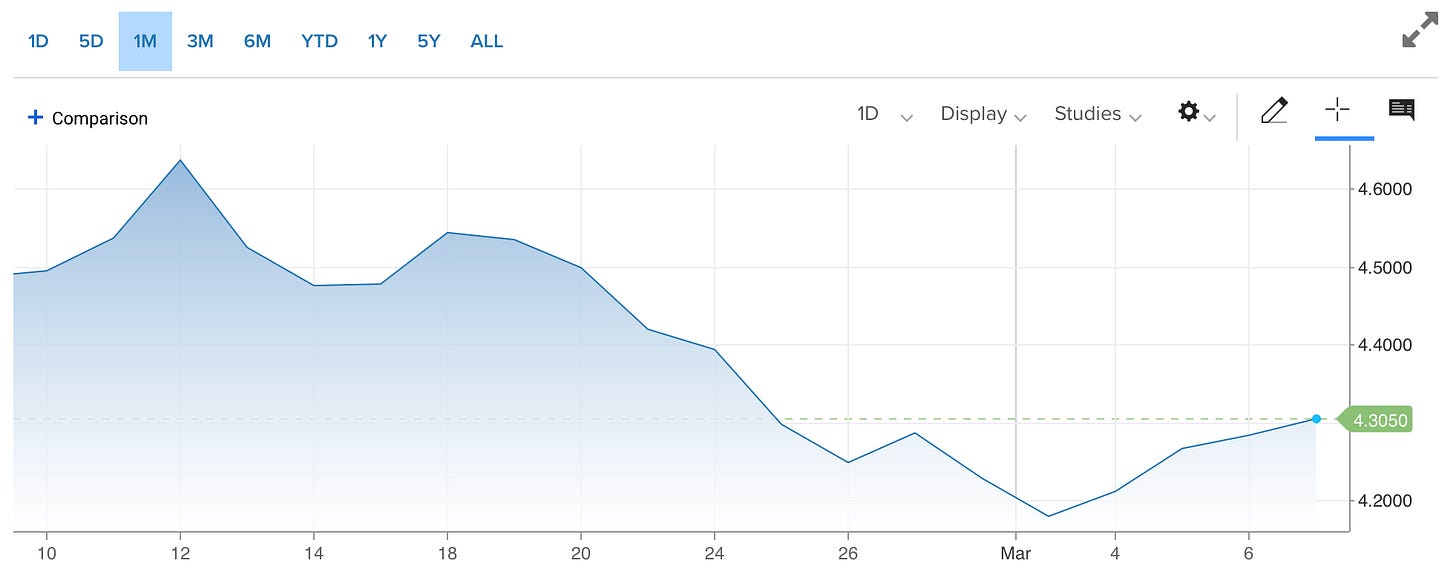

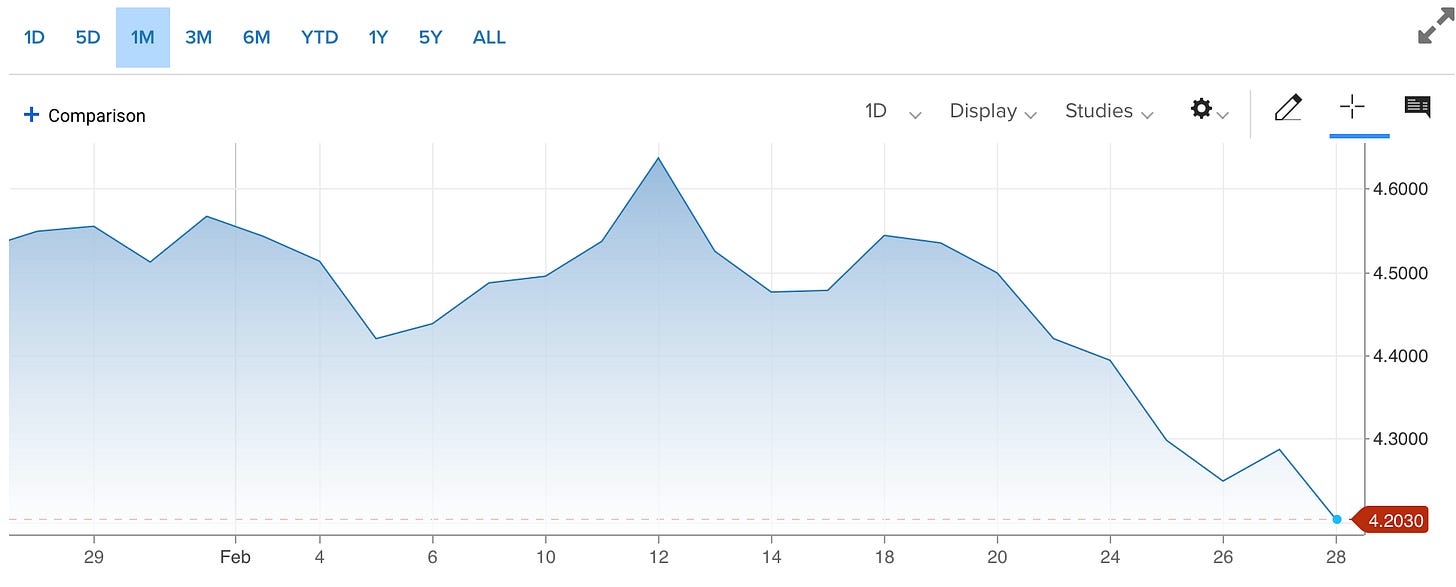

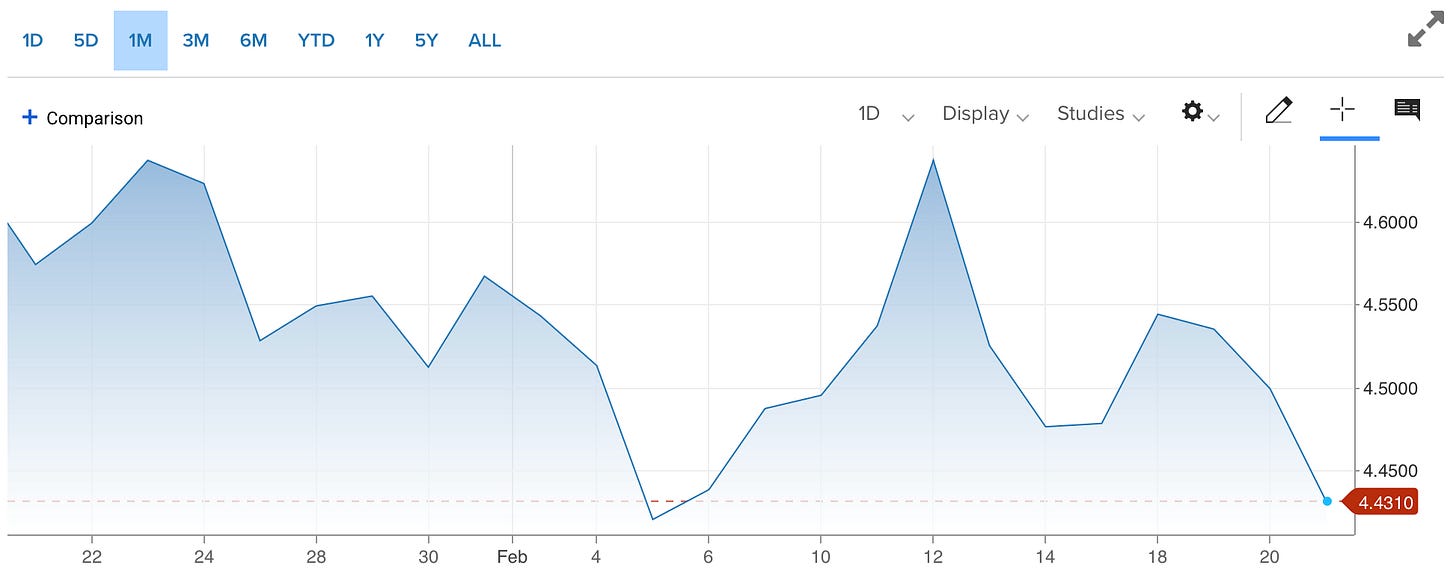

He said that treasuries are in a good position to perform better than U.S. equities.

“We believe that if you make 4 percent in a treasury bond over the next ten years, you will wipe the floor with the S&P index,” he said.

Turning to the energy sector, Smead forecasted that oil prices would rise over the next decade as the resource becomes increasingly scarce.

“Over the next ten years, production from the Permian Basin is going to decline,” he said. “The production, the last 10 years in the Permian Basin, was the swing supply that kept oil prices down… the swing supplier is going to dramatically peter out over the next 10 years.”

Market Movements

From February 28st to March 7th, the following assets experienced dramatic swings in price. Data are up-to-date as of February 7th at 5pm ET (approximate).

Cardano — up 36 percent.

John Wiley & Sons — up 15.8 percent.

Moderna — up 15 percent.

Tesla — down 10.3 percent.

Nvidia — down 9.8 percent.

The following major assets experienced the following price movements during the same time interval.

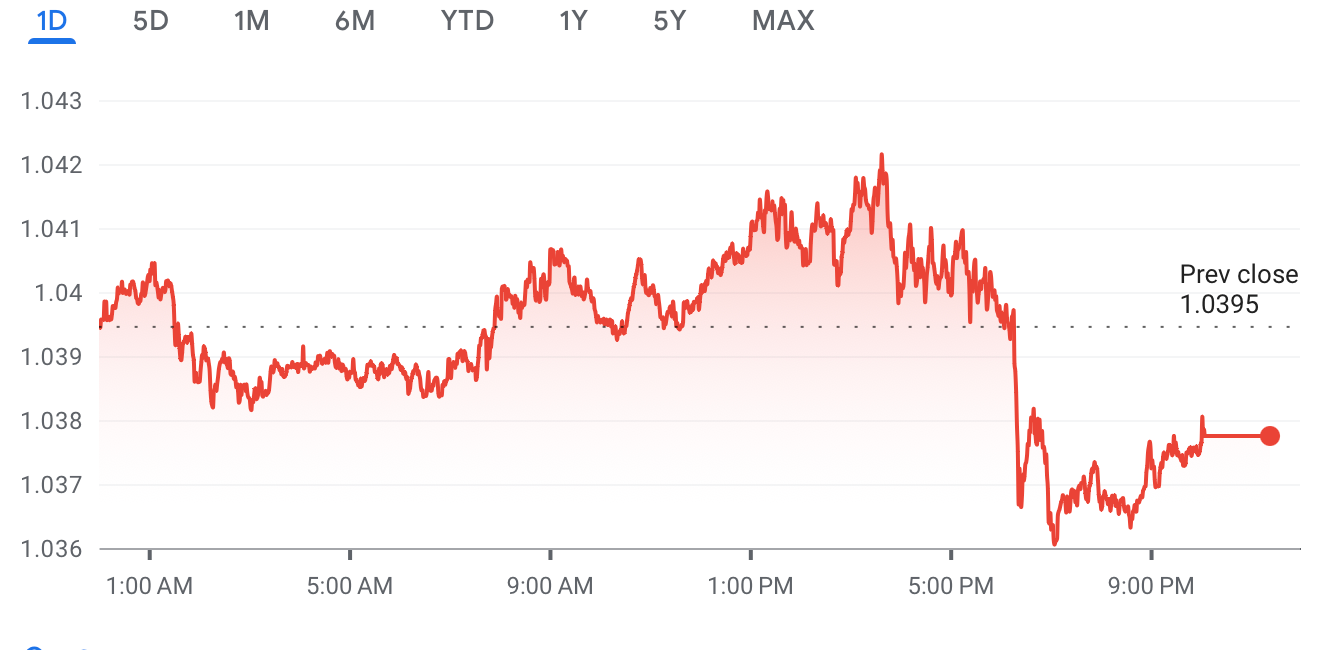

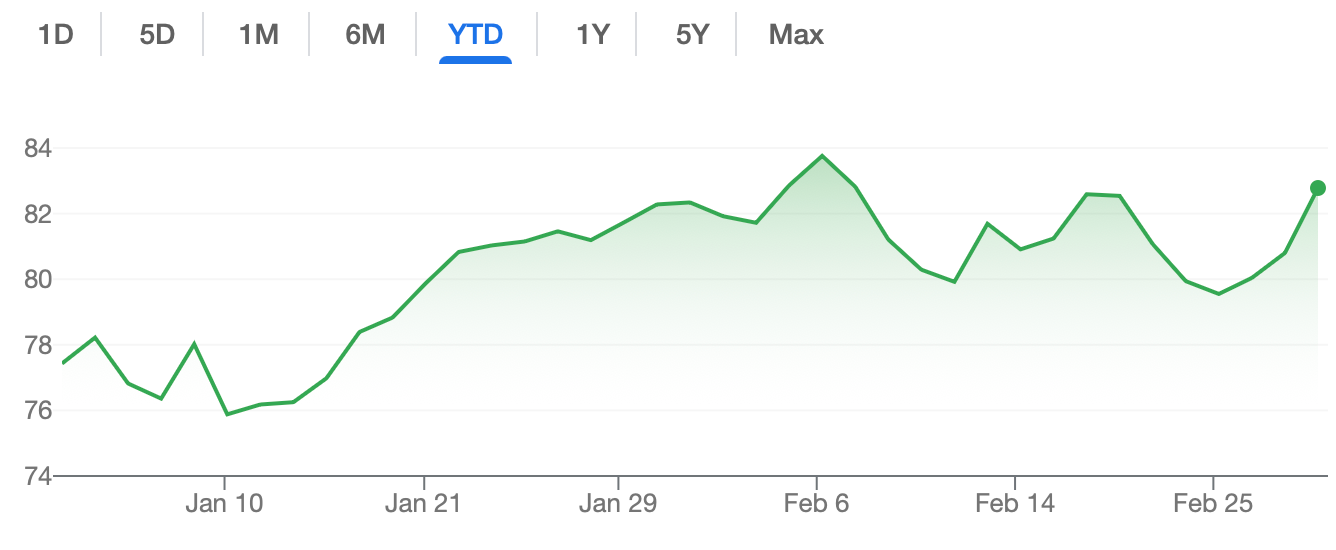

DXY — down 3.4 percent.

Bitcoin — up 7.6 percent.

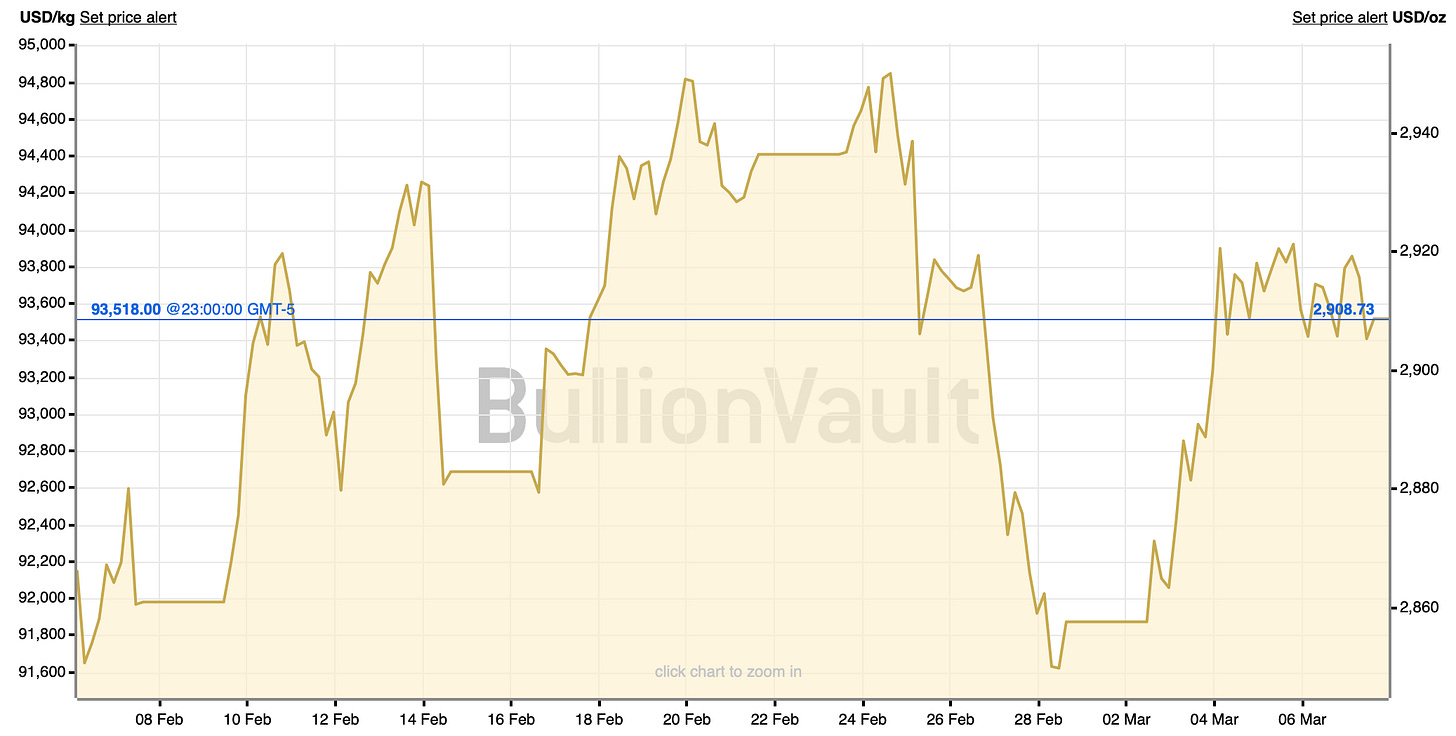

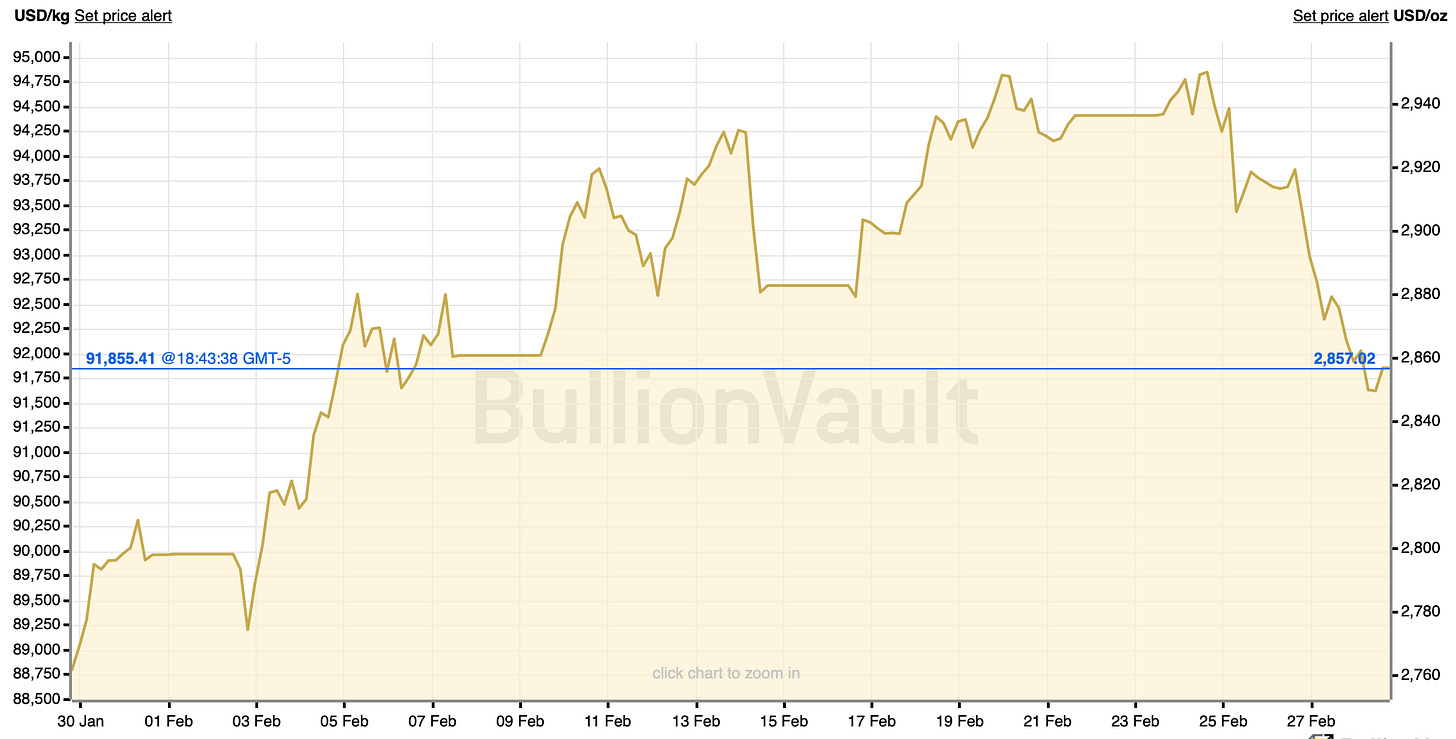

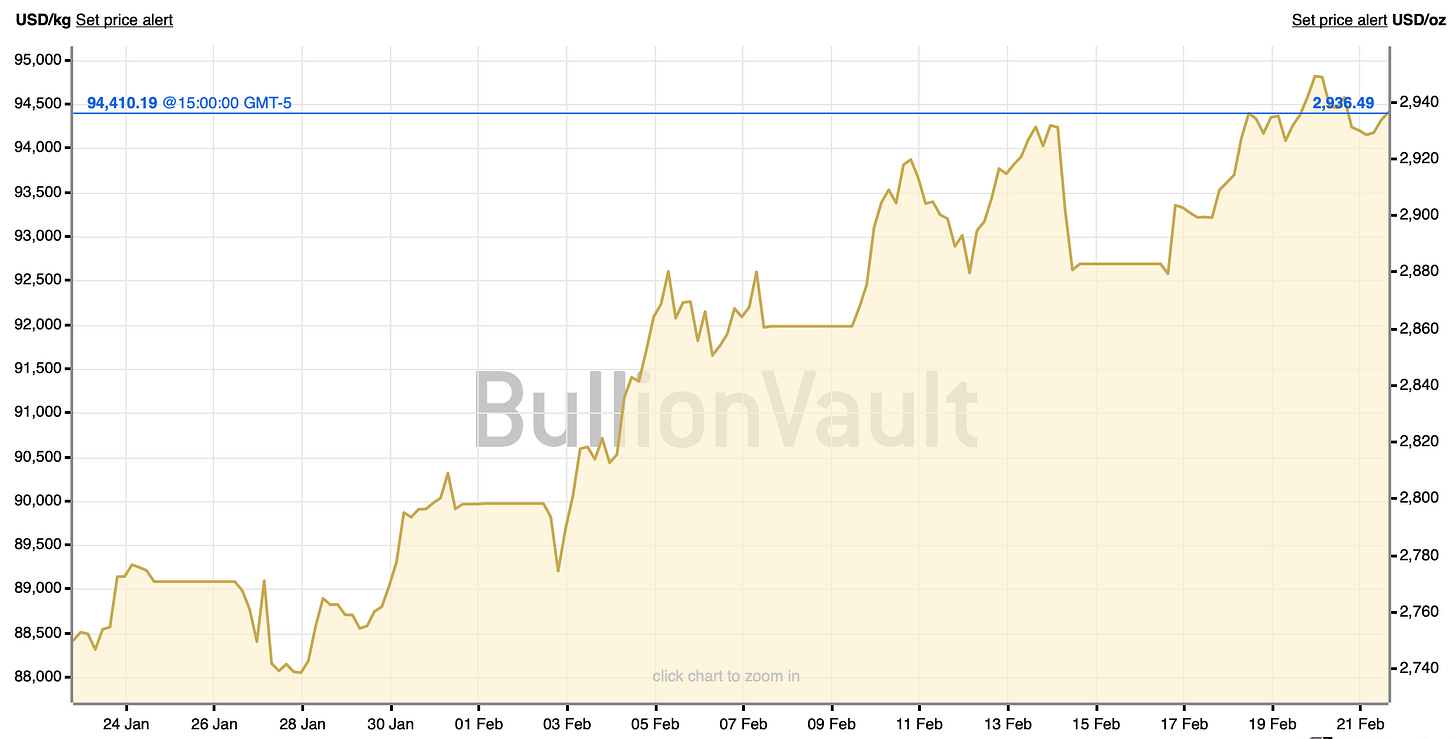

Gold — up 2 percent.

10-year Treasury yield — up 1.8 percent.

S&P 500 — down 3.1 percent.

Russell 2000 — down 4.1 percent.

USD/yuan — down 0.7 percent.

EQUITIES:

START OF BEAR MARKET?

Jim Bianco, March 3, 2025

Jim Bianco, President of Bianco Research, said that markets are struggling to understand Trump’s tariff policy, which in turn had led to market volatility.

“[Trump] uses [tariffs] both as a form of revenue, and he uses them as leverage,” he said. “Part of what’s happening with these markets is, we’ve got a whole new set of dynamics that we’re still not quite sure of. We can’t even figure out if [tariffs] are inflationary or recessionary.”

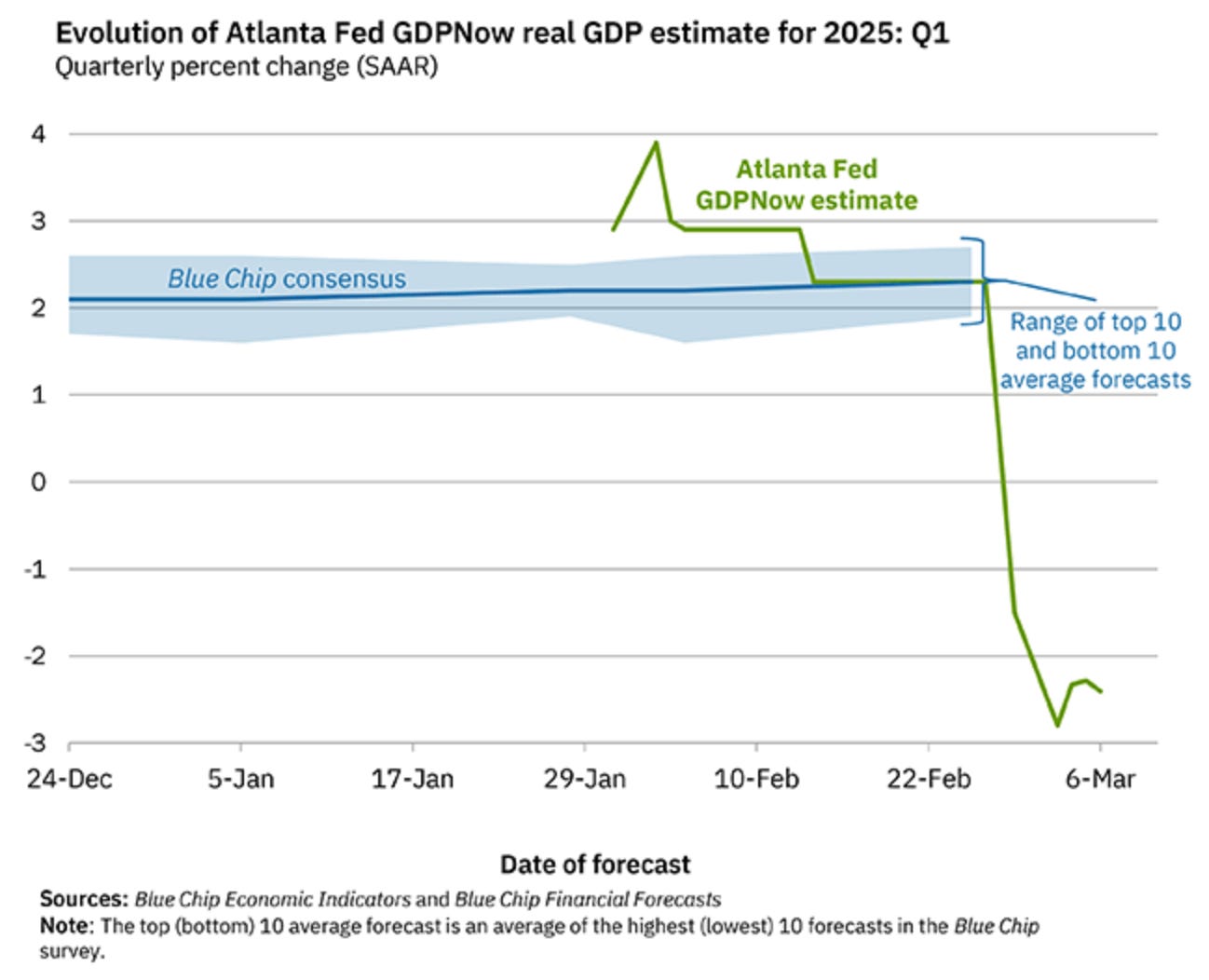

He added that uncertainty over tariffs had caused the Atlanta Fed’s GDPNow indicator to forecast a recession. Bianco said a rising trade deficit was the cause of this.

“Why was there a surge of imports?,” said Bianco. “Two things: one, people trying to beat the tariffs… Second thing, that’s not getting talked a lot about [that] was also in the imports, was gold. Because of the COMEX-LME arbitrage, a whole ton of gold has been imported into the United States.”

Amidst this macroeconomic backdrop, Bianco suggested that investors looking for defensive assets should consider bonds.

“If you really want to go defensive… [go for] the bond market,” he said. “They’re doing better than cash, they’re doing better than the stock market, they’re doing better than the crypto market right now.”

Bianco forecasted that stock markets would not see the outsize gains they had in recent years.

“There isn’t going to be a 15 or 20 percent gain in this market because of these high valuations,” he said. “You need to have monstrous earnings to have these high valuations… We need to adjust ourselves.”

ECONOMY:

ECONOMY ‘GOING OFF THE CLIFF’

Steve Hanke, March 7, 2025

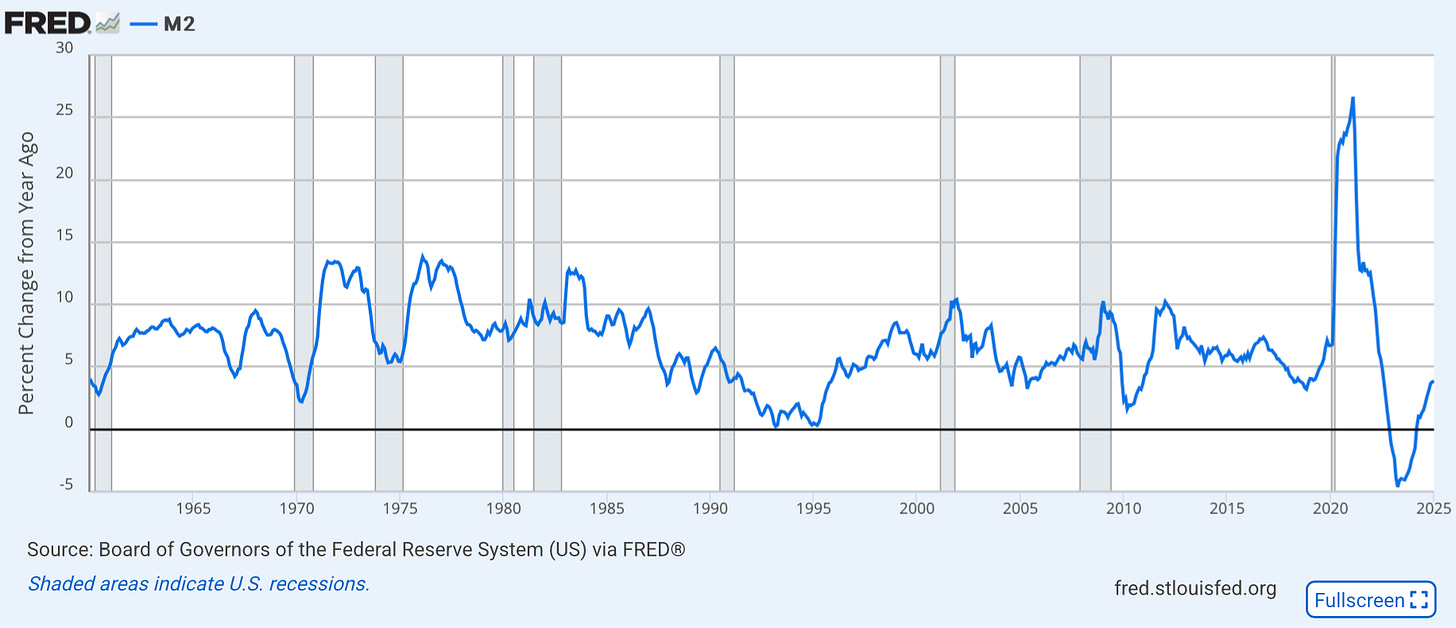

Steve Hanke, Professor of Applied Economics at Johns Hopkins University, said that the U.S. economy is “going off the cliff” because of its lower rate of money supply growth.

“The money supply calls the tune of the economy,” he said, commenting on the Atlanta Fed’s GDPNow, which recently forecasted negative economic growth. “Big changes in the money supply, with a lag, eventually work their way into the real economy… That’s why I have kept saying that a slowdown and recession, those things are baked in the cake.”

He added that while headline data suggest a strong economy, the underlying data point to much weaker trends.

“The headline numbers in the job market and in manufacturing might not look that bad, or look okay,” he said, “but if you look under the hood, they don’t look so great… The manufacturing sector has been more or less slowing down for quite some time.”

Because of these economic trends, Hanke suggested that the 10-year bond yield would continue to trend downwards.

“I think the 10-year is still looking pretty good,” he said. “We have the money supply contraction a couple of years ago that is working its way into the economy, the economy is going to slow down, inflation will keep slowing down, and Trump is throwing so many curveballs into the picture with this trade war thing… all of those things lead into a pretty good bond trade, being long.”

ECONOMY:

TRUMP’S END GAME REVEALED

Art Laffer, March 5, 2025

Art Laffer, Chairman of Laffer Associates, said that Trump’s tariff threats constitute a negotiating tactic that will result in freer trade agreements.

“Donald Trump has been negotiating… lower tariffs on [other countries’] part for access to our markets,” said Laffer. “He is using our very large market as a leverage point to get them to reduce their tariffs, quotas, and non-tariff barriers.”

He added that Trump’s first term saw the reduction of trade barriers.

“If you look at… all of these trade deals that Trump did with other countries [in his first term], all of them resulted in lowering tariffs, lowering non-tariff barriers, and lowering quotas, which is really great for the world,” said Laffer. “I think [Trump] is a free trader all the way, based upon his history as a CEO of a large international company.”

When it comes to the Department of Government Efficiency (DOGE), Laffer said that while he was impressed by the pace of their spending cuts, more permanent changes are needed.

“They [DOGE] are going on just cutting things down, which is also good right now, but they need to make this a permanent part of the U.S.,” he said. “We need to instil incentives in the government to let them run efficiently: reward politicians for doing a good job, and punish politicians for doing a bad job.”

Finally, on the war in Ukraine, Laffer said that it was crucial that Russia and Ukraine have an immediate ceasefire so that negotiations can ensue. He warned that nuclear war is “on the cards.”

“Just stop shooting, that is it,” he said. “You don’t have to have the totality of the agreement negotiated over five years, or whatever it is… I really do feel sorry for Ukraine, I do think it’s awful. I don’t want World War 3, to be honest with you.”

ECONOMY:

THE BIGGEST LIE ABOUT DEBT EXPOSED

Warren Mosler, March 1, 2025

Warren Mosler, widely known as a founder of Modern Monetary Theory (MMT), said that the U.S. government will never go broke, and that concerns about its debt are overstated.

Unlike traditional economics, MMT is a framework which suggests that deficits are not inherently problematic and that inflation is the real limit to government spending, though it can be managed through taxation and spending adjustments.

“The government checks won’t bounce, they’ll all clear,” said Mosler, responding to the U.S.’s rising deficit. “It won’t drive up interest rates, only the Fed does that… There won’t be a funding problem, there won’t be a solvency problem, the government won’t go broke.”

Mosler said that taxes by themselves do not fund government spending, since the government first has to make money available for people to pay their taxes.

“They [the government and its agents] have to spend the money first before anybody has it to pay their taxes,” he said. “Everybody’s got it wrong… They don’t understand that tax liabilities, which are tax requirements, cause the economy to need the government’s money — and the only source for getting it is government.”

He added that printing money, in and of itself, does not affect the economy unless there is a concurrent rise in spending.

“Spending is another matter… and that can drive the price up,” he said. “But if you’re just sitting in a room at the Federal Reserve, [and] you print up dollar bills, you’re not causing anything if they don’t go anywhere.”

When it comes to Fed policy itself, Mosler said that higher interest rates can be stimulative for the economy, because it leads to more deficit spending.

“If the debt held by the public is $28 trillion now, I think, a 1 percent [interest rate] increase would ultimately add $280 billion to deficit spending,” he said. “That has a positive effect, a direct effect, on income, unemployment, on growth, and on prices.”

COMMODITIES:

U.S. IS ALREADY BANKRUPT

Peter Grandich, March 4, 2025

The U.S. is “technically bankrupt already,” according to Peter Grandich, Founder of Peter Grandich & Co.

“If we start to put in the amount of monies that are expected to be paid out for Social Security, Medicare, and Medicaid, there’s no way we’re in a position to pay those in the future, unless we keep creating higher and higher deficits, and printing money that we don’t have,” he explained.

He said that concerns about public debt may have caused the recent rally in the gold price, which was fuelled by central bank buying.

“The very fact that the banks have done this transfer of gold in such large quantities strongly suggests that there’s something afoot that’s not yet ready for the public domain,” he explained. “That has to be the eventual usage of gold to somehow restructure the world debt which is so much out of hand.”

Grandich said that he was bullish on the gold mining sector, including junior miners.

“We’re basically seeing a flattening of earnings growth in the U.S. market,” he said. “One of the few sectors that are going to report, over the next few quarters, just dramatically increased better earnings are going to be the gold producers.”

Commenting on Trump’s proposed minerals deal with Ukraine, Grandich said that it would be “years away” from having an effect on commodities markets, if the deal is ratified.

“It will take many, many years to develop that and bring it to the market,” he said. “I actually think it hopefully enlightens people to how badly critical minerals are needed here in the U.S.”

CRYPTO:

THE PATH TO $1 MILLION BITCOIN

Arthur Hayes, March 2, 2025

Arthur Hayes, CIO of Maelstrom and Co-Founder of BitMEX, said that Bitcoin would hit $1 million as global liquidity grows due to a rise in nationalist economic policy.

“We’re not going to rely on a global supply chain of products,” he explained. “This requires a huge amount of capital, and the private savings market doesn’t have the money… so [The U.S. and Western Europe] are going to have to print the money.”

This money printing, in turn, will lead to a $1 million Bitcoin price, said Hayes.

“It’s, let’s increase the bank lending so they build the new factories,” he said. “Let’s sequester savings and do yield curve control, whether outright or surreptitiously… so that’s how we get to $1 million Bitcoin. How fast we get there, I don’t know, but I do think that this is on the horizon before the end of the decade.”

When it comes to Trump’s proposed crypto strategic reserve, Hayes warned that it could fall prey to political exploitation.

“Politicians buy and sell things for political reasons, not for financial reasons,” he explained. “Maybe a Democrat gets in, or a Democratic Congress or president in the next four years, and they say, I’ve got a bunch of Bitcoin, and it’s worth money… policy is about spending money to your supporters to get votes.”

Hayes said that for Bitcoin to be useful to the U.S. government, it should become an asset that backs the U.S. dollar.

“The de-industrialization of the United States, the export of finance, is a direct result of the way the financial system is set up,” he said. “To change the situation, people should not be saving in U.S. treasuries… I’m arguing for them to use Bitcoin.”

Thanks for reading! Subscribe for free to receive new posts and support my work.