TABLE OF CONTENTS

Market Recap: Steve Hanke on Trump’s election — ‘revolt against the elites’

EQUITIES: Milton Berg on Trump’s effect on markets

EQUITIES: Chris Vermeulen on ‘euphoric’ post-election market rally

ECONOMY: Nobel Laureate Simon Johnson on tariffs and hyperinflation

ECONOMY: Will interest rates spike after the election? Kathy Jones weighs in

ECONOMY: U.S. Senate candidate John Deaton on U.S. debt default

POLITICS: Why Trump won, and what it means for the economy — Matt Gertken

What to Watch

MARKET RECAP

Latest News. Donald Trump won the U.S. presidential election on Tuesday, November 6th, making him the 47th President of the United States of America.

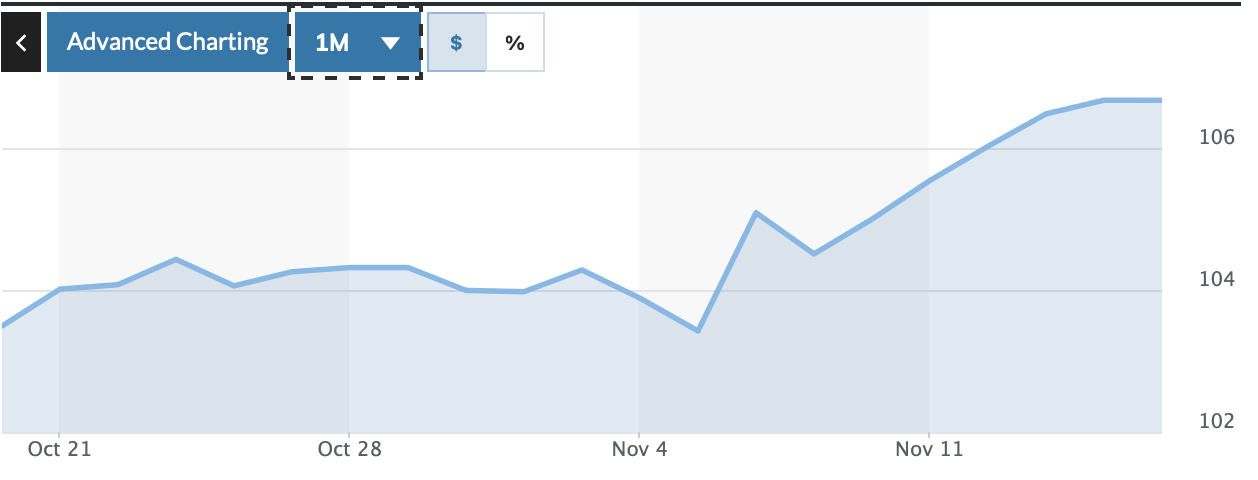

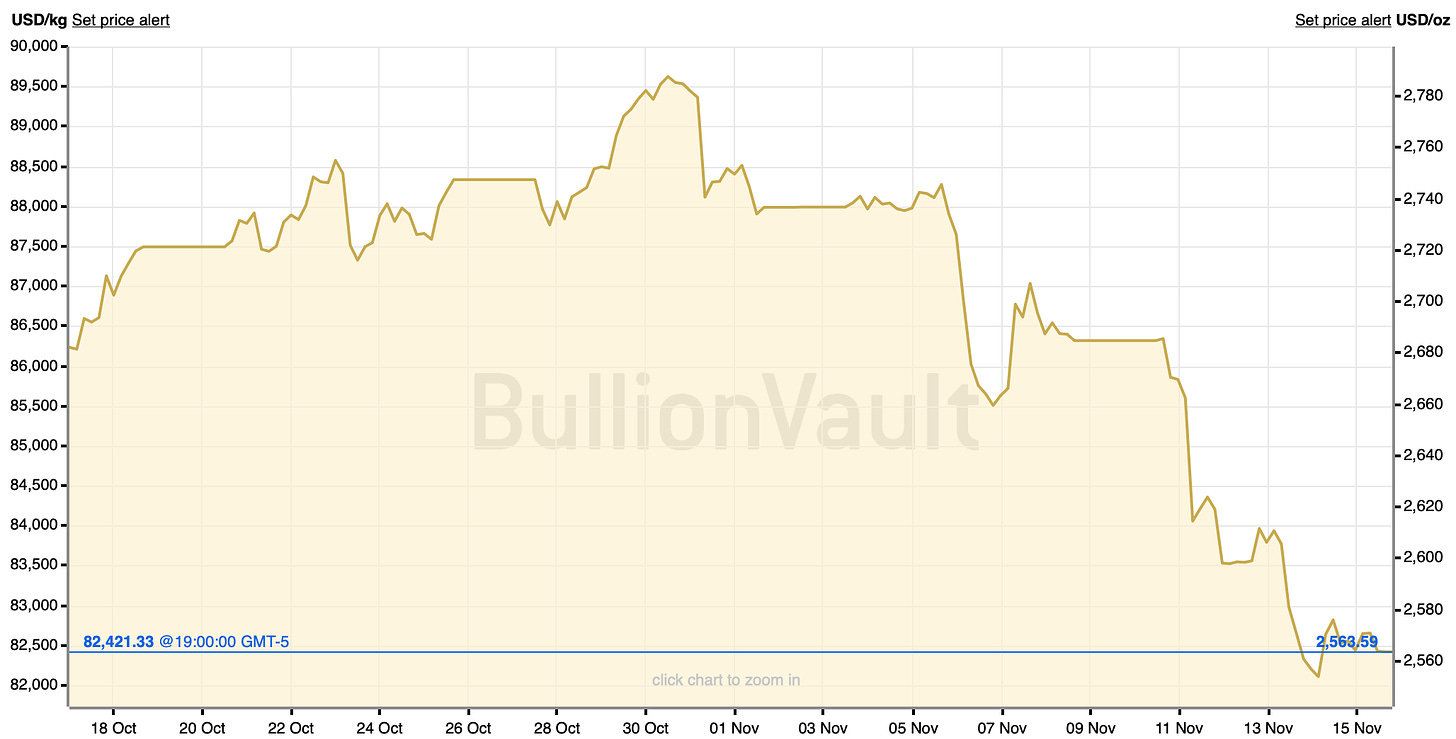

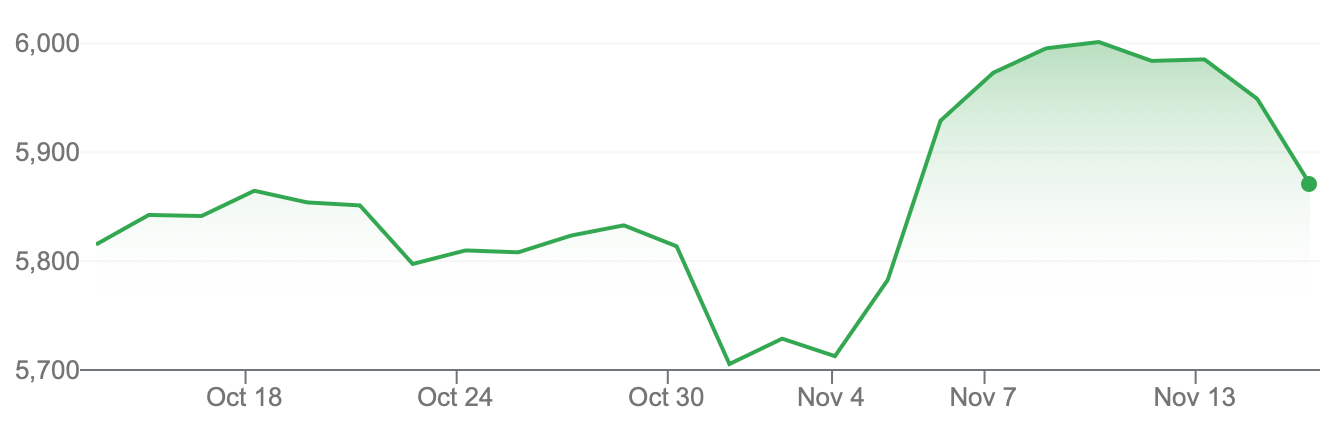

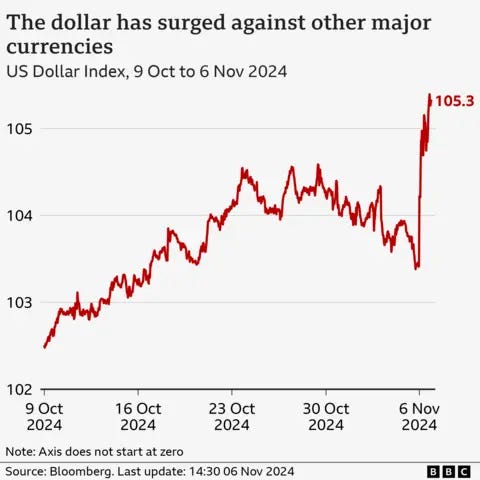

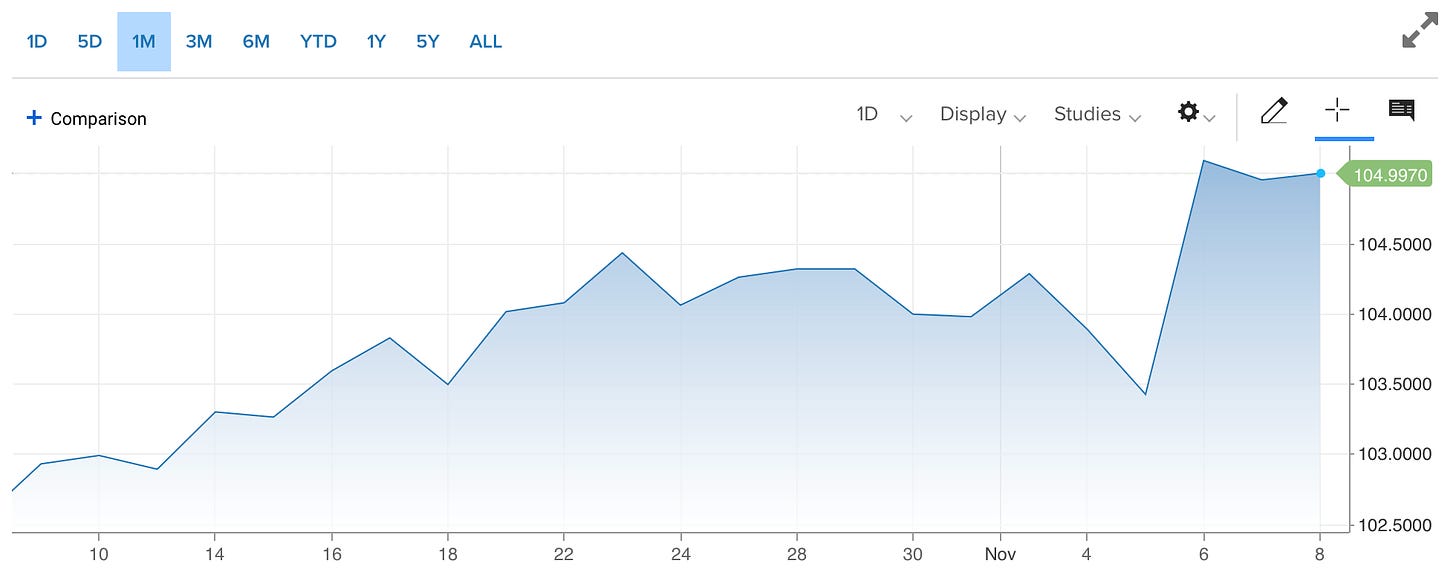

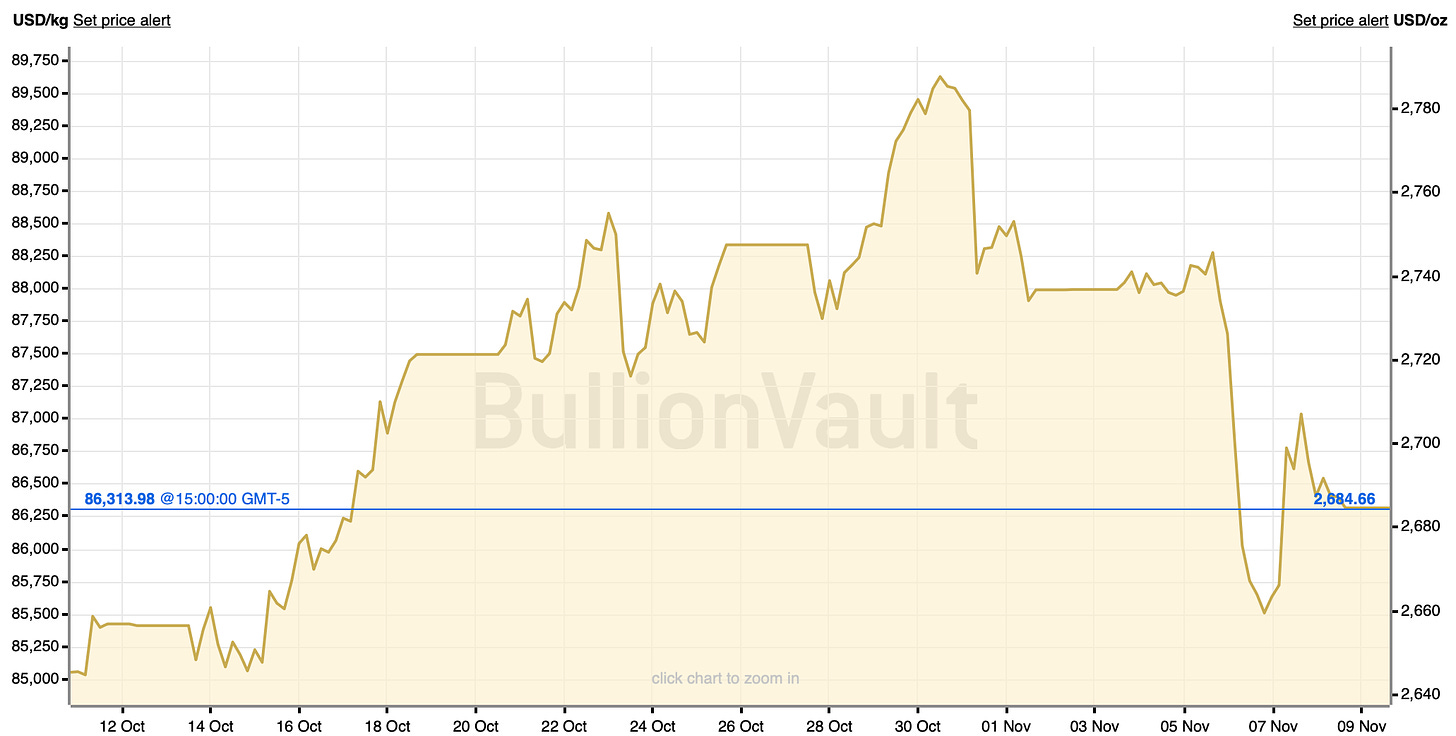

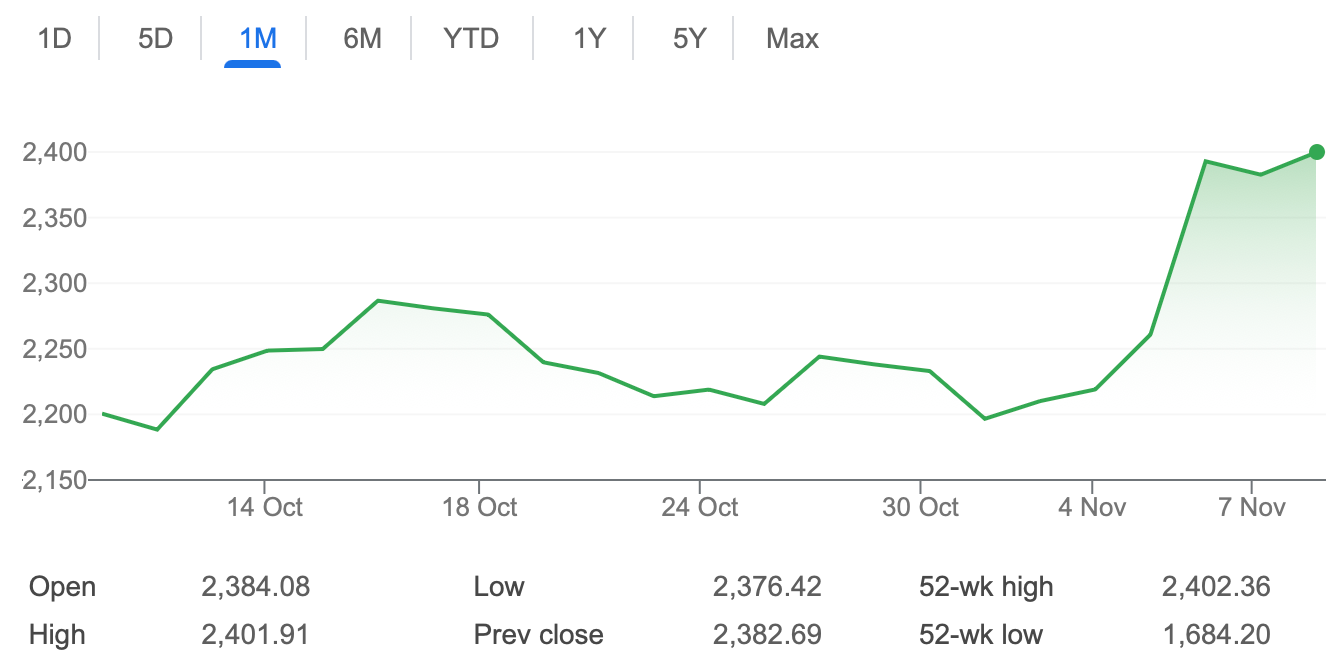

Risk assets reacted positively, with the Dow Jones up over 1,200 points on Wednesday morning; bank stocks performed particularly well. Bitcoin reached a record high of $75k on the day of the election, and the U.S. dollar index rose 1.65 percent. Treasuries, however, fell in price, and gold prices slid to a three-week low.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.

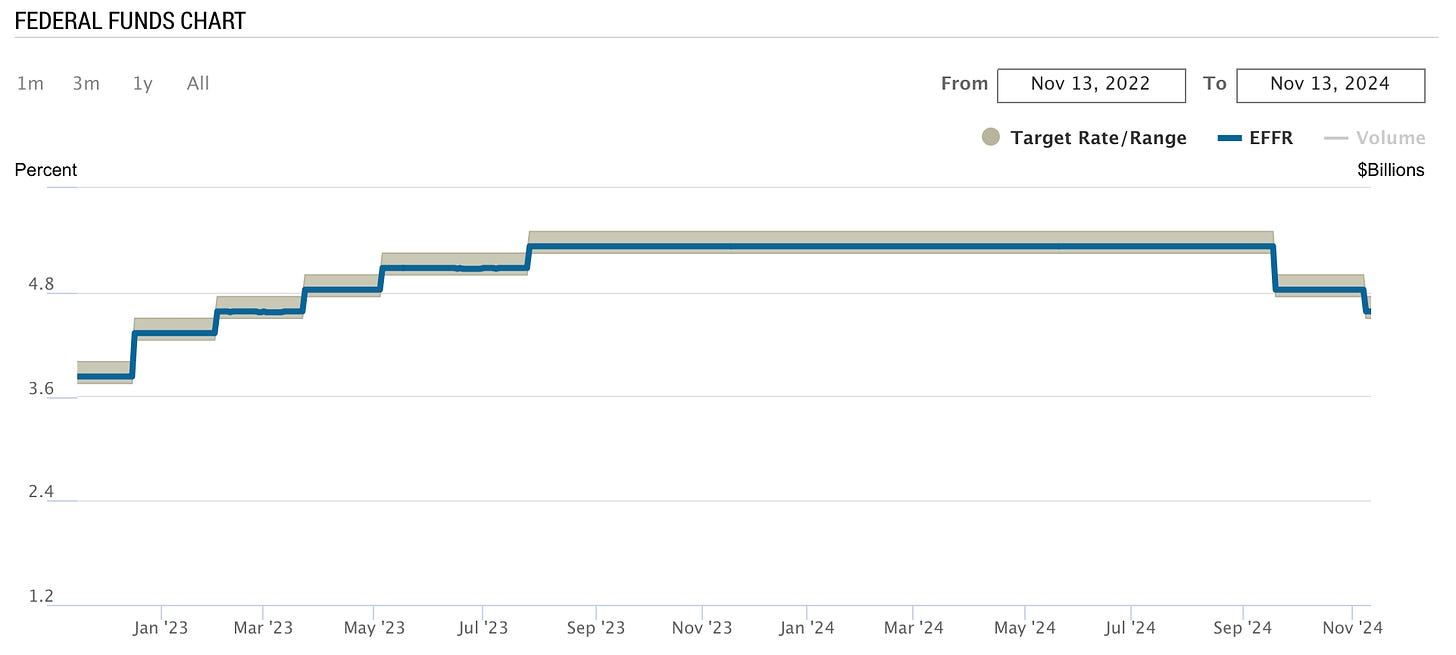

In other news, the Federal Reserve cut the Fed Funds Rate by 25 bps, in line with market expectations.

Steve Hanke, Professor of Applied Economics at Johns Hopkins University, had predicted a Trump win, and joined the program to give his outlook for a post-election economy.

Hanke said that the election of Trump represents a “revolt against the elites.” He emphasized that over the last four years, Americans grew frustrated with how Washington D.C. and media elites managed the country, particularly in handling fiscal and monetary policies that seemed to disproportionately benefit the wealthy.

Hanke predicted that Trump would focus on tax cuts rather than reining in government spending.

“Trump will likely focus on tax reductions,” said Hanke. “His attention to controlling the fiscal deficit will likely be lax.”

Hanke also mentioned the idea of Elon Musk heading a proposed “Department of Government Efficiency” under a potential Trump administration.

He drew a parallel to the Grace Commission during the Reagan era, which aimed to identify and cut waste, fraud, and abuse in government spending. He said that while the Grace Commission produced extensive reports, it ultimately did not result in significant policy changes or actions.

When it comes to the Federal Reserve, Hanke criticized the Fed under Chair Jerome Powell, calling it a "complete disaster," especially during its COVID-19 response. He explained how the Fed monetized over 90 percent of the increased deficit by purchasing government bonds, which led to a massive expansion of the money supply and, consequently, inflation.

Finally, when it comes to foreign policy, Hanke said that Trump would struggle to control conflicts like the Israel-Hamas conflict. While he might have some influence on Ukraine, Hanke said that Russia already holds a strong position.

“The winner calls the tune,” said Hanke. “The Russians have won the war [in Ukraine] so far, so they’ll be dictating the terms.”

Market Movements

From November 1 to November 8, the following assets experienced dramatic swings in price. Data are up-to-date as of November 8 at 9pm ET (approximate).

Beyond Meat — down 11.8 percent.

Palantir Technologies — up 39.3 percent.

Coffee (commodity) — up 4.5 percent.

Tesla — up 29 percent.

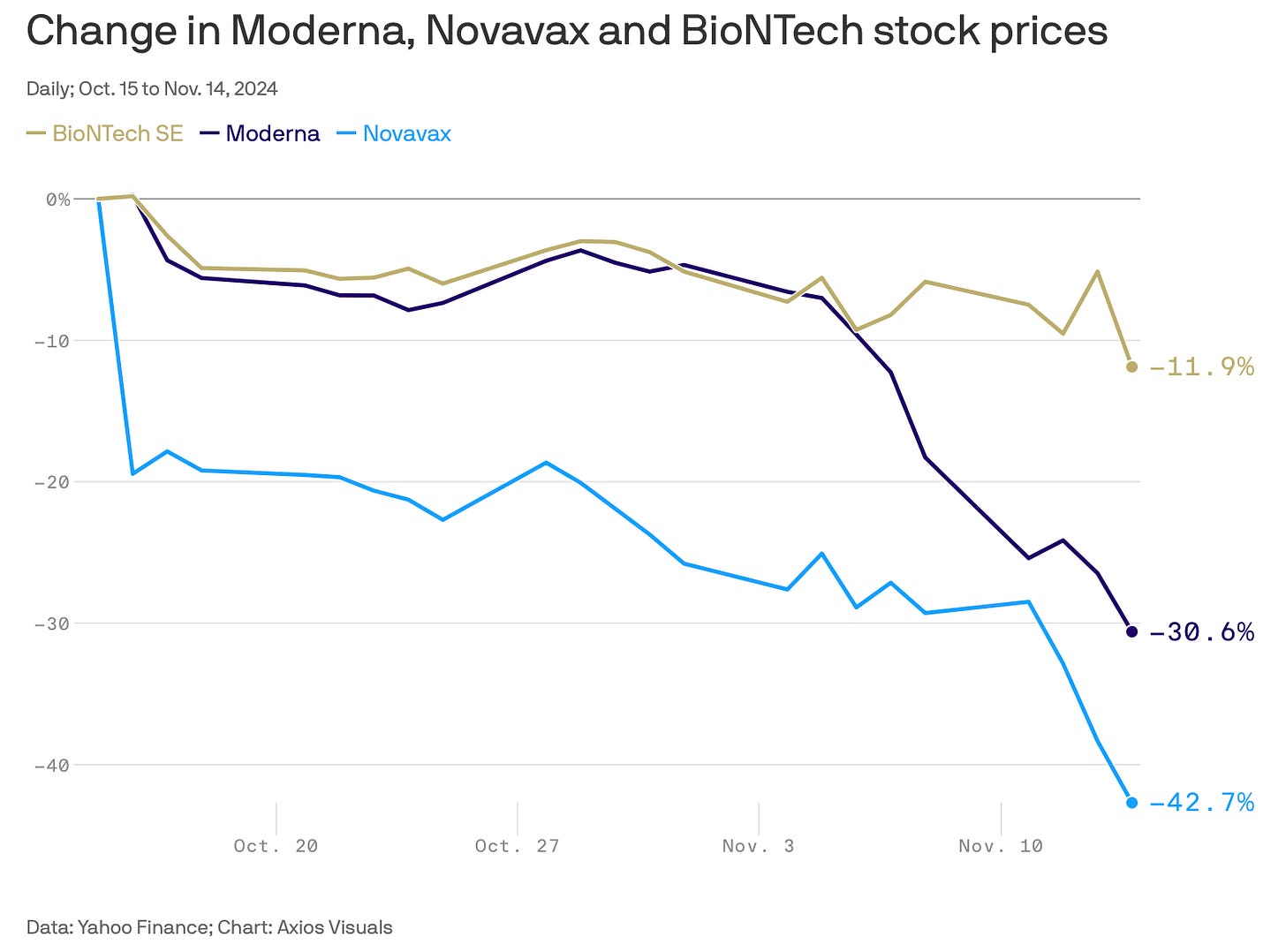

Moderna — down 14.3 percent.

DXY — up 0.6 percent.

Bitcoin — up 10.4 percent.

Gold — down 2 percent.

10-year Treasury yield — down 1.2 percent.

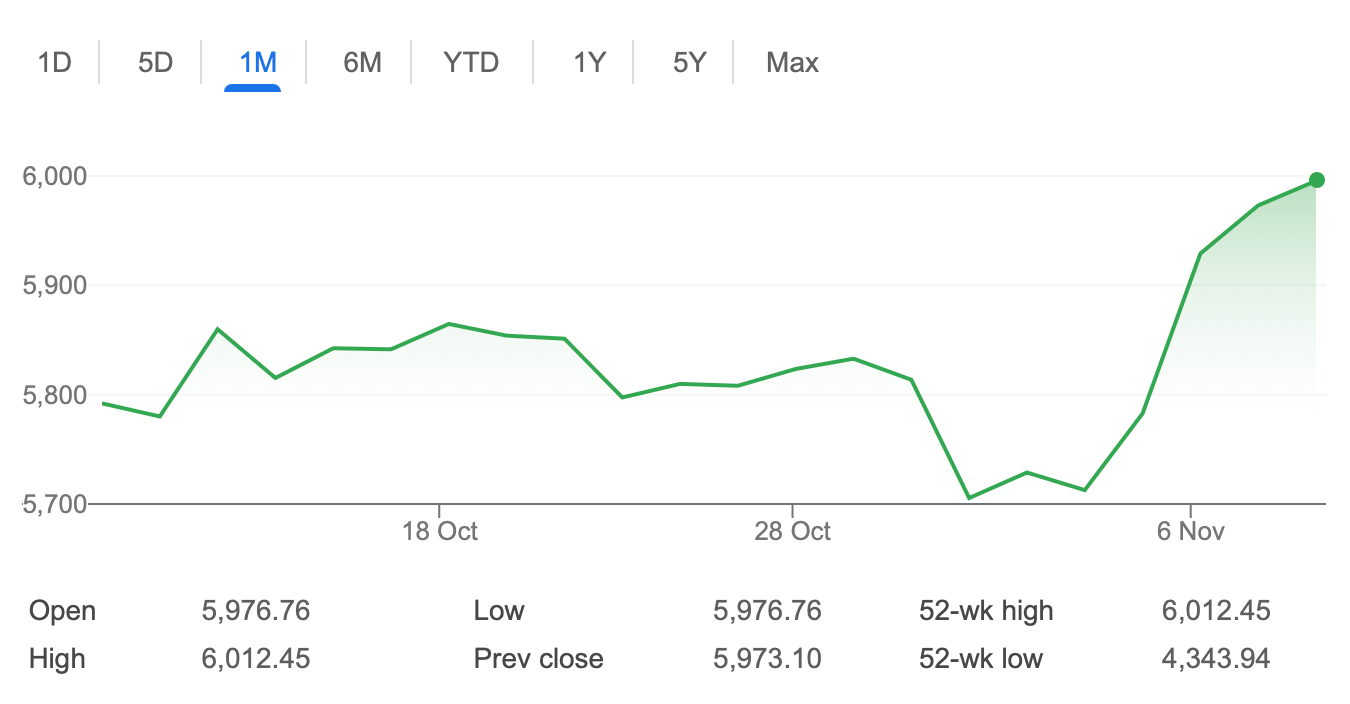

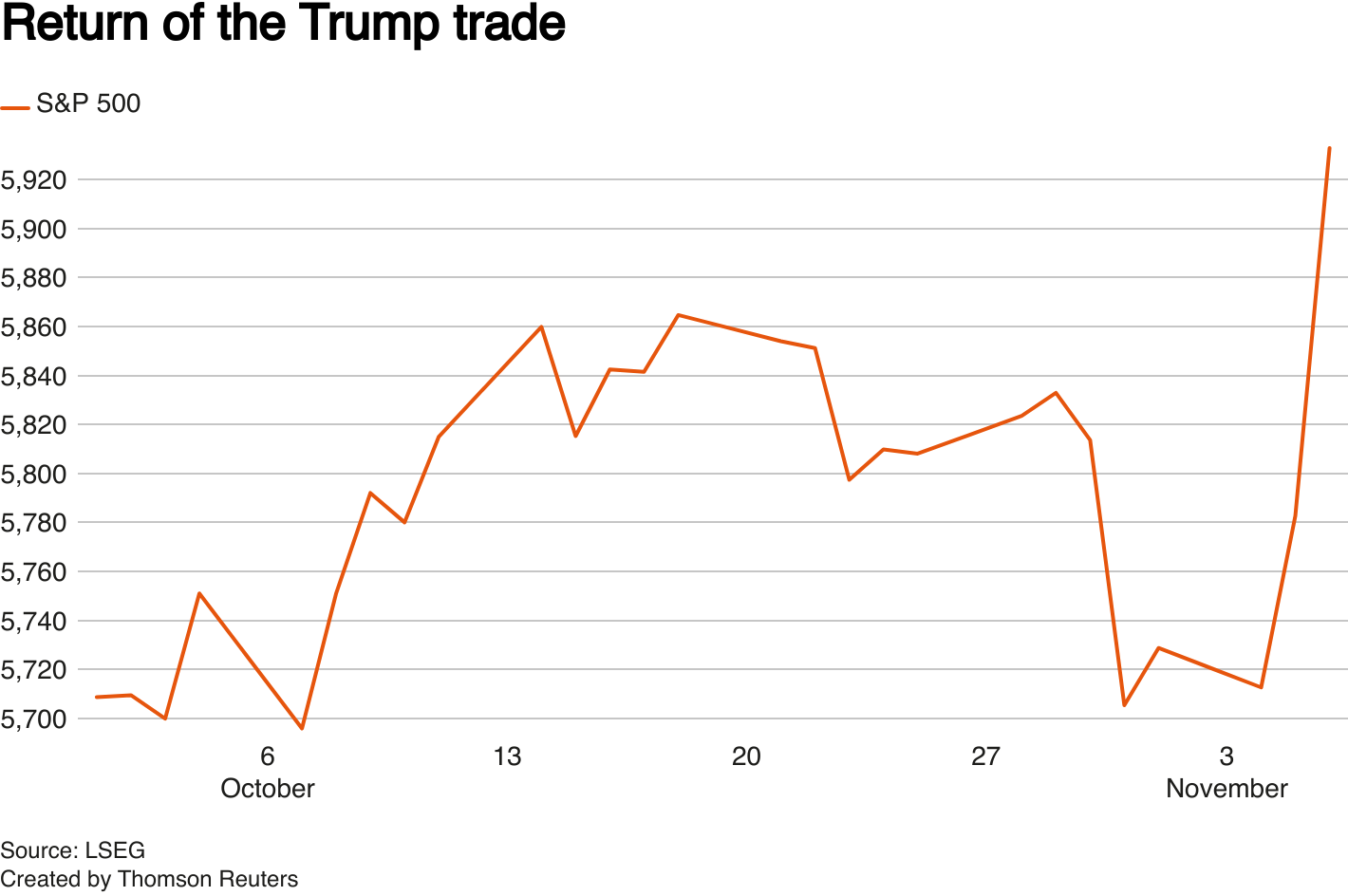

S&P 500 — up 4.7 percent.

Russell 2000 — up 8.6 percent.

USD/yuan — up 0.8 percent.

EQUITIES:

MARKETS ENTERING TOPPING PHASE

Milton Berg, November 8, 2024

Milton Berg, Founder of MB Advisors, joined us to discuss his analysis of how Trump’s presidency would affect markets.

Berg said that Trump, known for his frugality and negotiation skills, would focus on austerity and cutting waste, which could suppress market growth in the early years but ultimately be positive for the economy.

Cautioning that the response to Trump’s election could be a “buy the rumour, sell the news,” event, Berg said that markets would rally after the initial optimism following a Trump victory, followed by a potential decline. He also said that Trump would promote austerity.

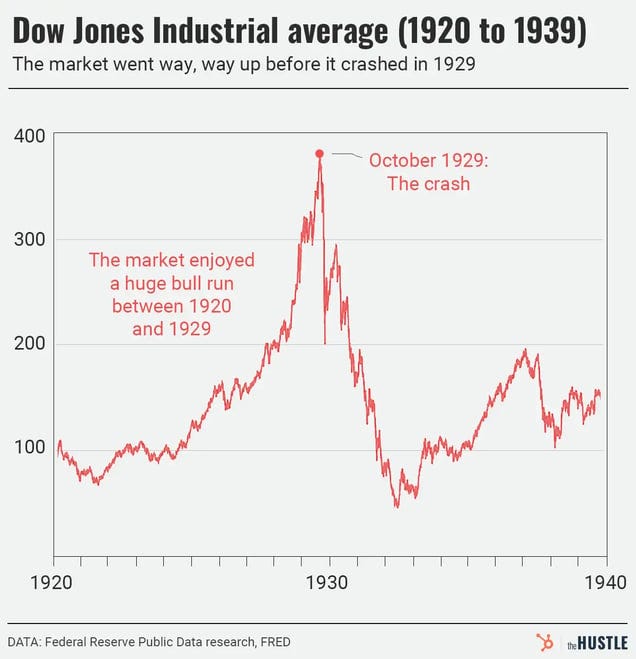

In particular, Berg predicted that Trump would hire people like Elon Musk and Scott Bessent to trim the size of government. He drew a parallel between Donald Trump and President Ronald Reagan, both of whom he labelled “capitalist” leaders. He said that after Reagan was elected, the market saw a significant rally but ultimately reached a peak following austerity measures.

“Reagan was great for the economy, but in order to do the great things he did, he had to first have some pain for two years,” said Berg.

Berg also addressed the concern that Trump's policies aimed at reducing the debt and government spending could be deflationary.

He said, “The risk is deflationary or disinflationary at this point... paying down debt is bearish for stock markets initially.”

He explained that this is because paying down the debt requires imposing cuts on government spending.

EQUITIES:

TRUMP WINS, ‘EUPHORIC’ MARKET RALLY

Chris Vermeulen, November 6, 2024

We were joined by Chris Vermeulen, Chief Market Strategist at The Technical Traders, to discuss market moves following Donald Trump's victory in the U.S. presidential election.

The financial markets showed a significant reaction. The S&P 500 rose by 2%, the NASDAQ by 2.3%, while gold prices fell by 2.7%. Bitcoin also hit a new all-time high, reaching around $74,500.

Vermuelen said that this was due to Donald Trump being viewed as a pro-business candidate, and that he has prominent business leaders like Elon Musk backing him.

“Trump and Elon Musk, they won together, more-or-less,” said Vermeuelen. “They’re both pro-business, and so we’re seeing small caps skyrocket today, and stocks across the board.”

Despite his short-term bullish outlook, Vermeulen said he is skeptical about a long-term bull market due to underlying economic cycles.

He said, "A one-day rally doesn't change an entire massive economic cycle," indicating that while markets could see further gains, caution is warranted.

Vermeulen said that the current market, even amidst rallies, could be in a late-stage cycle where a reset is looming. This reset would involve a significant correction or decline in asset prices, akin to what was observed during the 2008 financial crisis or the 2000 tech bubble.

“I believe stocks are overdone,” said Vermeulen. “We could have a big market correction or financial reset at any point.”

He said that “we’re many weeks” away from the market “breaking down” into a bearish pattern.

ECONOMY:

WILL TRUMP TARIFFS TRIGGER HYPERINFLATION?

Simon Johnson, November 6, 2024

We welcomed Simon Johnson, 2024 Nobel Prize in Economics laureate and Professor of Entrepreneurship at MIT, to the show.

Johnson won the Nobel Prize alongside his colleagues Daron Acemoglu and James Robinson “for how institutions are formed and affect prosperity.” He is also the former Chief Economist at the International Monetary Fund (IMF).

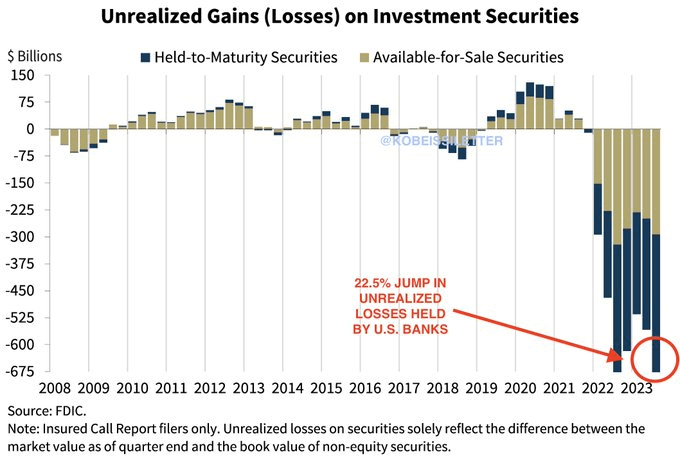

Johnson said that unrealized losses in U.S. banks are a significant concern, especially given the Silicon Valley Bank crash in 2023. He said that while there's increased awareness, these issues remain problematic.

“The regulators and supervisors are paying a lot more attention than they were before Silicon Valley Bank,” he said.

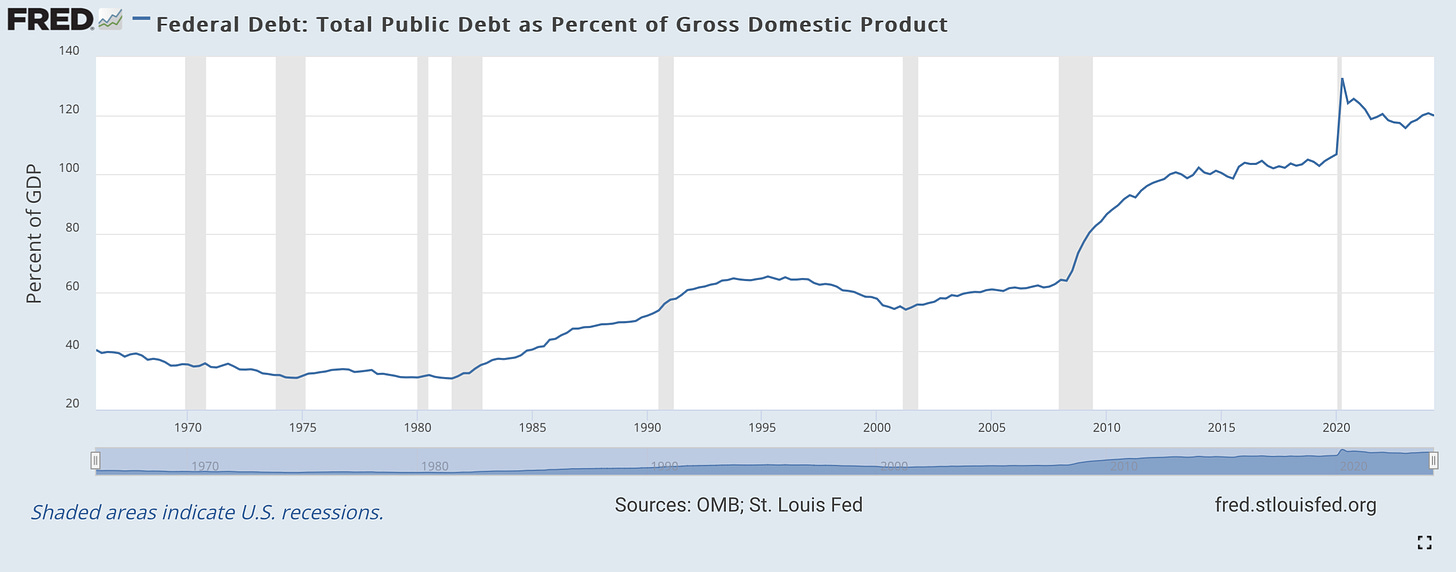

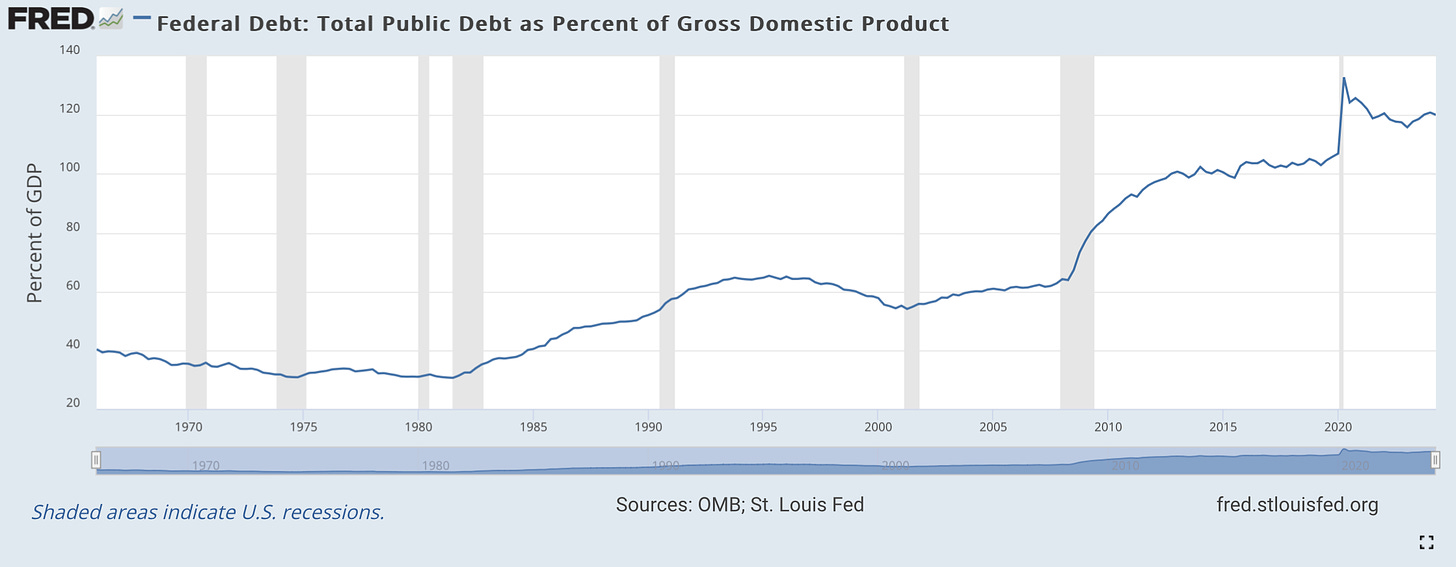

He added that the rising U.S. debt burden could trigger a financial crisis, in line with similar warnings offered by former FDIC Chair Sheila Bair. However, Johnson said that financial markets and politicians “do not take this issue seriously,” which is a concern.

Johnson also said that “too big to fail” (TBTF) banks pose significant risks to the financial system. He believes that failure is a fundamental part of capitalism, but these major banks are shielded from it in an unprecedented manner through bailouts and other taxpayer-subsidized protections. This, according to Johnson skews incentives toward taking excessive risks, as executives have little personal downside.

Finally, Johnson touched upon Donald Trump’s proposed tariff policies. He said that Trump’s plans for imposing sweeping tariffs among to a "massive tax" on lower-income Americans who rely heavily on imported goods. According to Johnson, such tariffs disproportionately affect low-income consumers, potentially costing them thousands of dollars annually in higher prices.

He also said that Trump’s ideas to replace income taxes with tariffs is unfeasible, calling them a "ludicrous fantasy" that doesn’t add up mathematically.

ECONOMY:

WILL INTEREST RATES SPIKE AFTER ELECTION?

Kathy Jones, November 4, 2024

We were joined by Kathy Jones, Chief Fixed Income Strategist at Charles Schwab, to discuss the economy and its effect on the bond market.

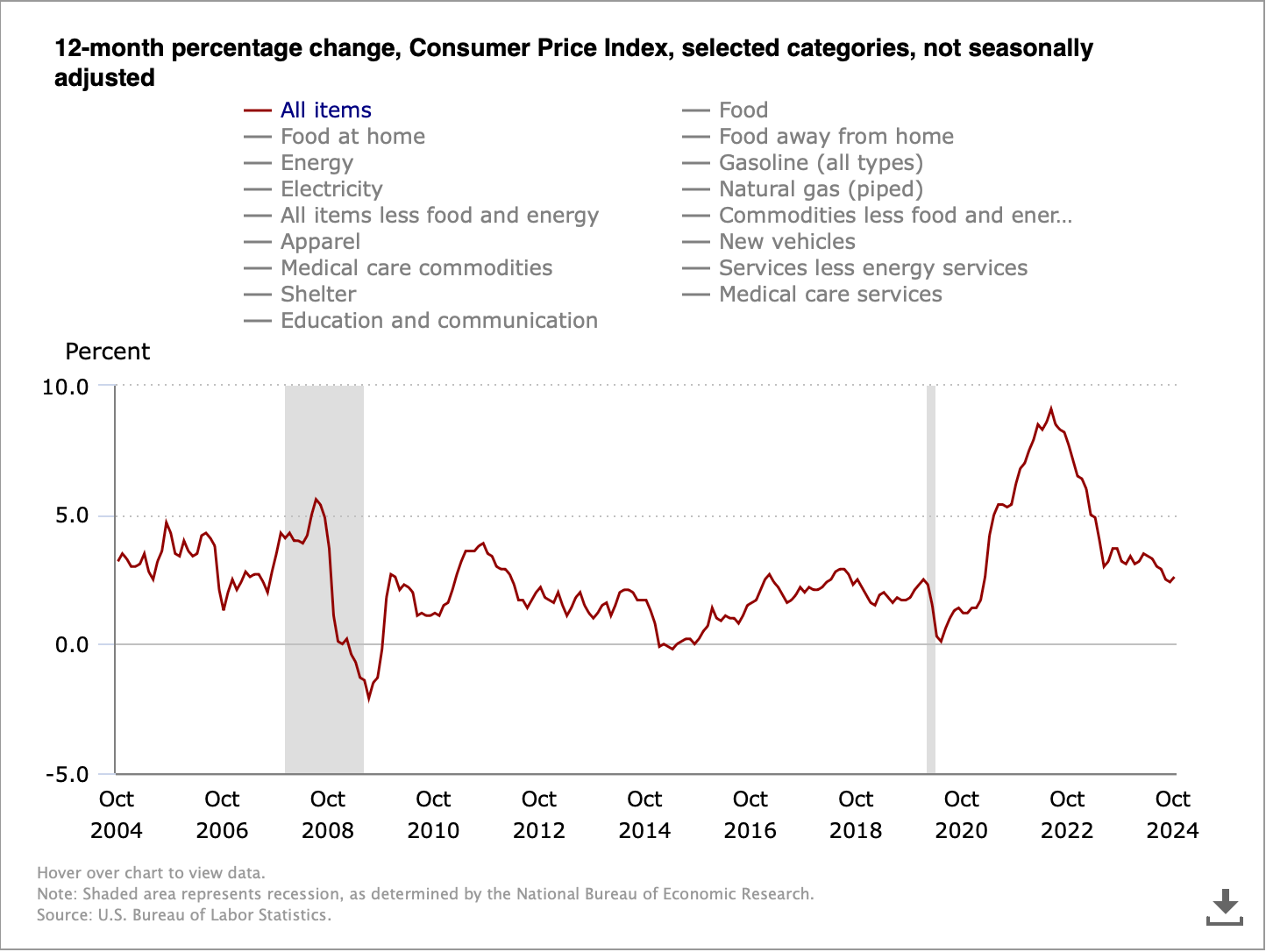

Jones said that while inflation expectations have risen from summer lows, they are stabilizing in the low-to-mid 2 percent range. This reflects a resilient economy that has performed better than anticipated, driven largely by consumer spending.

“The economy’s been much more resilient,” said Jones, “and that means the Fed can’t cut rates as much, and probably inflation doesn’t drift down as much as had been anticipated.”

Jones’s base case includes one more rate cut in 2024, followed by a gradual easing to a 3-3.5 percent terminal rate by the end of 2025. Despite certain categories like insurance and housing keeping inflation from dropping more, a 2-2.5 percent inflation rate would be acceptable for the Federal Reserve, said Jones.

Although unemployment has ticked up slightly from record lows, it remains close to full employment. Jones said that jobless claims are still low, indicating a healthy labor market.

“The labor market still looks healthy,” she said. “We could see it tick up a bit, but we’re not looking for it to really accelerate to the upside or downside.”

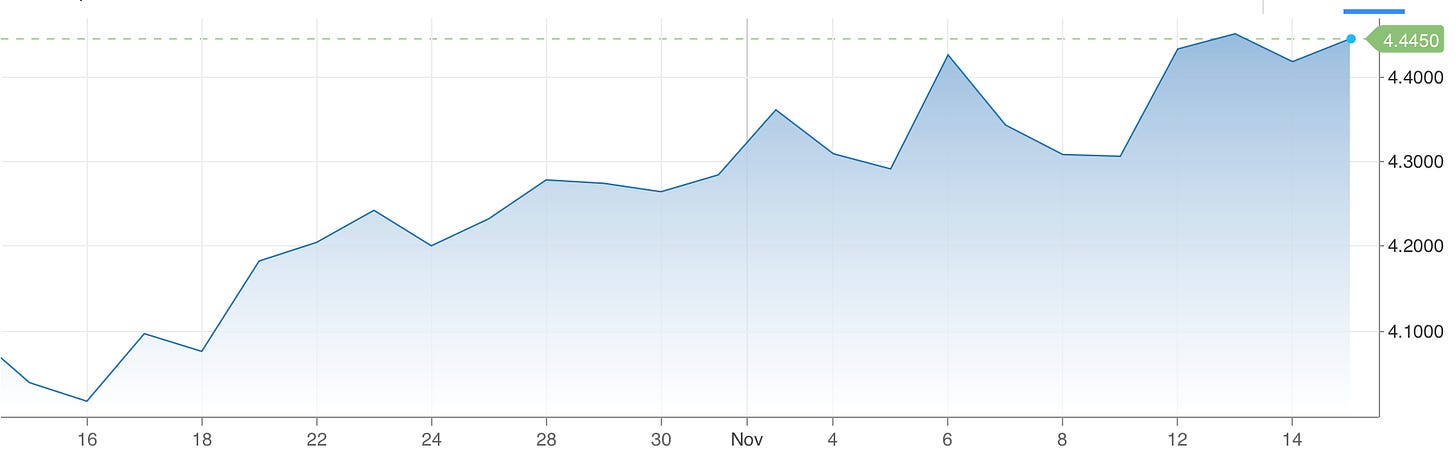

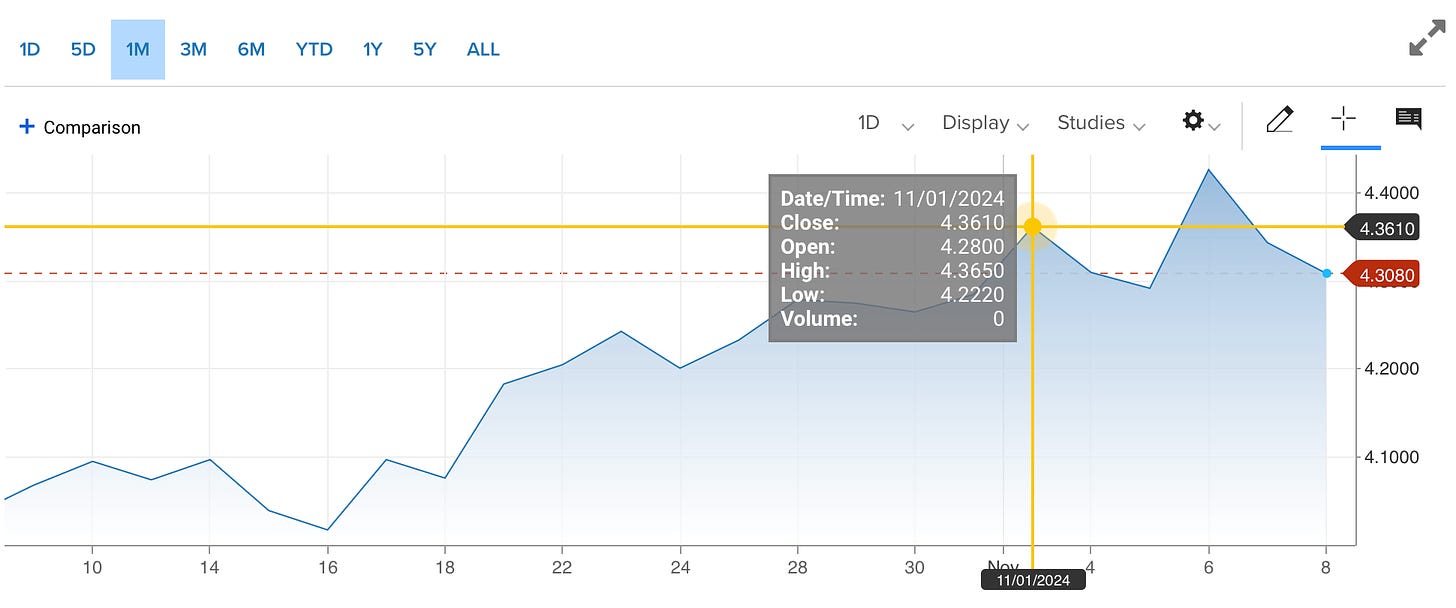

Jones’s outlook includes expectations of a “bull steepener” in the yield curve, with longer-term yields rising less than shorter-term ones. The 10-year yield is considered reasonably priced at 4-4.25%. She pointed out that the MOVE index, indicating bond market volatility, has increased due to rising rates and economic uncertainties, including the elections and fiscal policy ambiguity.

ECONOMY:

U.S. DEBT DEFAULT INEVITABLE

John Deaton, November 2, 2024

We welcomed John Deaton, Senate candidate and Managing Partner at Deaton Law Firm, to the show to discuss his views on the economy and cryptocurrencies.

Deaton said that the U.S. is facing multiple crises: immigration, debt, inflation, opioid abuse, and foreign conflicts. He criticizes the current leadership, particularly Elizabeth Warren, who he was running against, for being divisive and ineffective.

He warned that the U.S. is effectively broke, with $36 trillion in national debt, rising credit card and student loan debt, and $3 billion in daily interest payments. He opposed solutions that involve printing more money, as it exacerbates inflation and widens the wealth gap.

“If we continue down this path, we risk turning the United States into another Venezuela or Argentina,” said Deaton.

He proposed the "Government Spending Accountability Act" to require departments to pass audits or face funding freezes. He also advocated for a "single bill approach" to limit excessive and unrelated legislative additions.

“We can't tax enough,” said Deaton, “we can only grow our way out of this.”

Deaton has also been a prominent figure in opposing the SEC's classification of XRP as a security. He said that the government should foster innovation and adopt smart regulatory frameworks for blockchain and crypto, rather than trying to stifle the industry.

“The government overreach and what went down at the SEC by certain bad actors was just outrageous to me,” said Deaton. “When they control your money, they control your entire life.”

He also said that he is opposed to central bank digital currencies, saying that it’s a “hill I’m willing to die on for sure.”

POLITICS:

THE REAL REASON TRUMP WON

Matt Gertken, November 7, 2024

Matt Gertken, Chief Geopolitical Strategist at BCA Research, joined us to discuss the impacts of Donald Trump’s win in the presidential election, and what it could mean for U.S. economic policy and foreign policy.

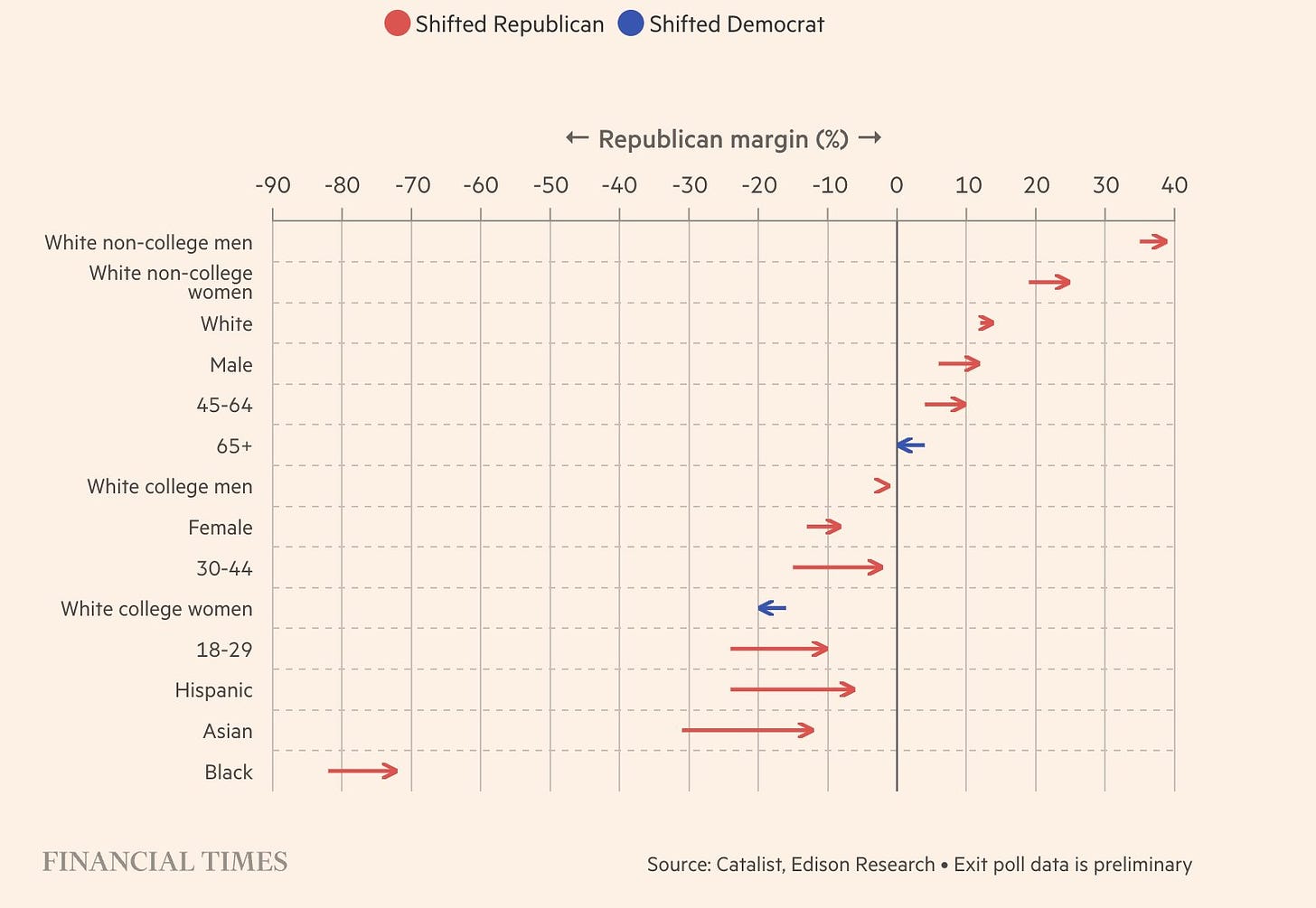

Gertken said that Trump had won 51% of the popular vote, driven largely by economic concerns such as inflation.

“Inflation was the real driver in this election,” said Gertken, “and that 20 percent increase in price levels over the last three years really motivated a huge opposition.”

He predicted that the Republicans' economic approach would involve substantial tax cuts reminiscent of Trump’s 2017 policies. While this could stimulate the economy in the short term, it could also lead to higher budget deficits and inflationary pressures.

The potential fiscal expansion would put the Federal Reserve (Fed) in a challenging position.

“The Fed has to be a little bit more hawkish, a little more vigilant, and that’s where we then see President Trump get entangled with Chairman Powell once again,” said Gertken.

When it comes to foreign policy, Gertken said that Trump would push for a ceasefire in Ukraine, but would have a harder time de-escalating tensions in the Middle East. He also said that tensions with China would continue.

“Trump's election in 2016 marked a historic shift toward competition with China,” he said, “and that trajectory is going to continue with him back in office.”

WHAT TO WATCH

Wednesday, November 13, 2024

Thursday, November 14, 2024

Friday, November 15, 2024

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.