Tariffs Triggered The Great Depression, Will History Repeat?

TABLE OF CONTENTS

Market Recap: Steve Hanke on whether Trump tariffs will cause depression

EQUITIES: A big selloff may occur in January, says Chris Vermeulen

ECONOMY: David Hay and Jeff Dicks on the biggest bubble ever?

ECONOMY: $200k Bitcoin and $4k gold in 2025, predicts Lawrence Lepard

CHINA: Keyu Jin explains how China will respond to Trump tariffs

MARKET RECAP

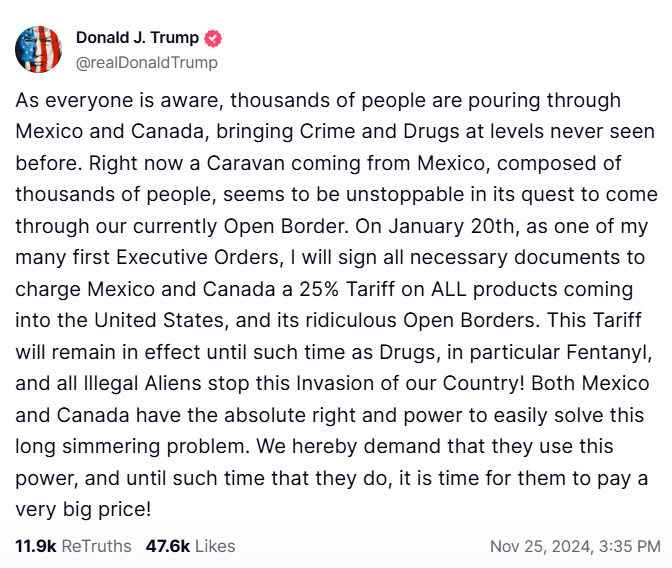

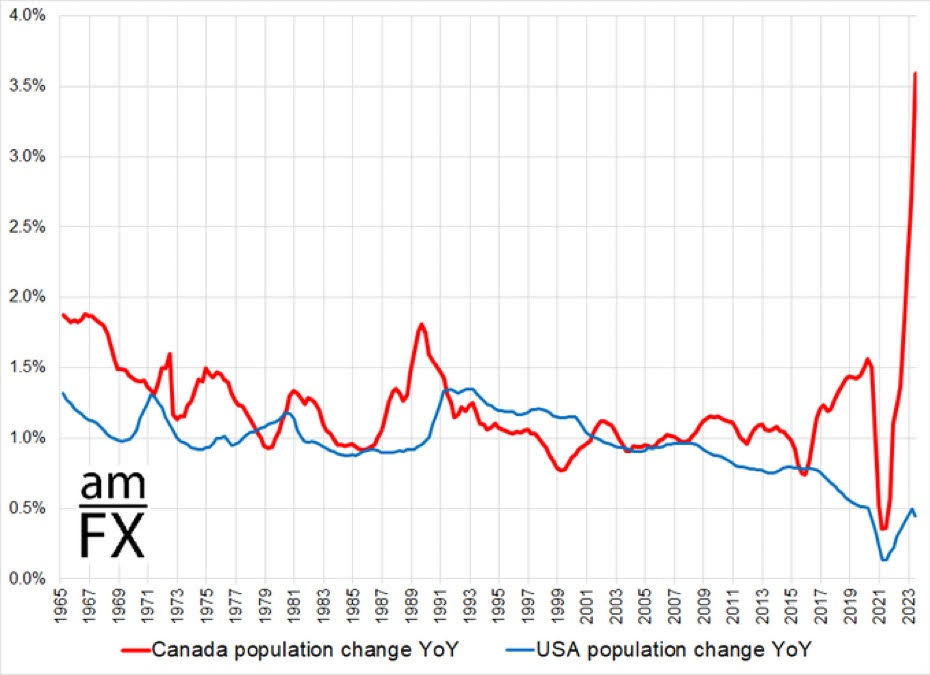

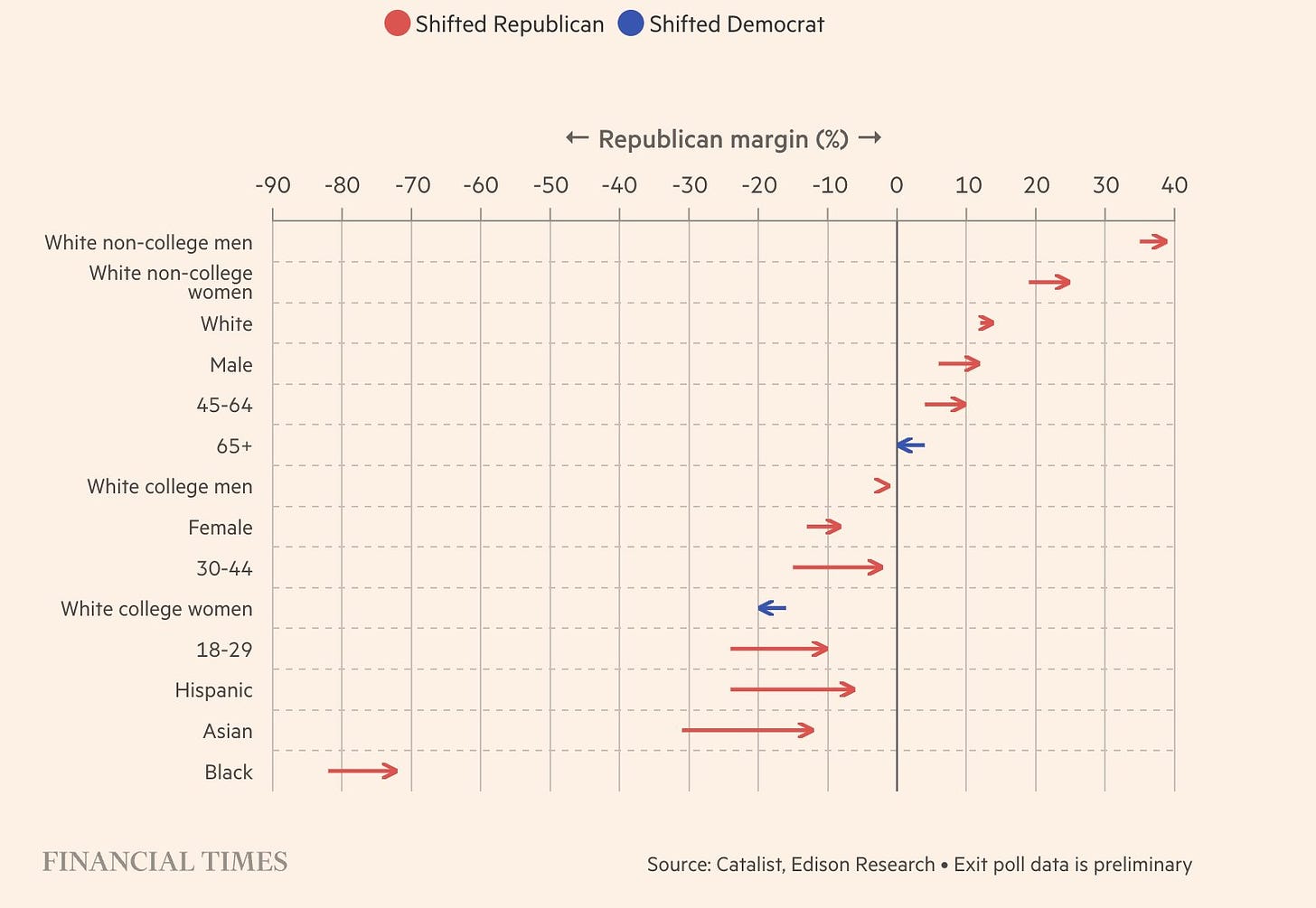

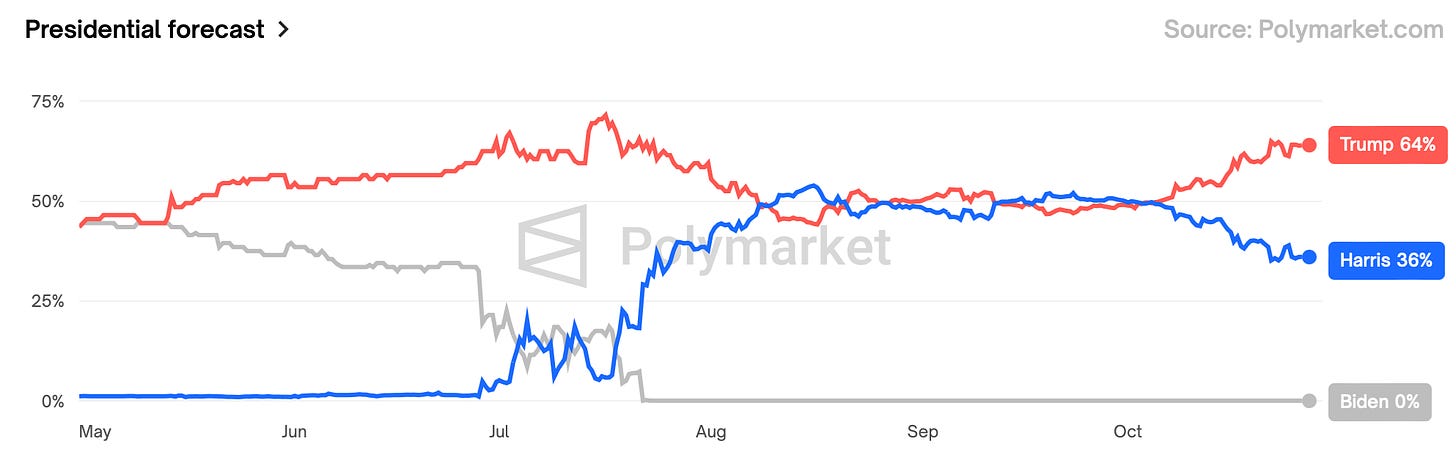

Latest News. On Monday, November 25th, President-Elect Donald Trump threatened 25 percent tariffs on Canada and Mexico, until “drugs, in particular fentanyl, and all illegal aliens” stop passing through the northern and southern borders into the U.S.

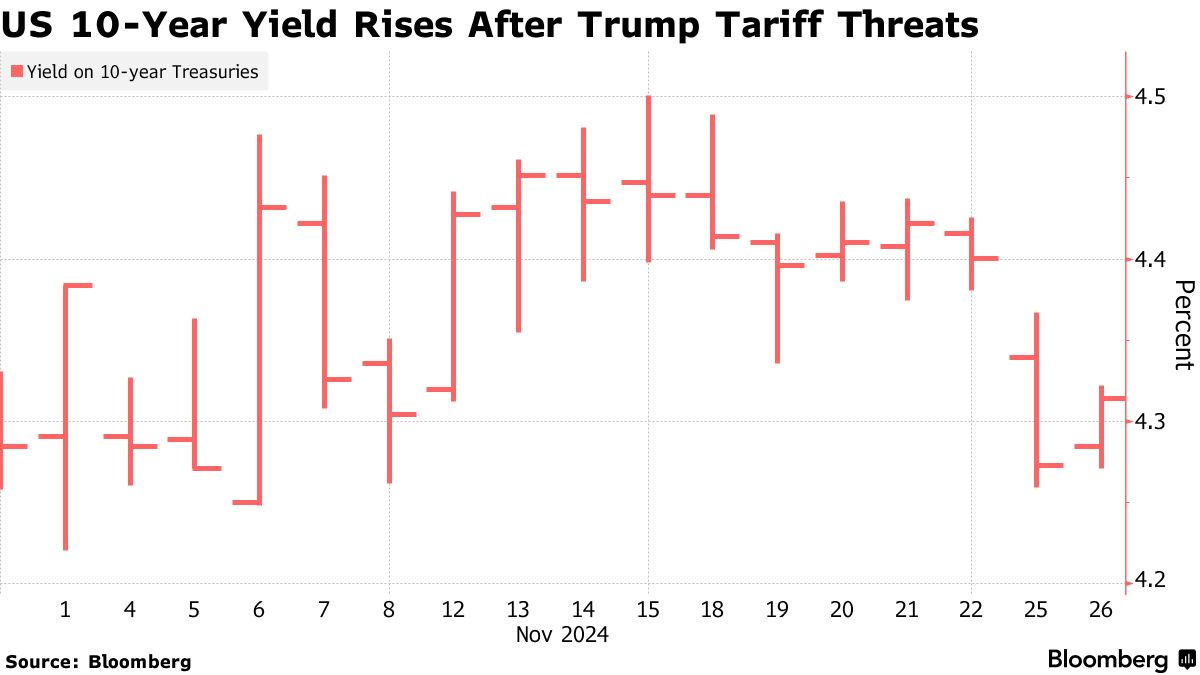

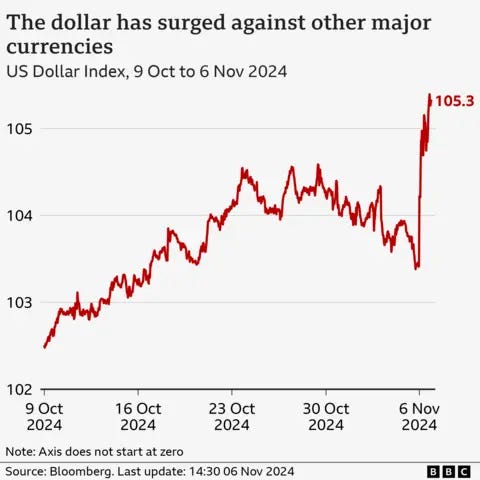

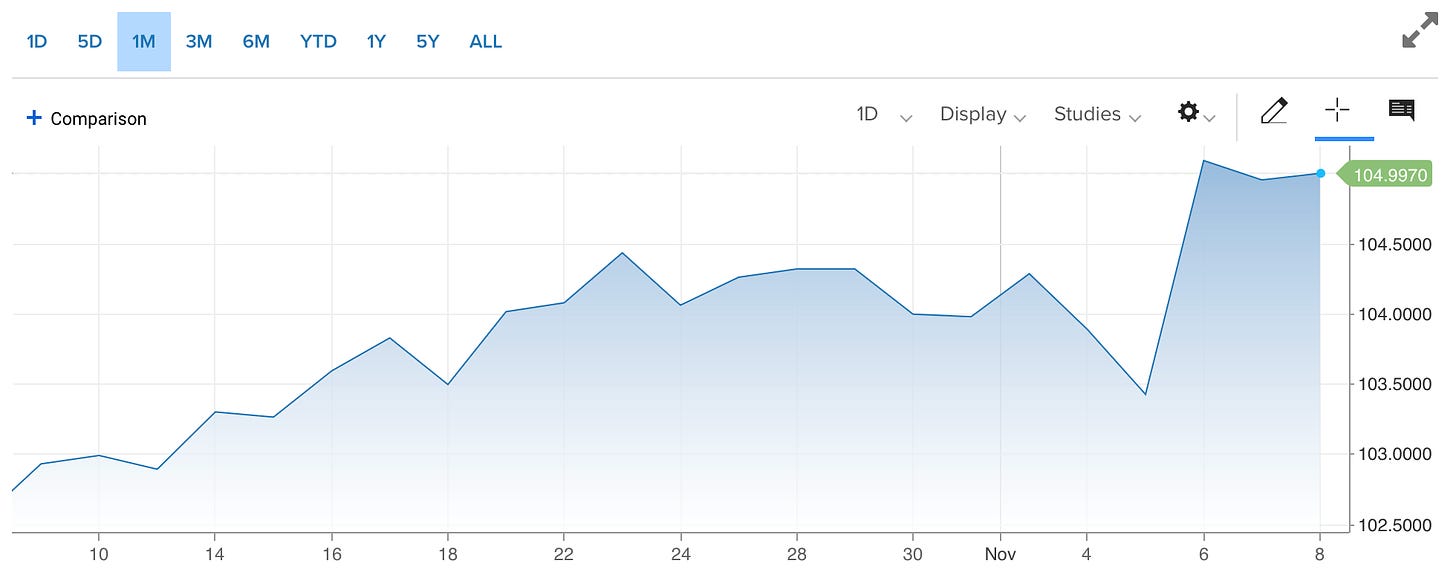

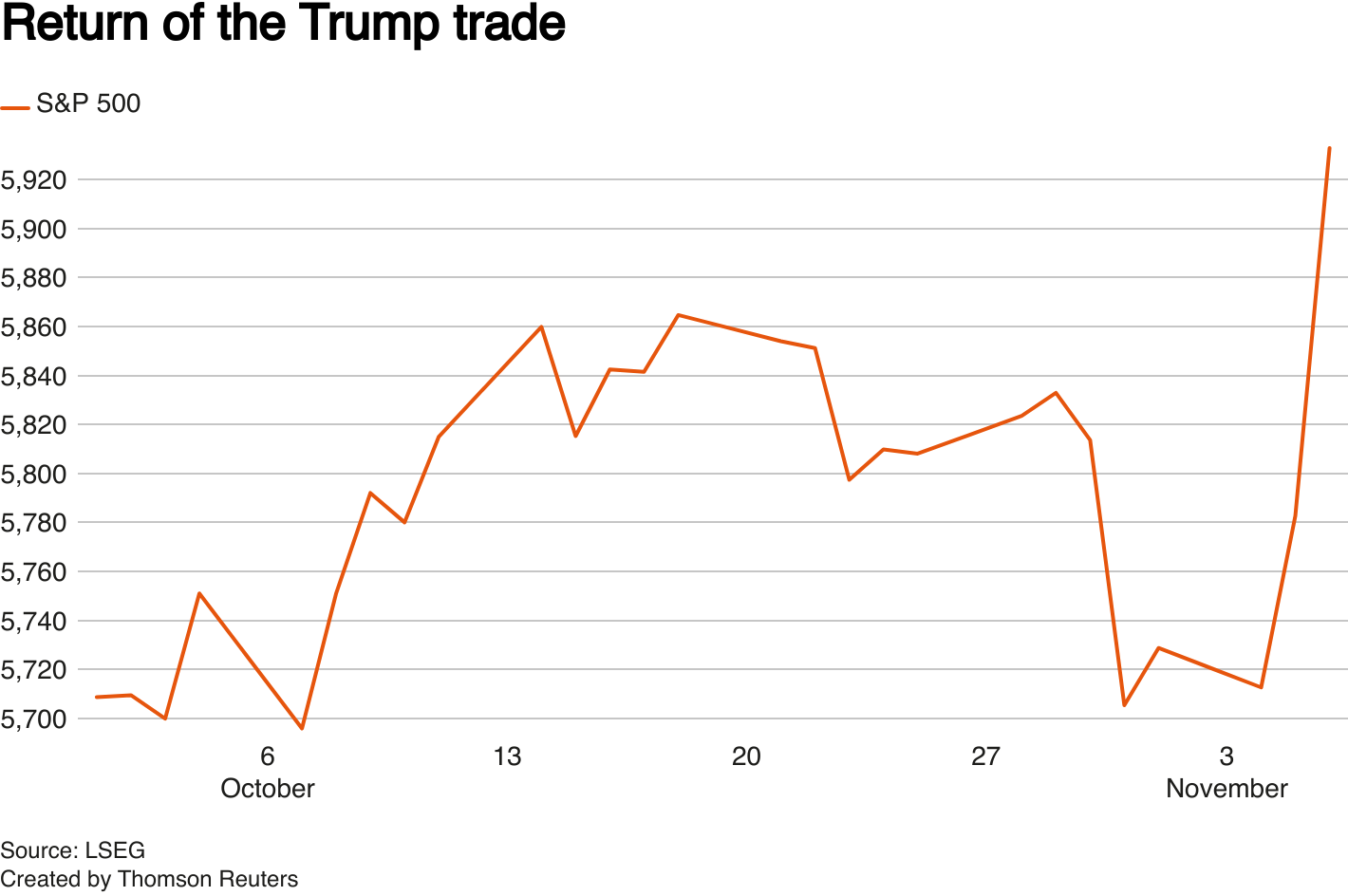

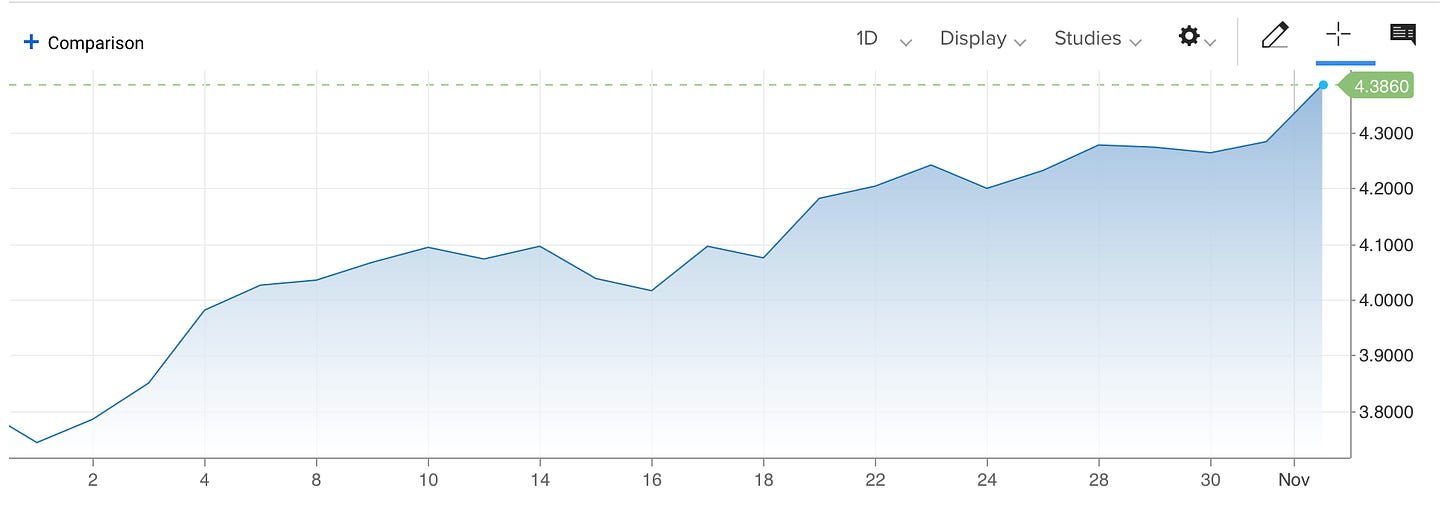

The market reaction was swift, with the U.S. dollar gaining 1 percent against the Canadian dollar and 2 percent against the Mexican peso. S&P 500 futures fell by 0.3 percent and the U.S. 10-year Treasury rose by four basis points to 4.31 percent on Tuesday, November 26th.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.

Prime Minister Justin Trudeau of Canada and President Claudia Sheinbaum of Mexico subsequently had phone calls with Trump.

Trudeau said that he had a “good call” with Trump, and his government later committed to spending more on policing the Canadian border. Trump met with Trudeau at Mar-a-Lago on Friday, November 29th.

Sheinbaum, by contrast, said that she would not agree to stop illegal border crossings, and even hinted at retaliatory tariffs if Trump were to impose tariffs on Mexico.

Trump also threatened a 10 percent tariff on China.

Steve Hanke, Professor of Applied Economics at Johns Hopkins University, joined the show to discuss these tariffs and their potential effects on the U.S. economy.

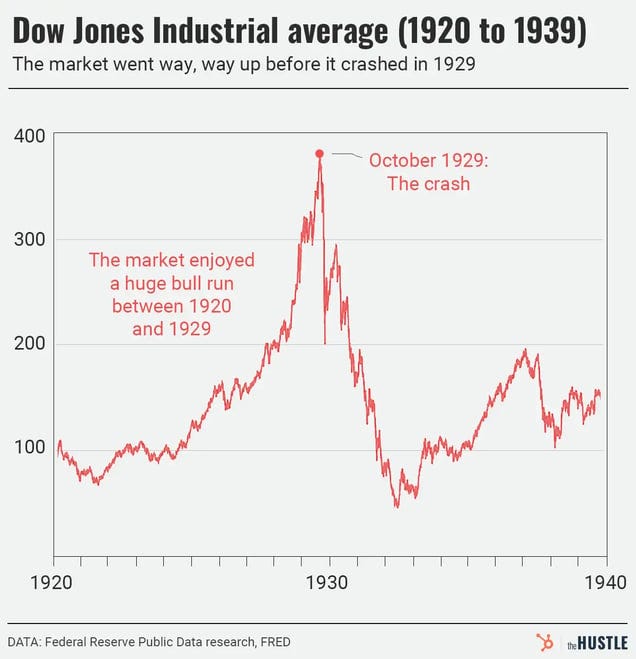

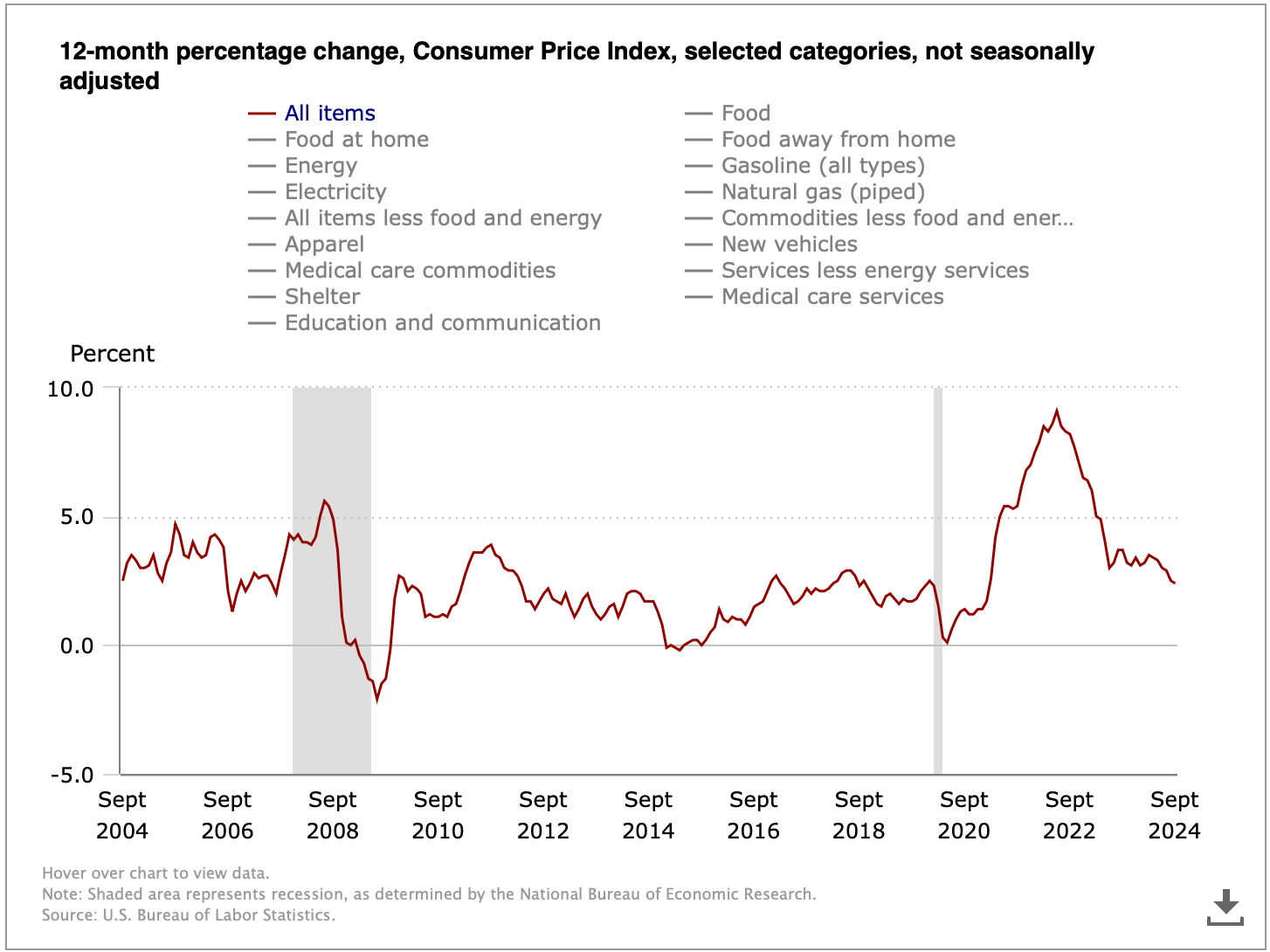

Hanke pointed to the historical example of the Smoot-Hawley Tariffs of the 1930s, which he said had exacerbated The Great Depression.

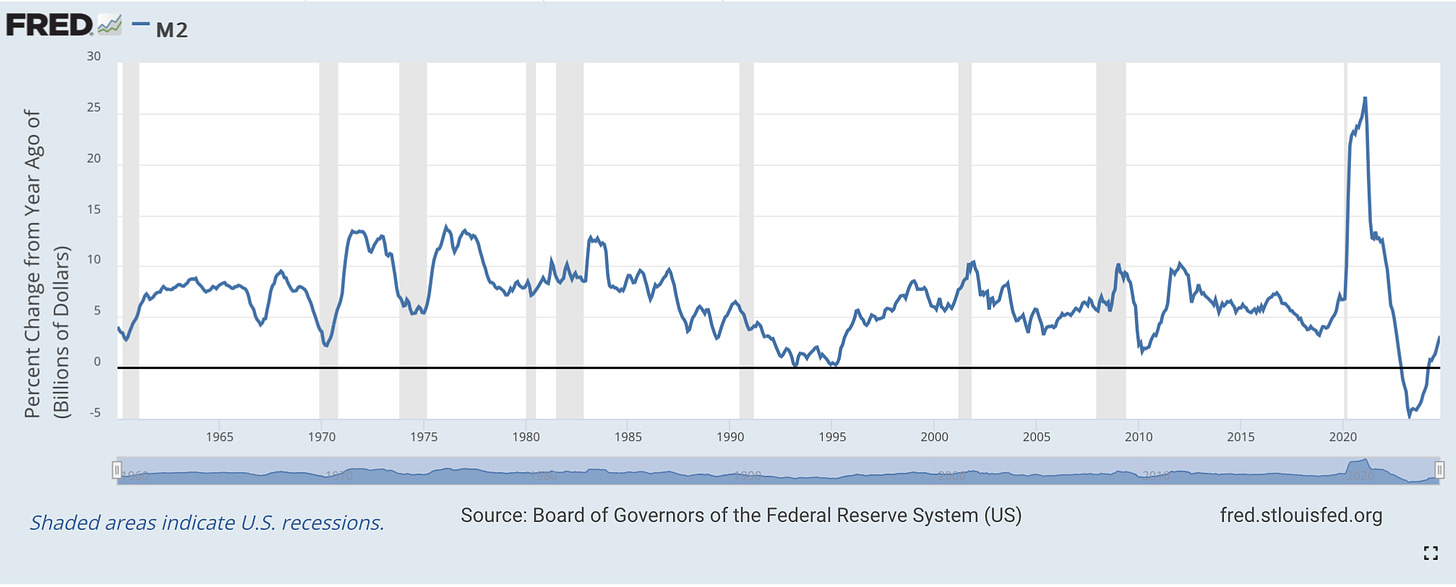

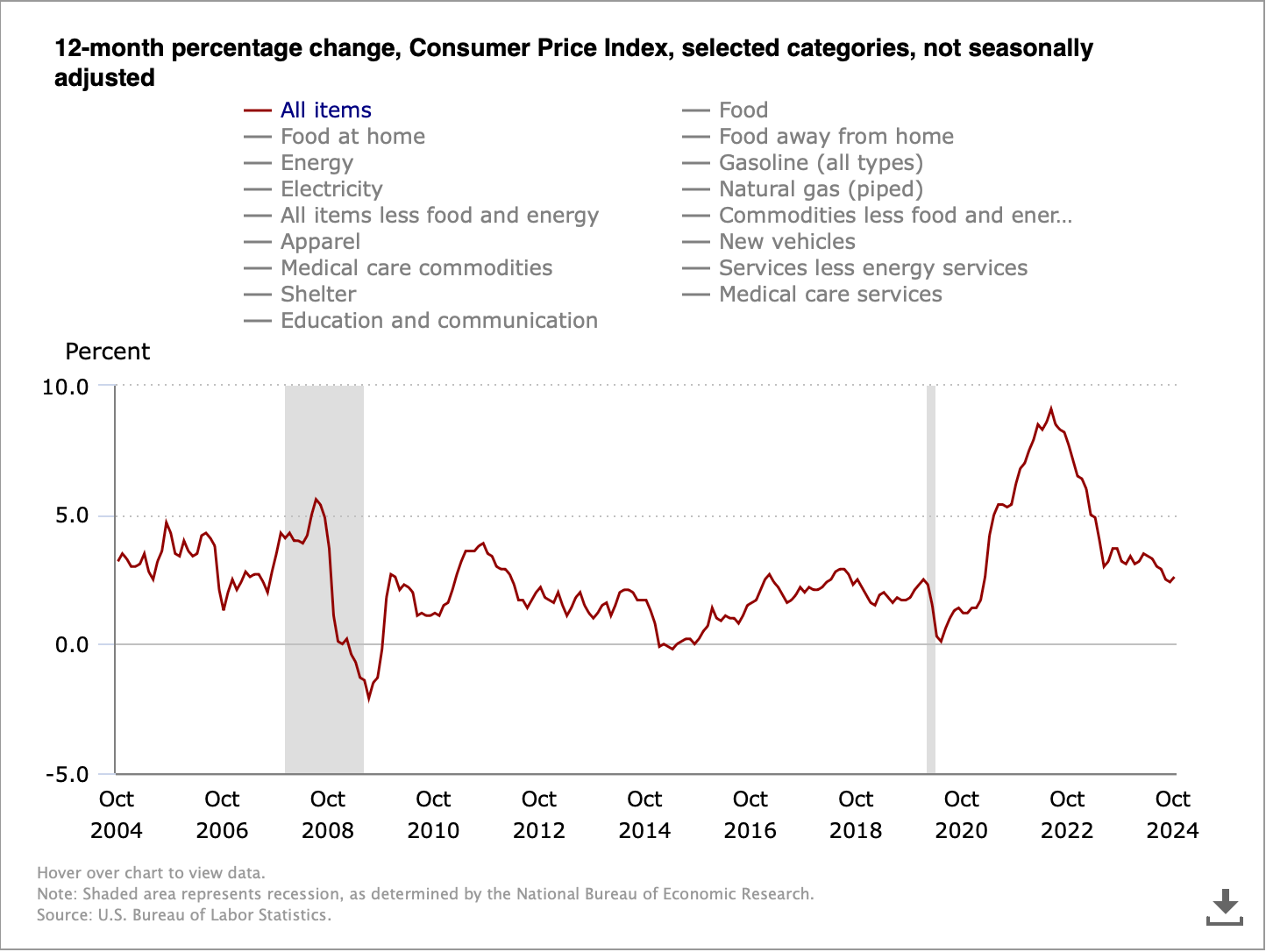

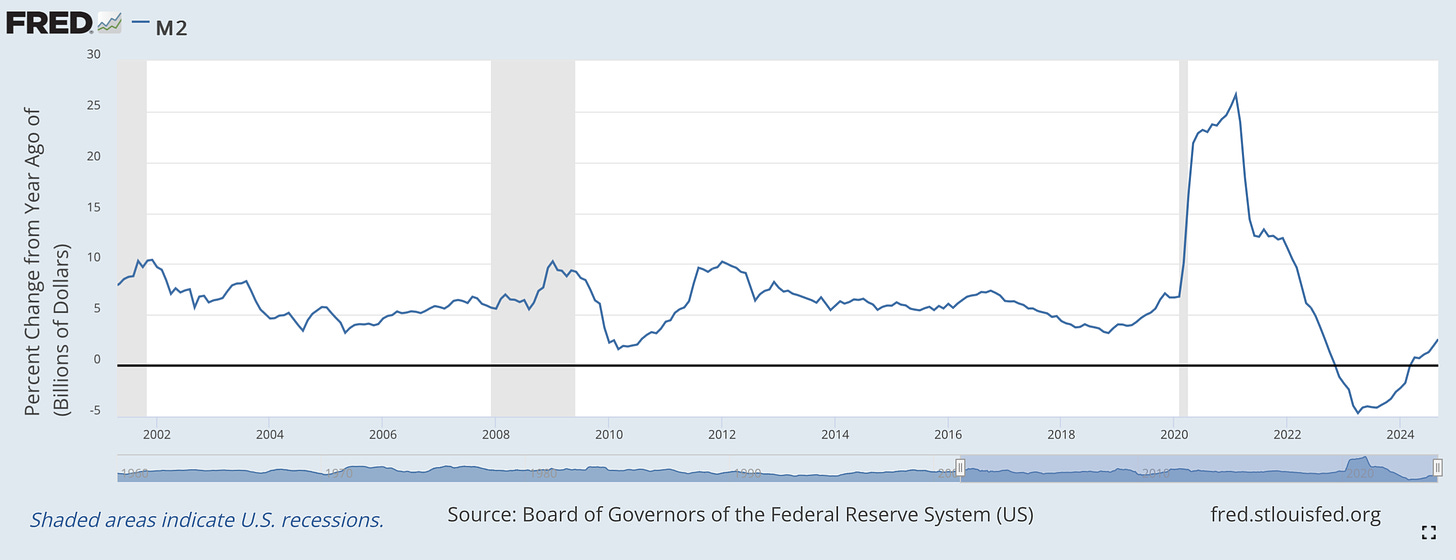

“The Smoot-Hawley Tariffs did contribute to The Great Depression,” he explained. “The money supply [also] contracted massively between 1929 and 1933. So that was a one-two punch that gave us The Great Depression.”

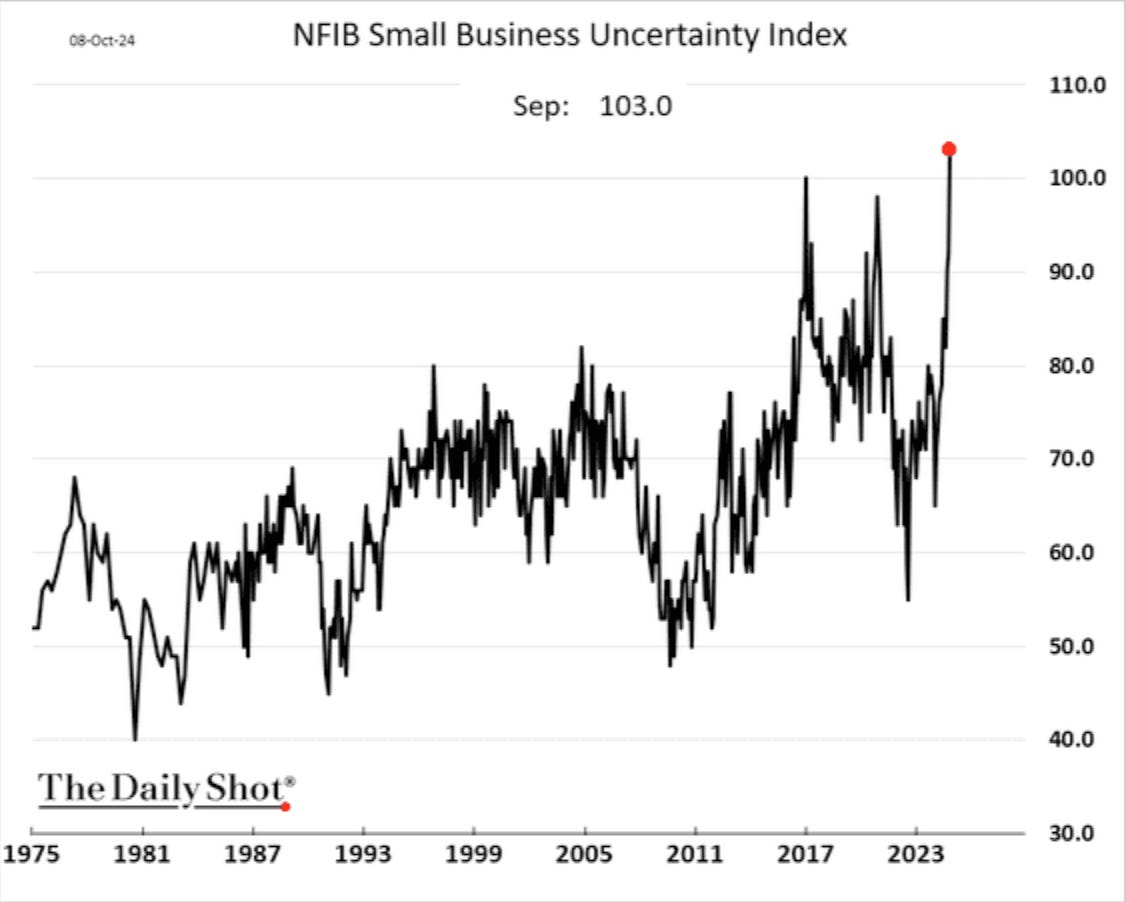

Hanke said that money supply growth has been contracting recently, which is a leading indicator of a recession. He also predicted that Trump’s tariffs could be more damaging to the economy than Smoot-Hawley, because “the U.S. economy is not as free market and flexible as it used to be.”

The American consumer and the manufacturing sector would also suffer under tariffs, said Hanke.

“A lot of imports to the United States aren’t consumer goods, they’re intermediate inputs,” he said. “You have complicated supply chains, and those will be disrupted and affected.”

He added that tariffs would be ineffective against China, which would simply allow its yuan to weaken.

“If you put a 20 percent tariff on China, then China will say… we’re going to let the yuan depreciate against the U.S. dollar 20 percent,” said Hanke. “The Chinese can do all kinds of things. By the way, they can cut us off from critical materials, and send the U.S. economy into a total tailspin.”

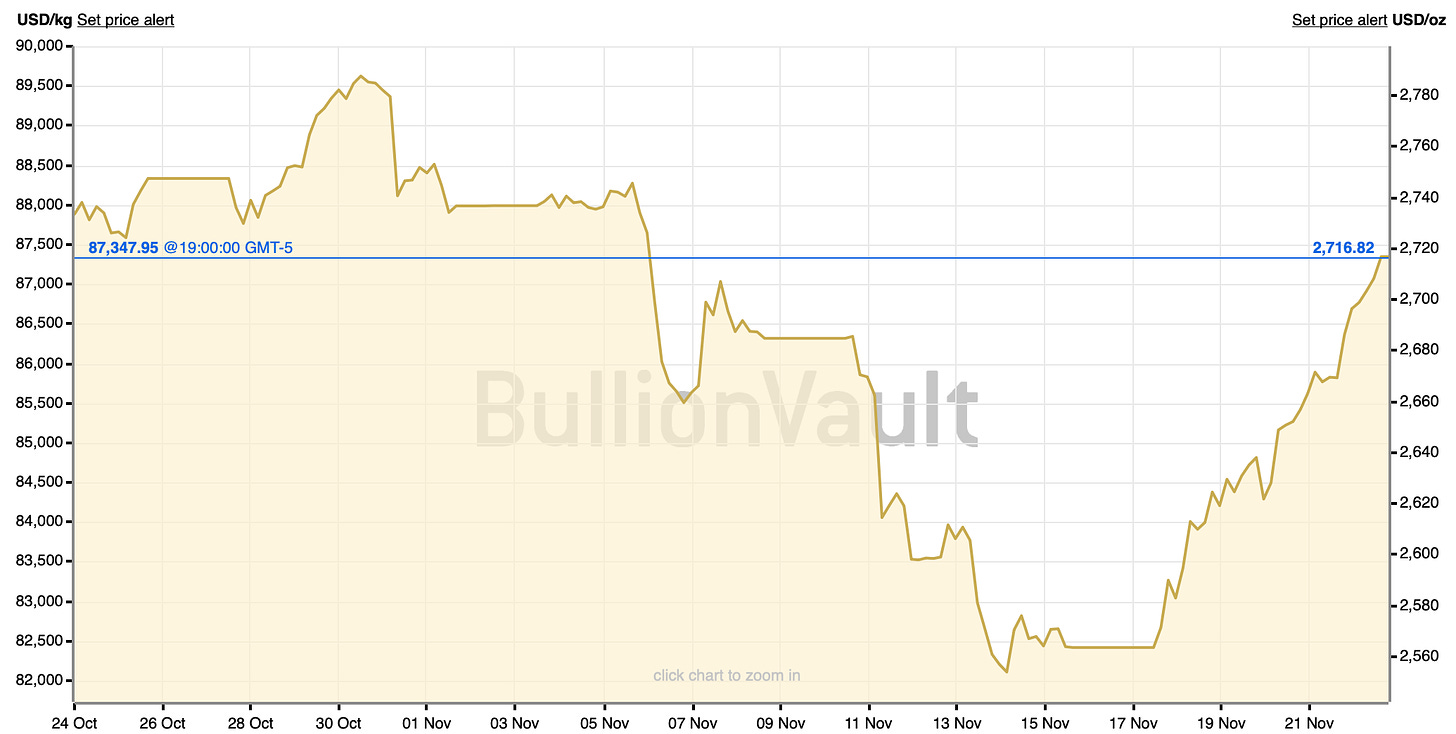

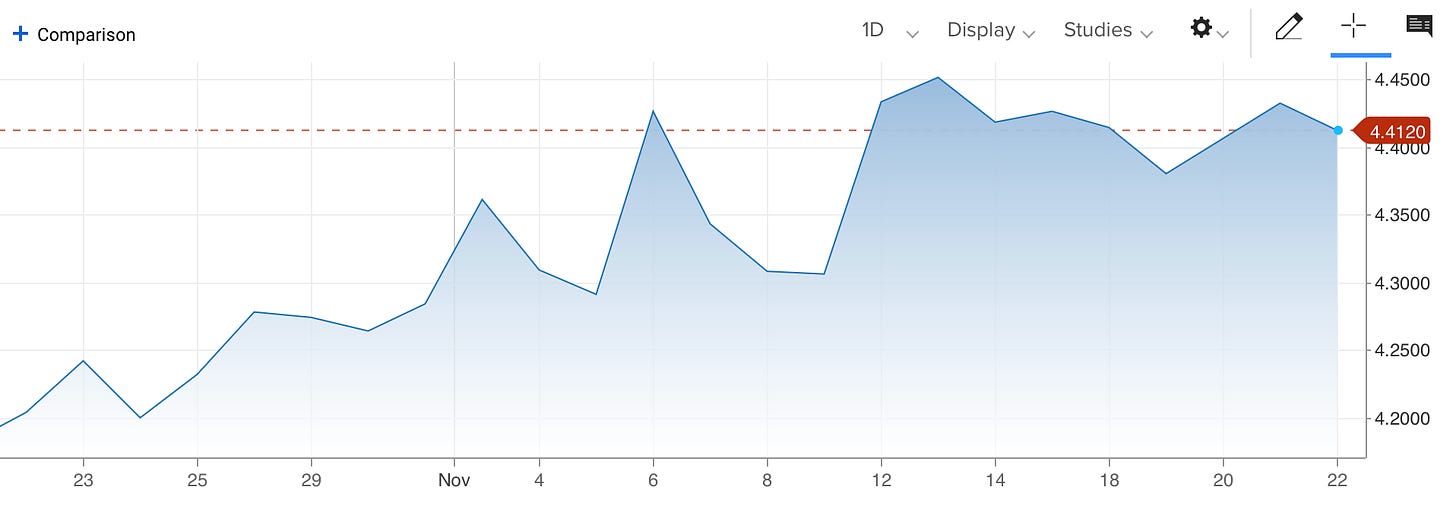

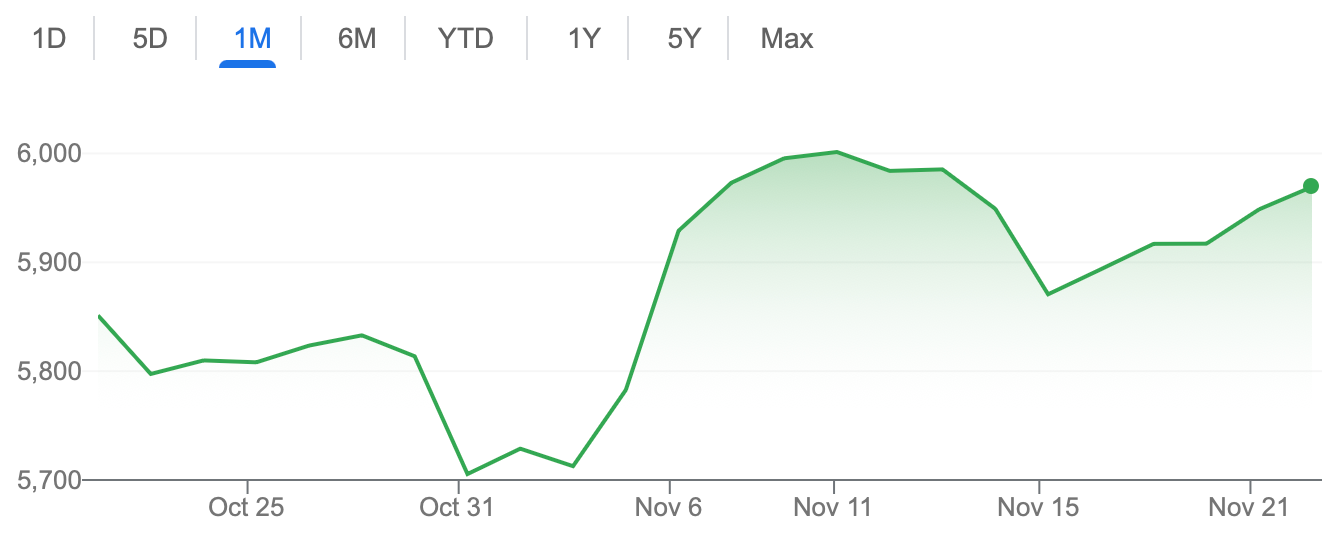

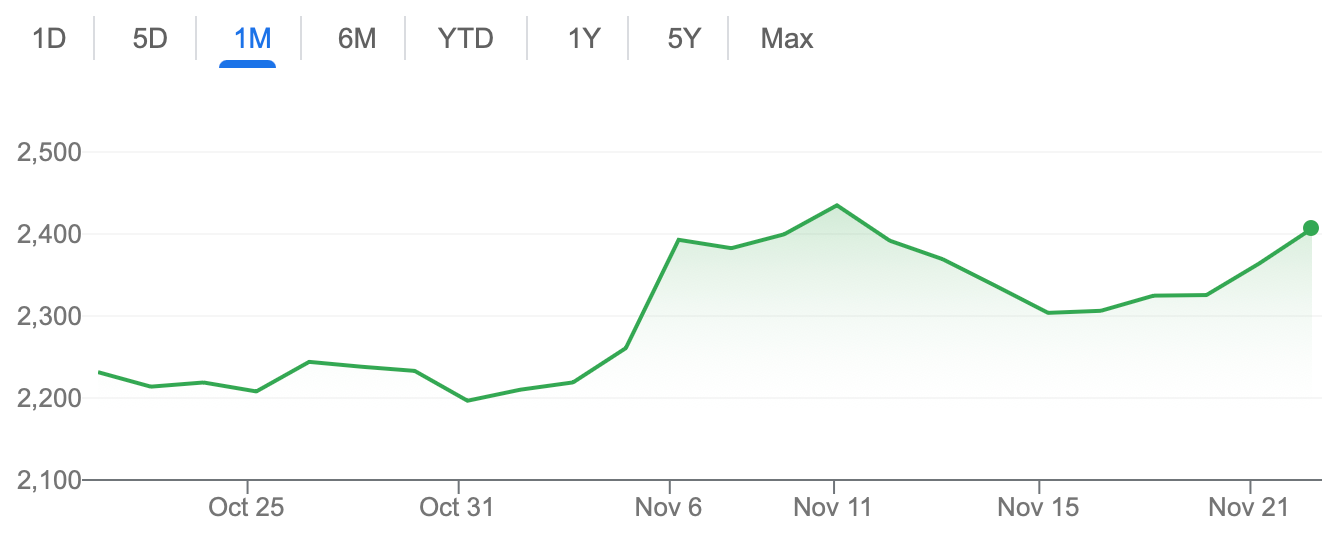

Market Movements

From November 22 to November 29, the following assets experienced dramatic swings in price. Data are up-to-date as of November 29 at 9pm ET (approximate).

MicroStrategy Inc. — down 8.2 percent.

Hertz — up 22.4 percent.

Bath & Body Works — up 18 percent.

Natural Gas (Henry Hub) — up 7.7 percent.

Solana — down 7.4 percent.

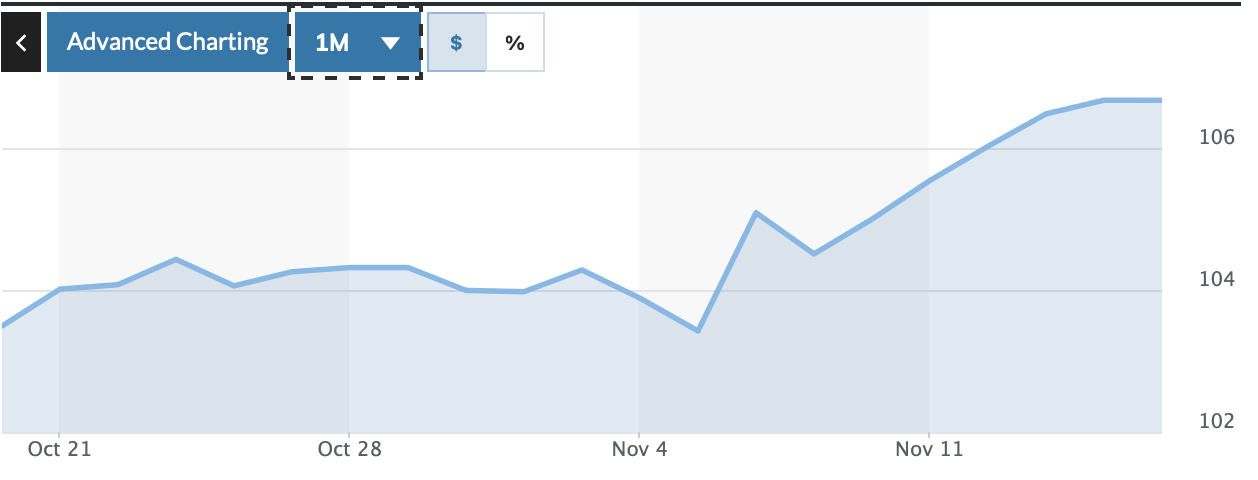

The following major assets experienced the following price movements during the same time interval.

DXY — down 1.6 percent.

Bitcoin — down 2 percent.

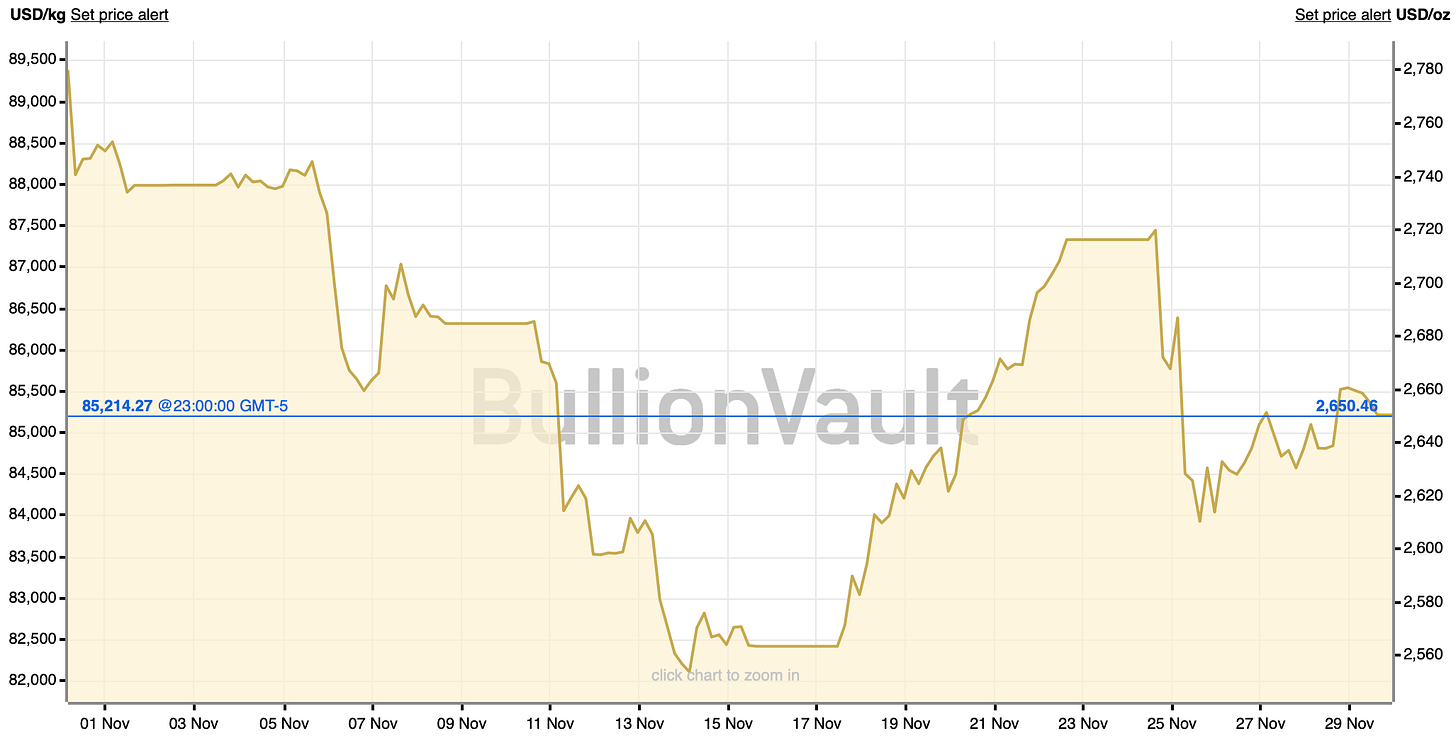

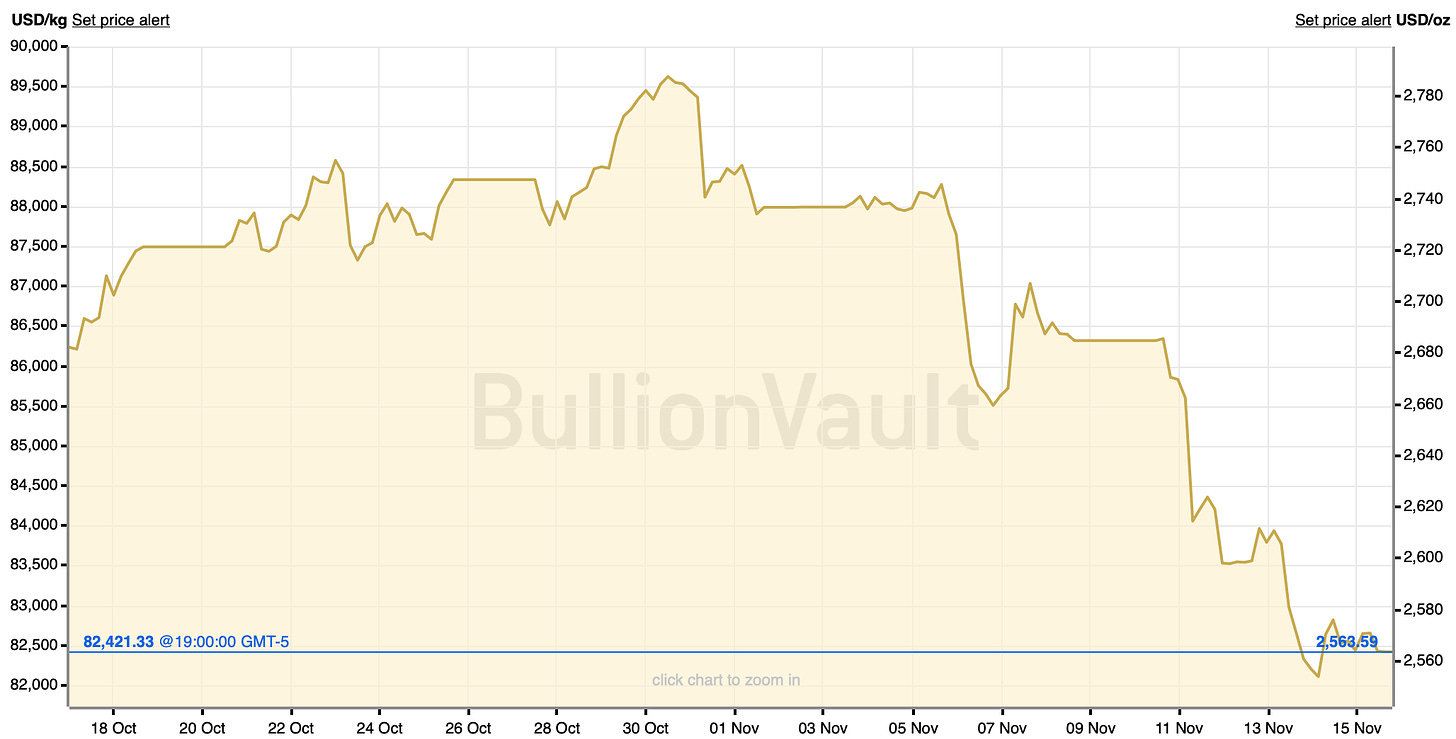

Gold — down 2.1 percent.

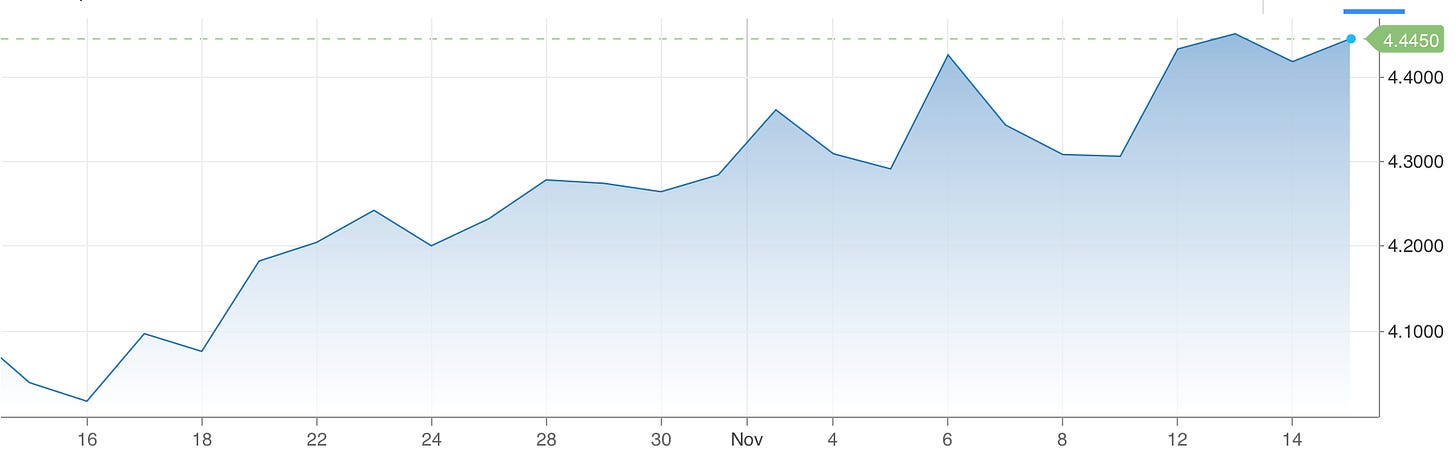

10-year Treasury yield — down 5.3 percent.

S&P 500 — up 1 percent.

Russell 2000 — up 1.2 percent.

USD/yuan — no significant change.

EQUITIES:

BIG SELLOFF IN JANUARY?

Chris Vermeulen, November 28, 2024

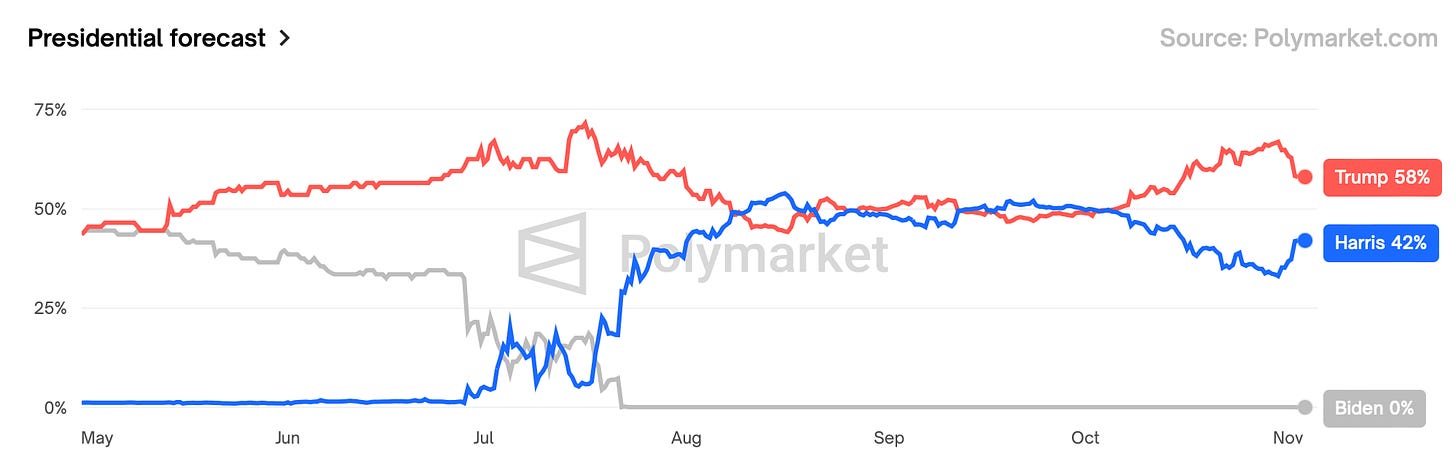

Chris Vermeulen, Chief Market Strategist at TheTechnicalTraders.com, returned to the show to give us his market outlook on stocks, Bitcoin, gold and the U.S. dollar.

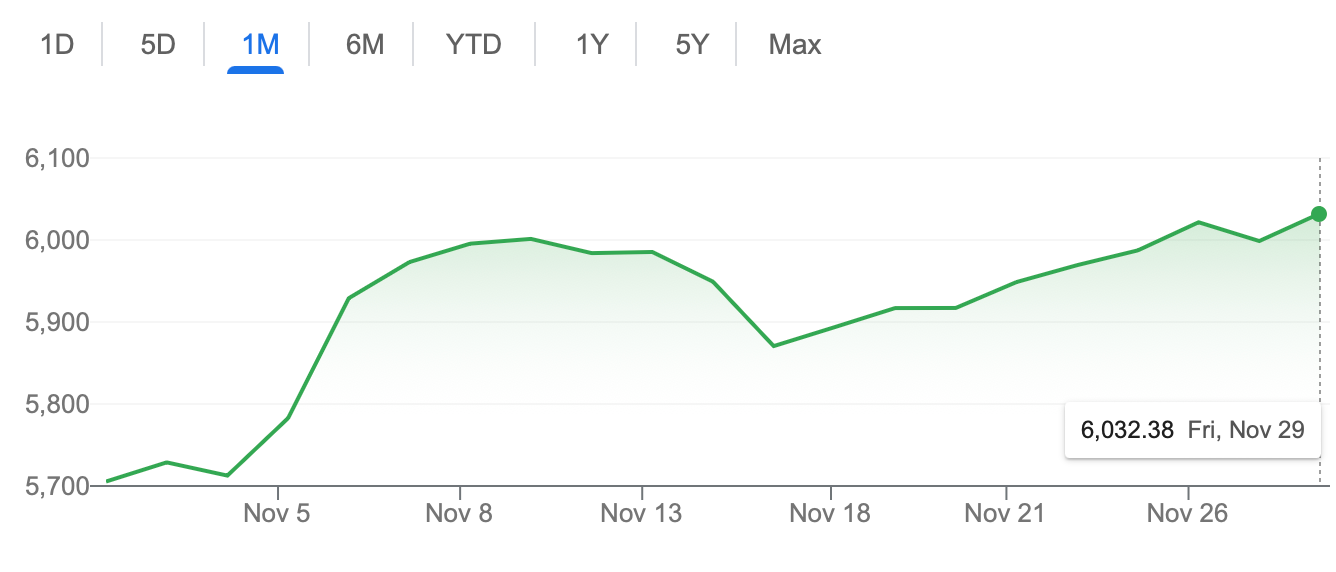

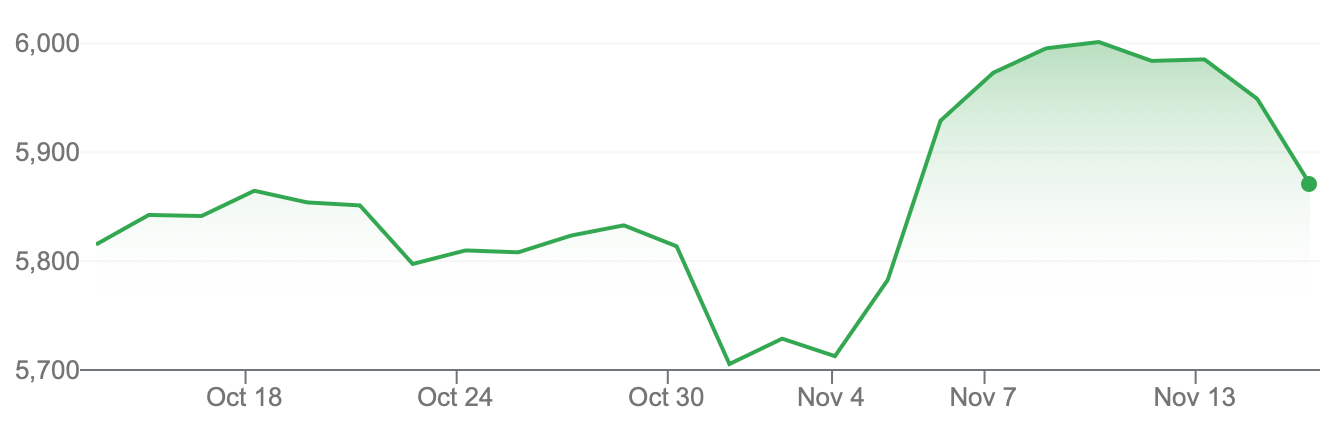

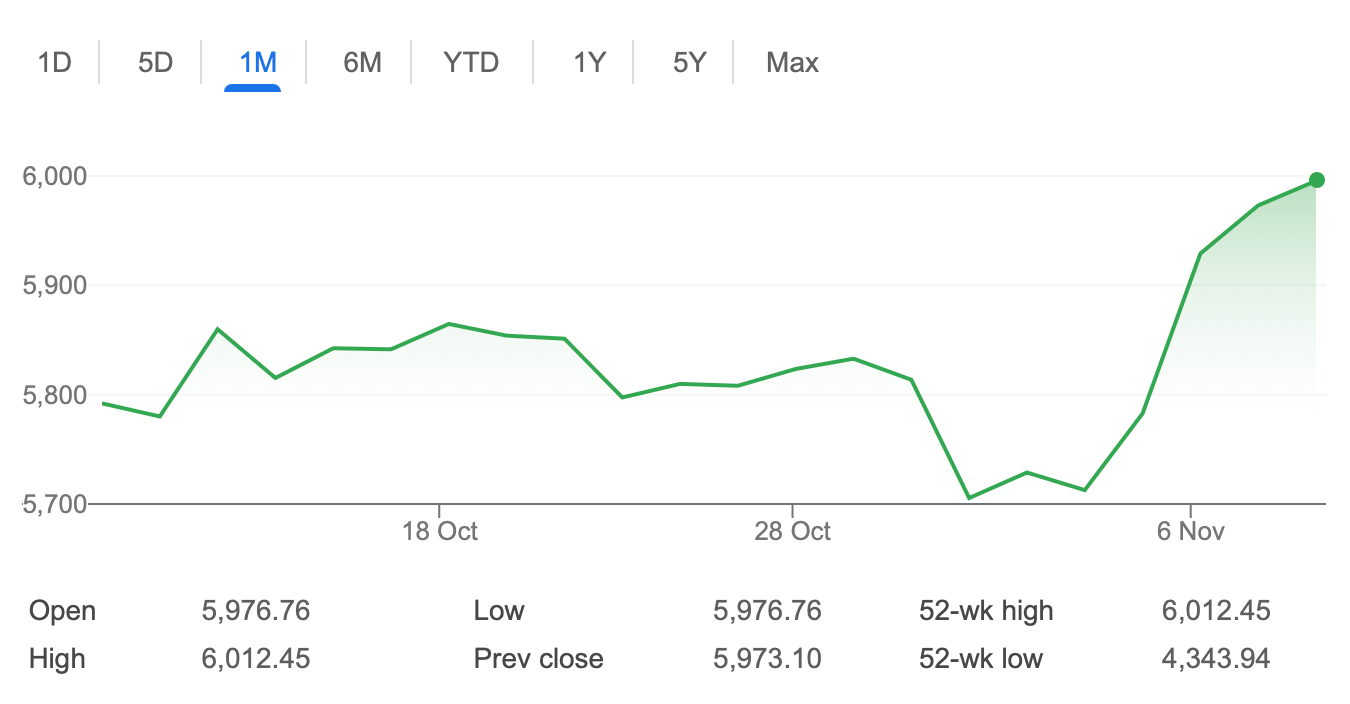

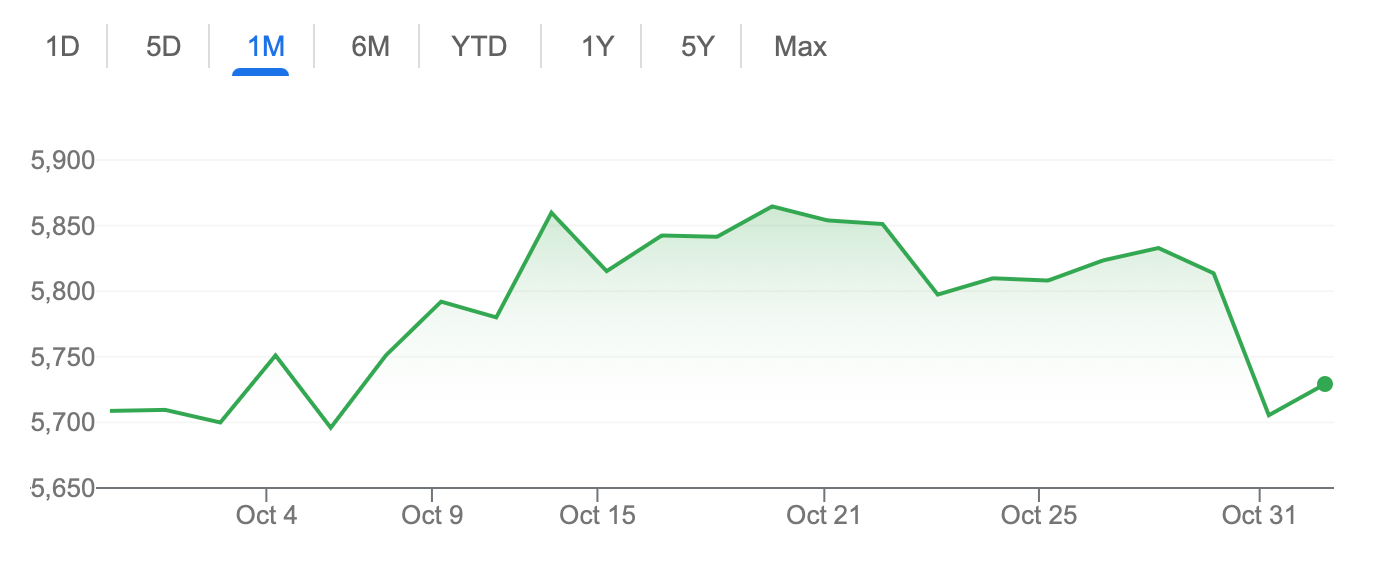

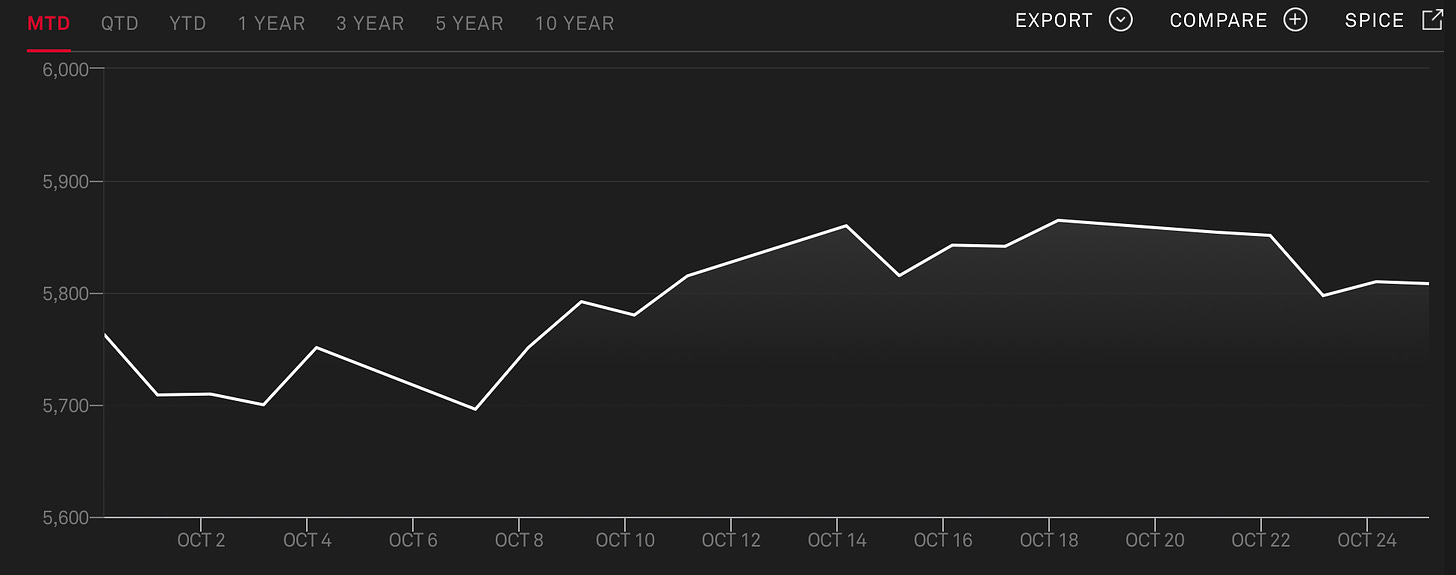

Vermeuelen said that the S&P 500 had reached a “psychological level” of 6,000 before retracting. He explained that psychological levels are “typically whole numbers” like 5,000 or 6,000, which make traders feel like they should sell.

However, he remained bullish on equities, predicting a short-term rise of 2 percent in the S&P.

“The market is trying to digest a previous high,” he explained. “I know people are pretty nervous right now that the market is going to roll over, but in the grand scheme of things, I think the stock market is ready to climb.”

However, he cautioned that January would be “pretty ugly” as the market experiences a “much bigger drop” after the optimism following Trump’s inauguration “fizzles out.”

“I think this momentum in this Trump bump in price… I think once all of that fizzles out, I think we could see some big selling,” Vermeulen predicted.

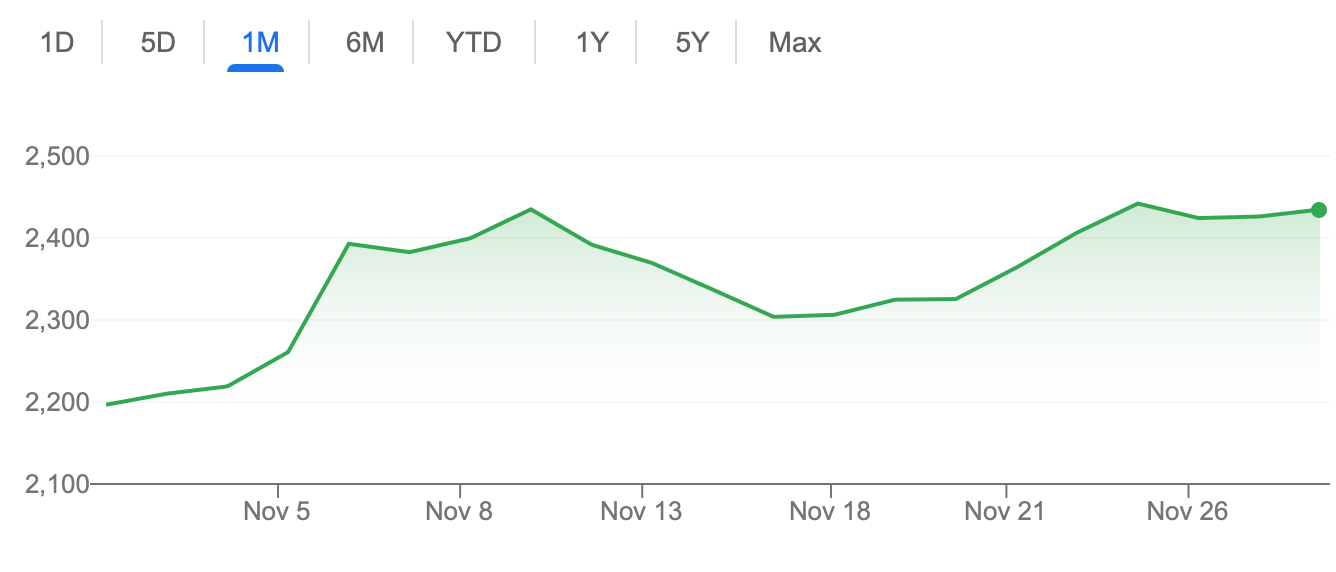

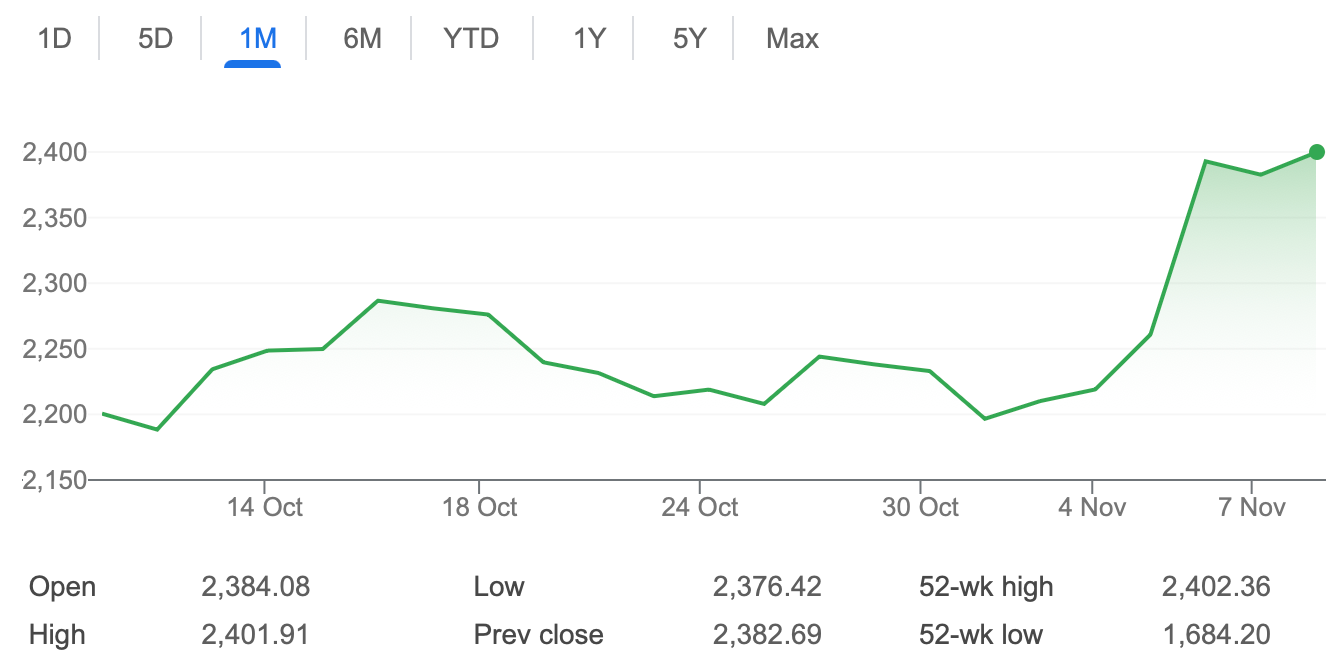

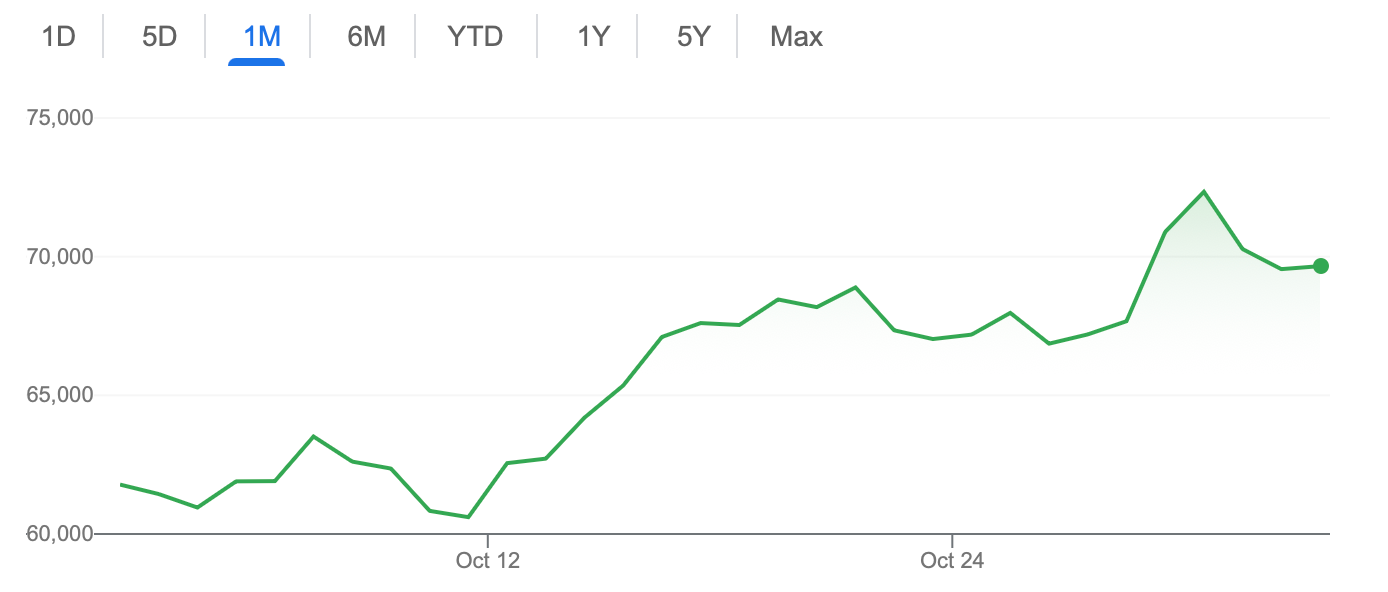

When it came to Bitcoin, Vermeulen predicted that once Bitcoin hits $100k, “we’re going to see some selling,” because this would be a “mental resistance level.”

However, he said that he had recently bought some Bitcoin.

“I like Bitcoin, not as an investment,” he said. “The reason I like it is that it is such a herd mentality trade… I still think it’s going higher.”

Pointing to his chart, Vermeulen said, “this tells us where Bitcoin should go next, which is about 108 to 109 thousand dollars.”

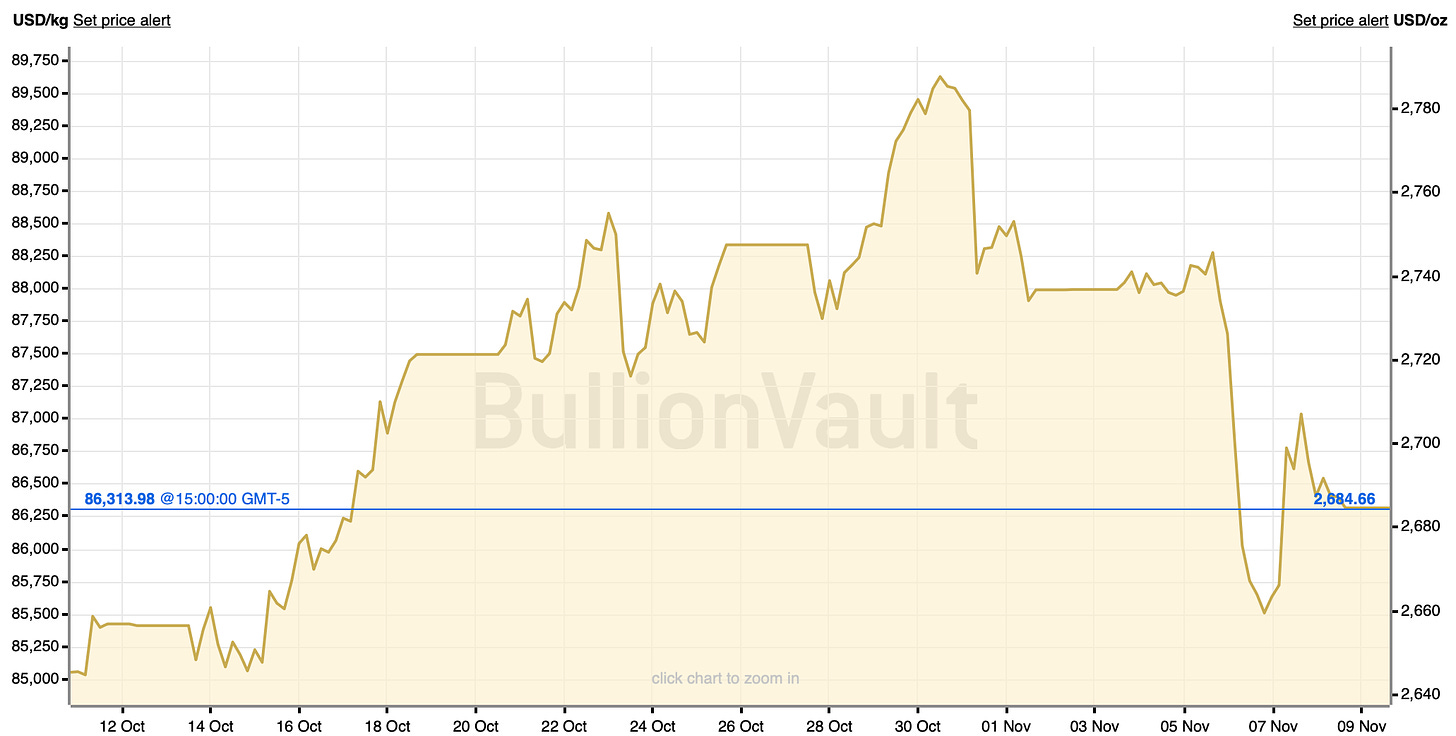

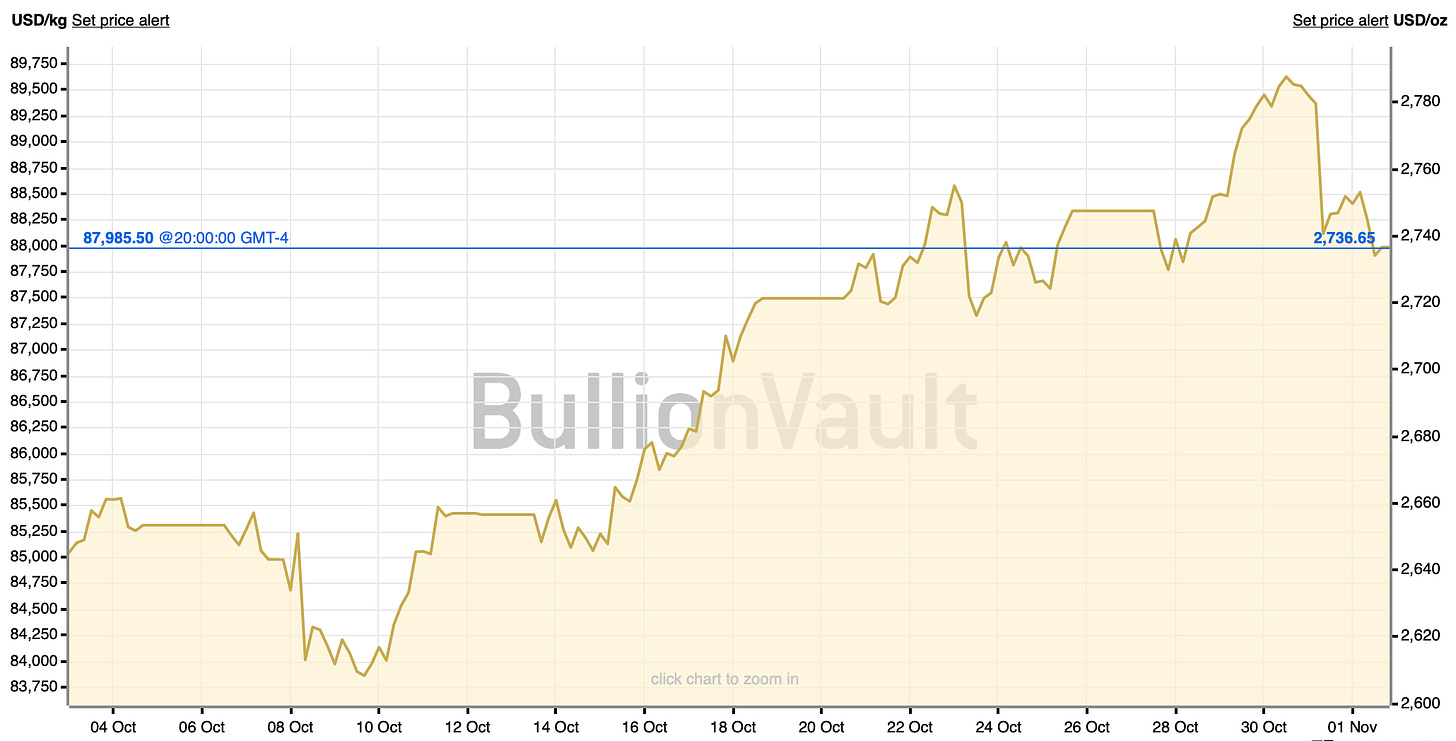

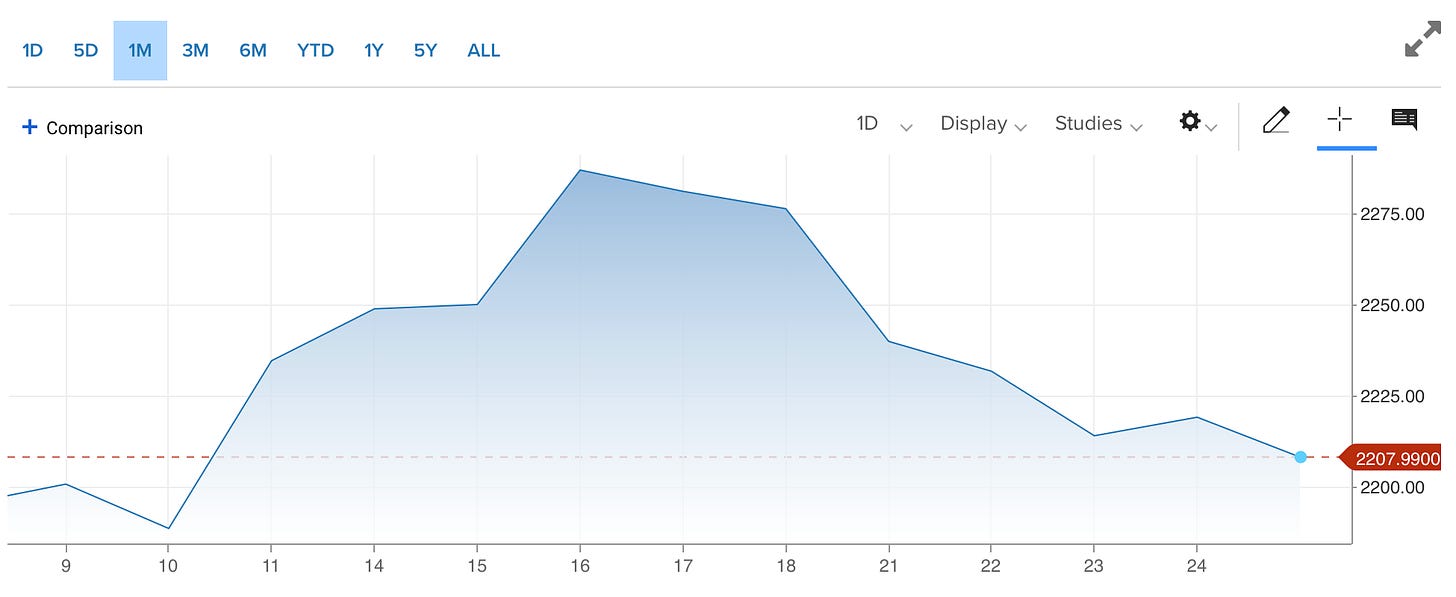

Vermeulen said that gold has hit its measured move target around $2,800 and anticipates a 15-25 percent correction. He plans to add more after a significant correction.

Despite recent fluctuations, he remains bullish on the dollar, viewing it as a safe haven.

“When chaos hits, I think we’re eventually going to see… the DXY up to maybe 130,” he said.

ECONOMY:

BIGGEST BUBBLE EVER?

David Hay and Jeff Dicks, November 30, 2024

David Hay and Jeff Dicks, co-CIOS of Evergreen Gavekal, gave us their outlook for the U.S. economy following the election of Donald Trump.

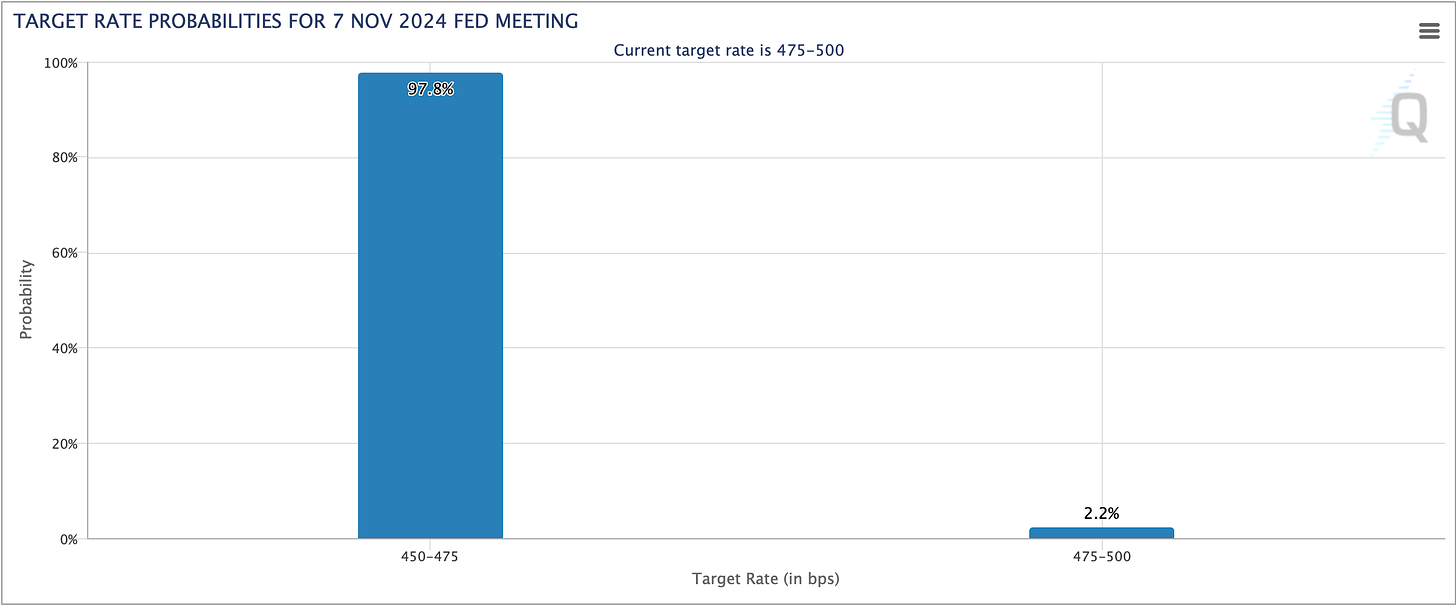

Dicks said that markets are interpreting Trump’s policies to be inflationary, which has caused bond yields to surge higher.

“The policies that Trump will put through are going to be largely inflationary,” he explained. “So far, that’s been bad for bonds.”

However, Dicks said that bonds “looked fairly oversold,” and that fixed income may benefit from a “relatively strong economy” in the coming years. He pointed to consumer spending, real wages, and GDP as being strong.

“I think it’s almost no question we are having a soft or no landing,” he said. “Q2 GDP is 2.9 [percent], and Q3 GDP looks like it’s coming in at 2.8 [percent]… those who think there’s a recession at hand, I think, are wrong.”

When it comes to the U.S. dollar, Hay said that Trump had sent mixed messages in his campaign on whether he wanted a strong dollar.

“He wants to get the U.S. trade deficit down meaningfully,” he said. “To do that with a rising dollar is really tough, and I actually believe he’d like to see the dollar come down significantly, particularly against the Chinese currency, the renminbi, and also against the Japanese yen.”

Hay was also skeptical about Trump’s proposed DOGE (Department of Government Efficiency), headed by Elon Musk and Vivek Ramaswamy, which was set up to cut $2 trillion in government waste.

“So many of these expenditures are locked in,” said Hay. “Medicare, Social Security, Medicaid — those are tough to cut.”

He explained that even if the Trump admin manages to cut $2 trillion, this would hurt the American economy and could cause “pain” that would be “unacceptable” for most Americans.

ECONOMY:

$200K BITCOIN AND $4K GOLD IN 2025

Lawrence Lepard, November 26, 2024

Lawrence Lepard, Managing Partner of Equity Management Associates, gave us his surprising forecast: Bitcoin will reach $200k and gold will reach $4k in 2025. He also discussed his economic outlook for the U.S.

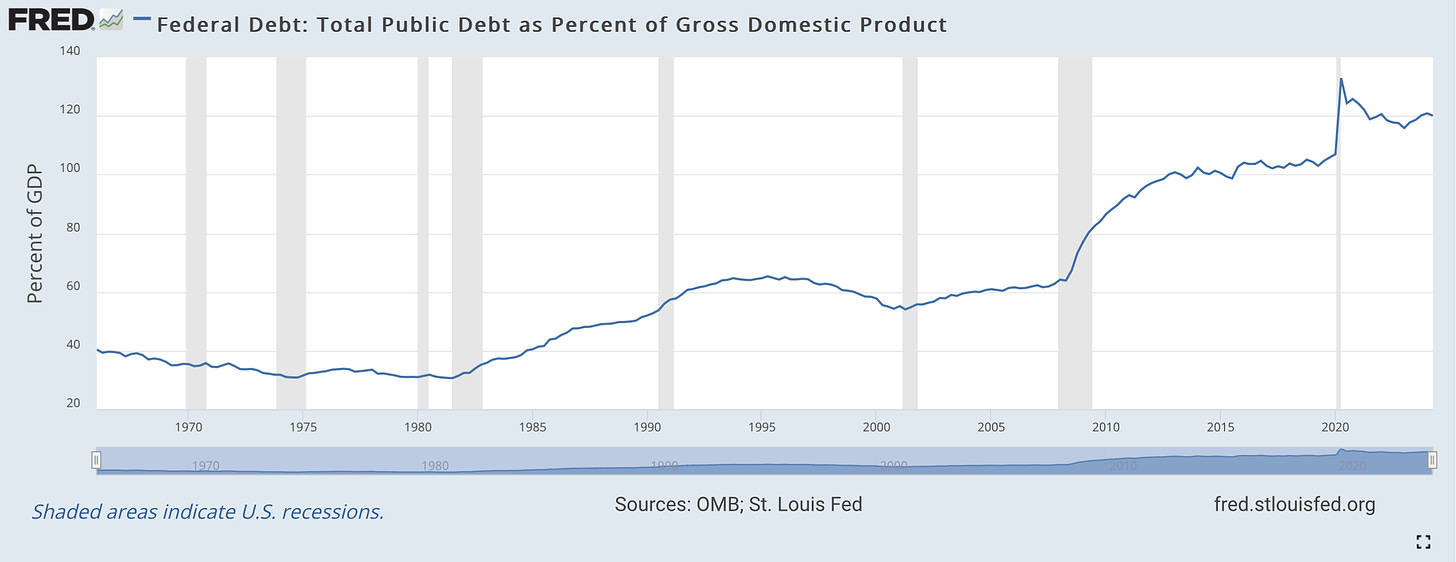

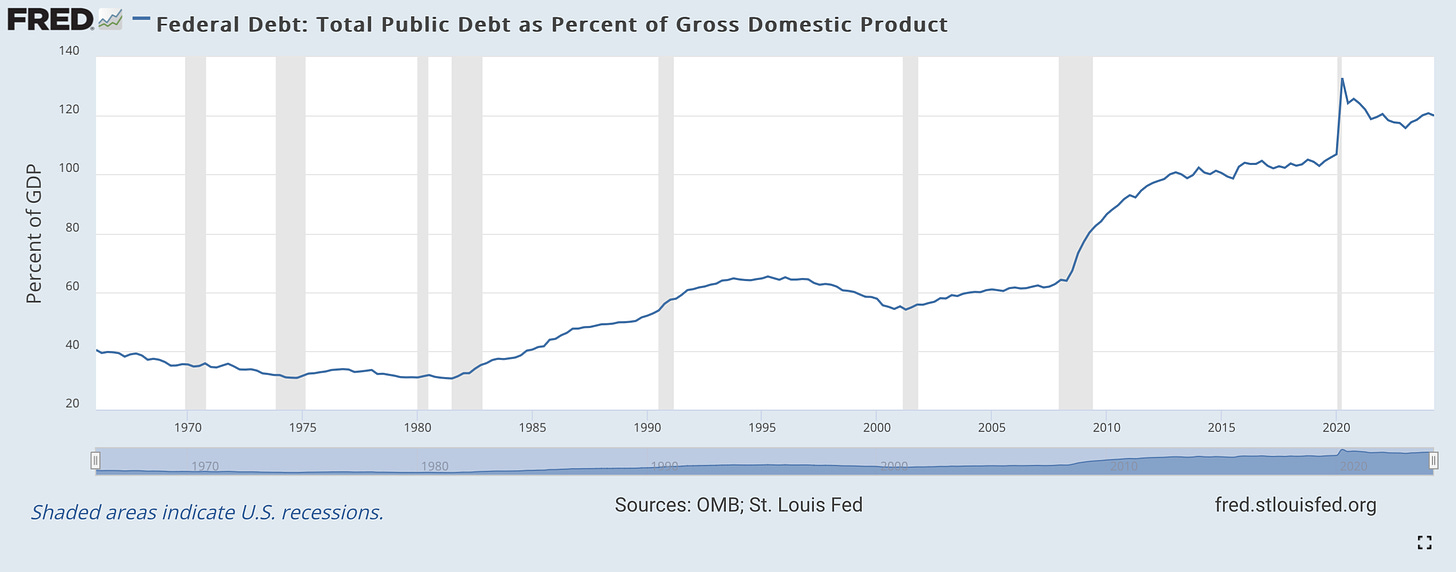

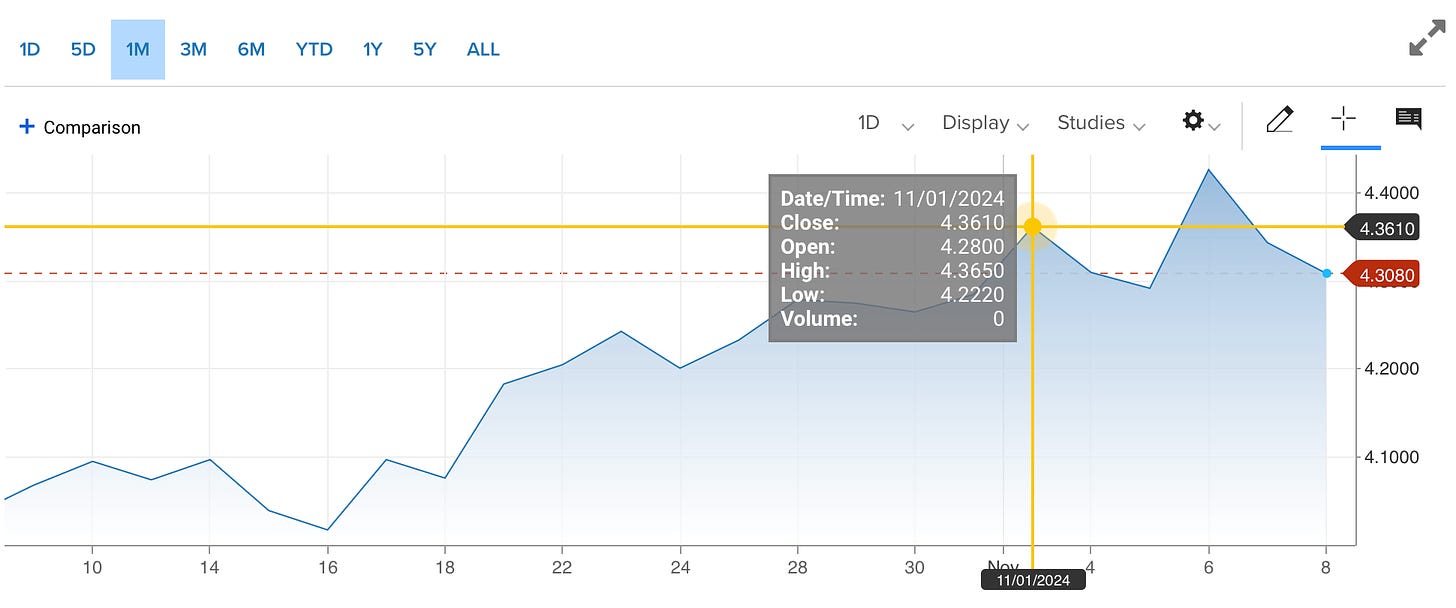

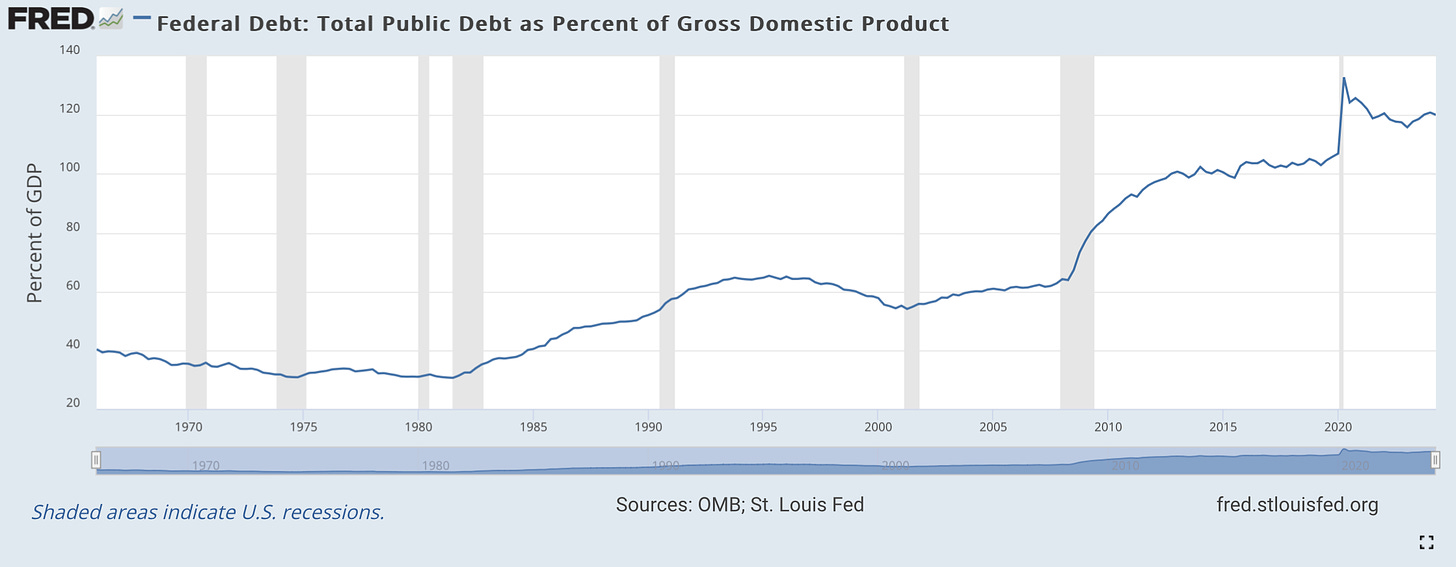

Lepard warned that rising U.S. debt and deficits are unsustainable. He said that the U.S. is currently running a $2.4 trillion deficit, with no plan to reduce it, and that this is reflected in a weakening bond market.

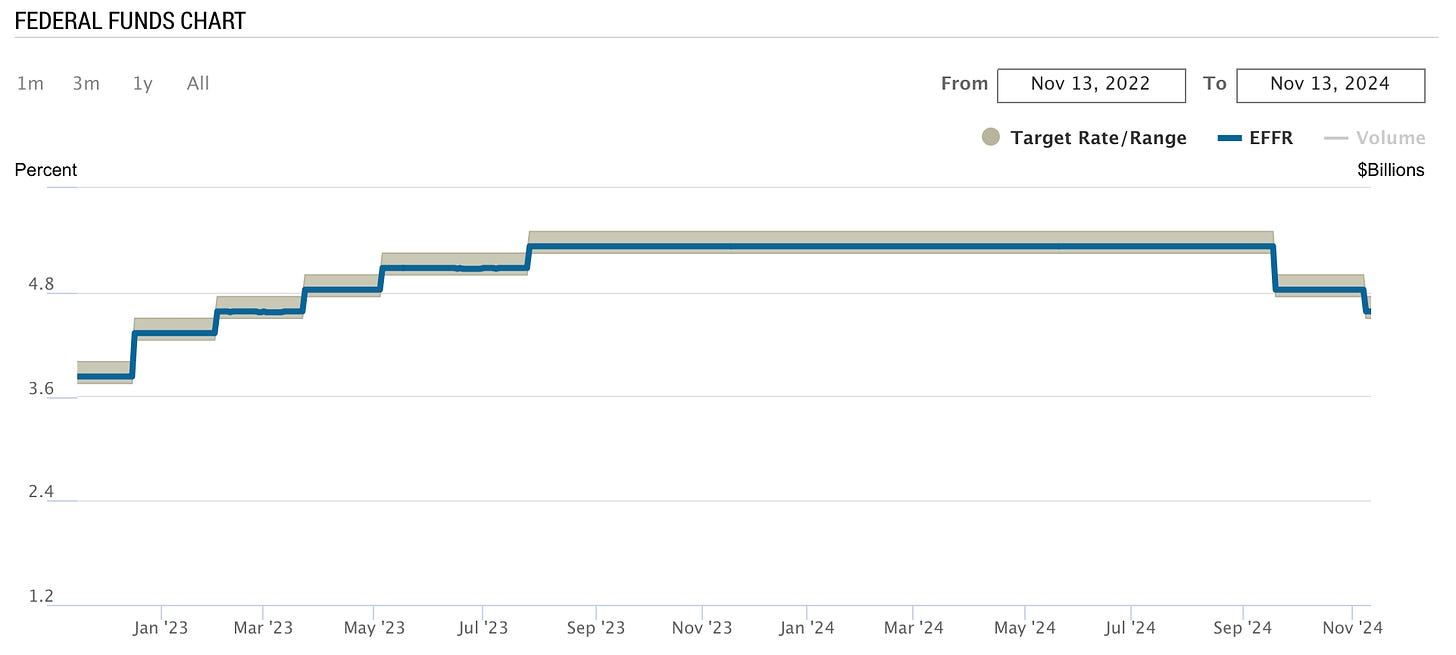

“The bond market is… in the process of failing,” he said. “The Fed cut interest rates, and yet the 10-year [Treasury yield] has gone up 75 basis points. That’s not supposed to happen, and it tells you that the Fed is probably too loose.”

Lepard predicted that the Fed would use yield curve control and print money to address rising debt levels.

“The Fed and the Treasury are going to have their hands full… in the next six months,” he said.

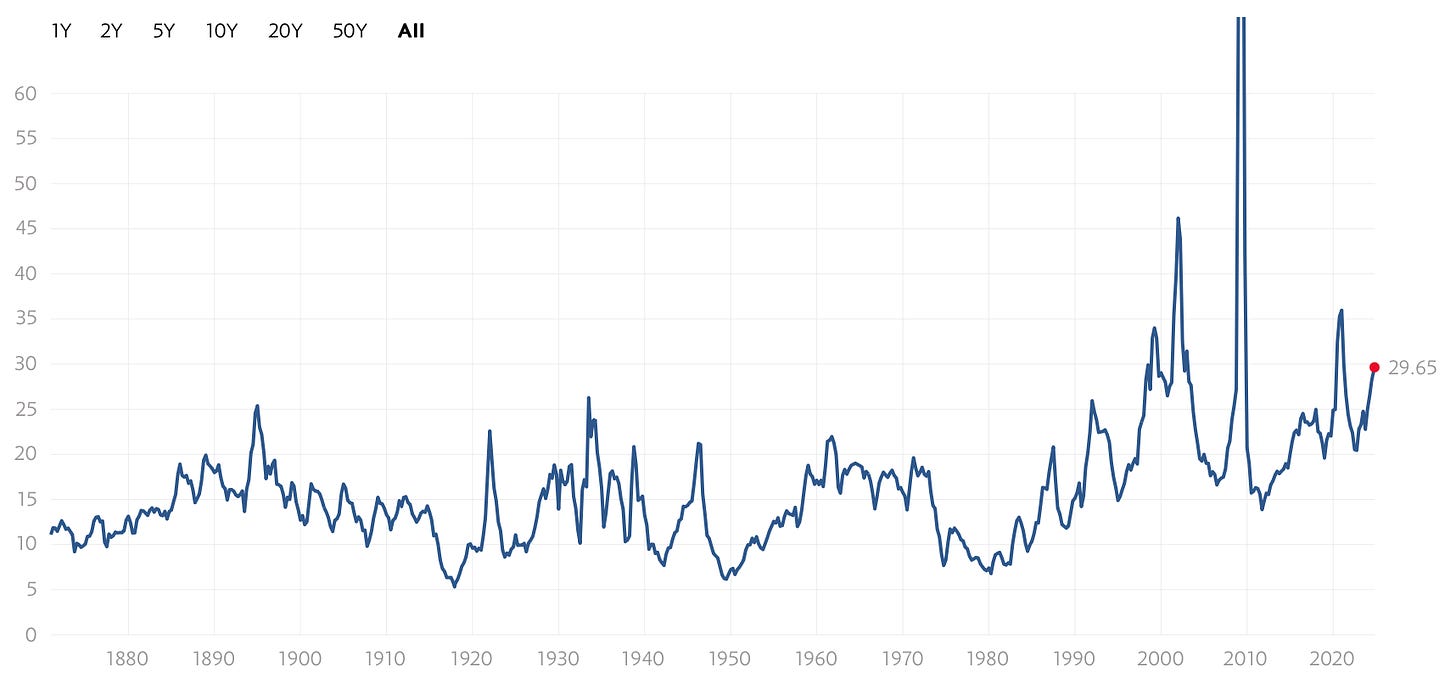

Saying that the stock market is “overvalued,” even as there are signs that the real economy is faltering, Lepard said that the stock market would face a significant correction.

“We haven’t had a truly prolonged and serious bear market since ‘08,” said Lepard. “I think there is a real day of reckoning coming for stocks.”

To address a crashing stock market, the Fed will “turn on the [money] printer” and loosen monetary policy, said Lepard. This, in turn, could benefit gold and Bitcoin.

“The last time they turned on the printer… Bitcoin went from $10,000 to $50,000, and gold went from $1,365 to $2,070,” he said.

ECONOMY:

WORLD’S MOST DANGEROUS ERA

Doug Casey, November 23, 2024

Doug Casey, Best-selling author of Crisis Investing and Founder of Casey Research, discussed his outlook on the U.S. economy and investing.

Casey said that President-Elect Trump will have to face the most “dangerous” time in history since World War II, given ongoing conflicts in Ukraine and the Middle East, as well as rising tensions with China.

“Before Biden leaves office he may yet start World War III with Russia or may attack Iran, or may provoke the Chinese,” he said. “It’s a dog’s breakfast.”

Given these risks, as well as poor economic data, Casey said that the stock market is over-valued.

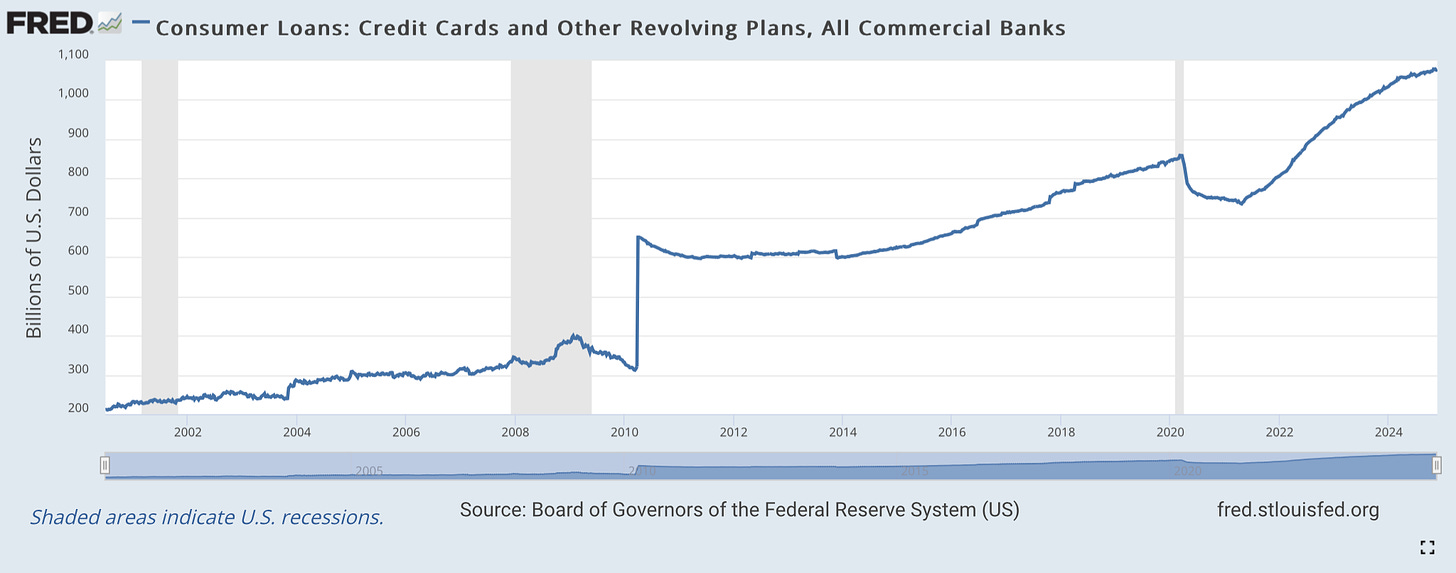

“By all conventional metrics, the stock market, which is at all-time-highs… is quite overpriced,” he said. “Meantime, the actual number of employed people is going down. The actual debt in this country is gigantic and growing… what we’re entering upon is something I call the greater depression.”

He pointed to rising credit card debt, auto loans, and student loan debt.

Although Casey was optimistic about President-Elect Trump getting into office, he said that he worries about Trump’s trade policies.

“If Trump puts on tariffs, then trade internationally will collapse,” he predicted. “It’s a potential catastrophe.”

When it comes to investments, Casey was bullish on energy stocks, particularly hydrocarbons and uranium, citing their essential role in industrial economies. He was also optimistic about Bitcoin, viewing it as a superior store of value and a privacy mechanism.

“I’m a Bitcoin bull,” he said. “Lots of governments are going to adopt Bitcoin as a high-tech alternative to gold, and certainly to the U.S. dollar.”

BANKING:

$3 TRILLION IN BANK LOSSES COMING

Chris Whalen, November 27, 2024

Chris Whalen, Chairman of Whalen Global Advisors, joined the show to assess the U.S. banking sector and provide his economic outlook.

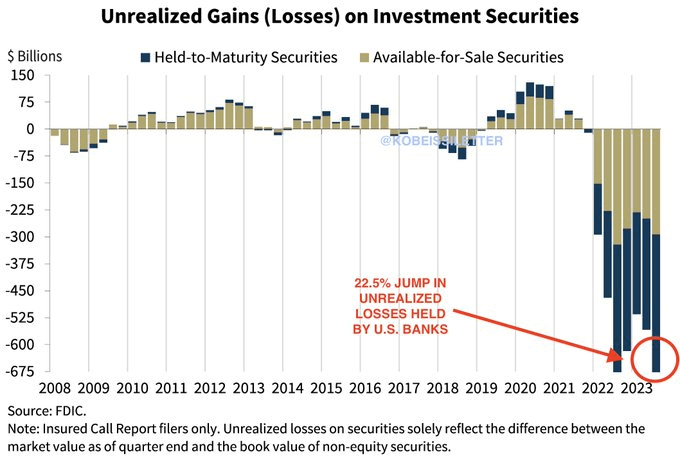

Whalen warned that U.S. 10-year Treasury rates have increased in recent months, which could hurt commercial bank balance sheets. In particular, he said that a yield of 5 percent could result in a $3 trillion negative capital position for banks.

“If the 10-year goes to 5 [percent] or higher, the pain from these securities is going to get really tough,” he said. “My fear is that the regulators still aren’t focused on this.”

He warned that if Fannie Mae and Freddie Mac, two mortgage companies which have been under conservatorship since 2008, were to come out of government conservatorship, that this could increase mortgage costs and affect the U.S. financial system.

“Fannie and Freddie, if you want to keep them the way they are, as both an issuer of securities and a guarantor of mortgages, then you have to have sovereign support,” he said. “I think ultimately they won’t come out.”

Whalen said that Moody’s would downgrade Fannie and Freddie if they were to leave conservatorship.

When it comes to banking stability, Whalen said that the Federal Deposit Insurance Corporation (FDIC) had “done a lot of work” to calm panic since the failure of Silicon Valley Bank in 2023.

“I think there is still going to be a tendency to go to larger banks for safety,” he said. “But I think, generally, the public shouldn’t worry about the deposit side.”

CRYPTO:

THE END FOR BITCOIN?

Clem Chambers, November 29, 2024

Clem Chambers, Founder of AnewFn, provided us his outlook for Bitcoin and crypto markets.

Chambers pointed to the recent and dramatic rise in the Bitcoin price. He said that Bitcoin has predictable four-year cycles driven by halving events, in which the reward for mining Bitcoin falls by one half. This, in turn, allowed him to forecast Bitcoin’s price movements.

“The supply halves, and the price doubles,” he said. “The top could be $150k, but I think that’s stretching it.”

He expected Bitcoin to hit $115K-$120K, before correcting, and said that he had already exited his Bitcoin position.

Highlighting his strategy, Chambers said, “If you buy near the bottom and sell near the top, you’ll do very well… we’re now near the top.”

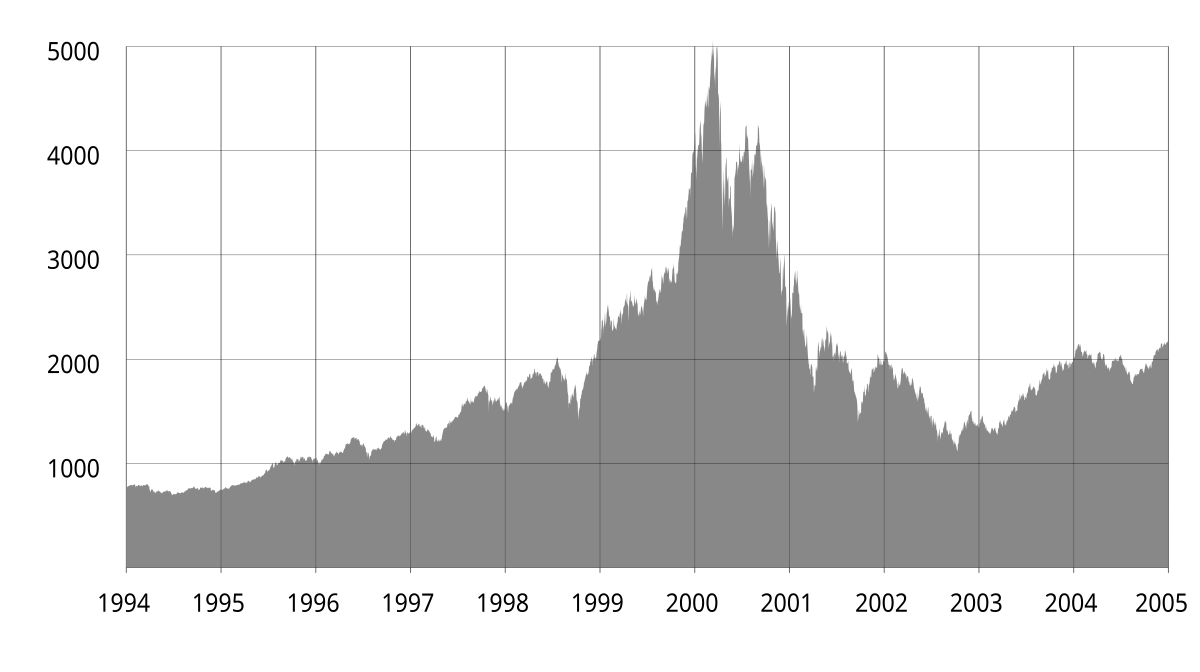

Referring to the relationship between the NASDAQ and Bitcoin, Chambers said that “Fed liquidity” explained the close correlation between the two.

“When they do a twist on the yield curve, it goes into markets,” he said. “It just doesn’t go into equities… it goes into crypto too, because they’re all connected.”

When it comes to altcoins, Chambers said he maintains Ethereum holdings, expecting a short-term rally following Bitcoin’s peak. However, he criticized Ethereum’s frequent changes, such as its protocol change from proof-of-work to proof-of-stake.

“Human beings being in control of cryptos debases them,” he said, adding that Bitcoin does not have this problem because “there ain’t no Satoshi Nakomoto to say I’ve changed my mind.”

Chambers also discussed Solana’s momentum, branding it as “rock and roll” compared to Ethereum’s “jazz.” When it comes to meme coins, Chambers said that their rally meant that the market is near its peak.

CHINA:

CHINA’S RESPONSE TO TARIFFS

Keyu Jin, November 27, 2024

Keyu Jin, a global economics professor and author of The New China Playbook: Beyond Socialism and Capitalism, discussed China’s economy, and Beijing’s response to Trump’s potential tariffs.

Jin said that China would respond to tariffs by strengthening trade alliances globally. She explained that during Trump’s first term in office, “40 percent of the reduction in trade with the U.S… was compensated by more trade with other economies.”

She pointed to how China is working to bolster trade with Europe, especially in the EV sector.

“Trump marks an anti-globalist, anti-multilateralist, isolationist, de-sinicization policy,” she said. “This could potentially push Europe to work with other countries on a grander and broader scale.”

If Trump ends up implementing tariffs on China, Jin said that China would respond, but not with “extreme measures.”

“The weighted average of tariffs is already at 13 percent,” she said. “Half of the goods that China exports to the U.S. are already suffering from pretty high tariffs, so any additional change on these tariffs is actually quite vacuous.”

When it comes to diplomacy, Jin said that China views Trump as more “peace oriented,” given his intent to resolve conflicts in Ukraine and The Middle East. This, in turn, could make Trump easier for Beijing to negotiate with.

“Geopolitically, we might be seeing a slightly different road map compared to the Biden Administration,” she said. “Obviously, we’re talking about the more sensitive areas — The South China Sea, Taiwan, and so forth.”

WHAT TO WATCH

Tuesday, December 3, 2024

Job Openings — This is the total of all job vacancies, including those for part-time or temporary employment.

Friday, December 6, 2024

Unemployment Rate — This BLS release shows the percentage of unemployed persons in the U.S. labor force.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.