Huge Shift: Biggest Movers This Decade To Awaken

TABLE OF CONTENTS

COMMODITIES: The ‘Lose-Lose’ Economy: Why Both Bulls And Bears Could Suffer

MARKETS: S&P500 Breaks 6,100: ‘Dead Cat Bounce’ Or New Bull Market?

COMMODITIES: Economic Earthquake: Why ‘Big’ Bill Shakes Up Everything

MARKETS: Are Markets On Verge Of Imploding? Trader Reveals Key Signals

ECONOMY: Personal Incomes Plummet: What’s Behind The $109-Billion Decline?

CRYPTO: Bitcoin ‘Tidal Wave’ Approaching As It Becomes World’s Reserve Asset

CRYPTO: Bitcoin vs. Real Estate: Grant and Gary Cardone Twins Settle Debate

MARKET RECAP

The S&P 500 and Nasdaq continued their record-breaking streak this week, hitting new all-time highs for the third time in four days, as a stronger-than-expected June jobs report showed 147,000 jobs added, versus the anticipated 106,000, with unemployment dropping to 4.1%. The robust employment data diminished Federal Reserve rate cut expectations, with traders nearly eliminating prospects for a July reduction. Tesla's June delivery figures, released on Wednesday, exceeded expectations and provided a comprehensive view of the company's first-half performance, contributing to the continued strength of the tech sector.

Meanwhile, the House and Senate passed President Trump's "One Big, Beautiful Bill" budget package ahead of the July 4 deadline, while trade negotiations with multiple partners advanced beyond the initial July 9 tariff deadline. The Bill will now wait to be signed by the President. Investors remain focused on upcoming economic data, particularly inflation and employment figures, as well as potential Federal Reserve policy moves. While equities are at record highs, some caution persists due to mixed economic signals and global uncertainties. U.S. markets are closed on July 4 for the holiday and will reopen on July 7.

Thomas Hayes, Founder, Chairman, and Managing Member of Great Hill Capital, outlined an expansionary strategy echoing post-World War II recovery as Trump's budget legislation advanced through Congress. Hayes argued that current 120% debt-to-GDP ratios mirror the conditions of the 1950s, when America successfully reduced fiscal burdens through sustained growth rather than the Hooverian austerity approach. "You're not going to cut your way to prosperity," Hayes explained, advocating nominal GDP growth above inflation to organically reduce debt ratios.

Hayes criticized Federal Reserve Chairman Powell, comparing him unfavorably to past monetary authorities. "Powell is not the right guy for the job right now because he doesn't understand history," Hayes said, noting that the chairman’s prediction-dependent rather than data-dependent approach. Hayes pointed to Amazon executives reporting no inflationary pressures as evidence that monetary authorities ignored ground-level realities.

Investment strategy centered on Hayes's "unmagnificent 493" thesis, predicting small and mid-cap outperformance as technology earnings growth decelerates from 30% to 10%. At the same time, the remaining S&P components are expected to accelerate from negative territory to 10.3% growth by early 2026.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of July 3 at approximately 1pm EST.

CVNA - up 13.66%

HOOD - up 11.69%

ORCL - up 11.51%

GM - up 10.14%

PLTR - down 6.86%

SPOT - down 6.55%

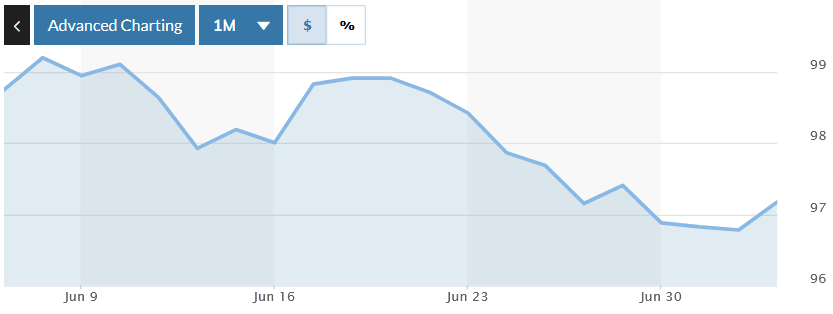

DXY - down .03%

Bitcoin - up 2.06%

Gold - up 1.65%

10-year Treasury Yield - up 2.18%

S&P 500 [SPX] - up 1.37%

Russell 2000 [RUT] - up 3.17%

COMMODITIES: The ‘Lose-Lose’ Economy: Why Both Bulls And Bears Could Suffer

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, warned that Bitcoin reaching $100,000 represents a speculative ceiling similar to the NASDAQ's 5,000 in 2000, while gold's outperformance signals an economic slowdown ahead.

"Since Bitcoin closed above $100,000, gold's up about 30%, Bitcoin's up 7%, stock market's barely unchanged," McGlone said, calling this threshold comparable to historic market peaks. He predicted Bitcoin could "drop a zero" alongside broader cryptocurrency weakness.

McGlone outlined a deflationary scenario in which gold rises in response to economic deceleration rather than inflation. His $3,500 gold target would signal trouble for overvalued equities. "Right now, the US stock market cap to GDP is 2.1 times, the highest since 1929," he explained.

Oil faces structural headwinds toward $40 per barrel due to excess North American supply and declining demand in China. The Dow-to-gold ratio exhibits similar patterns to those observed during the 1971 monetary regime change.

McGlone characterized current markets as potentially "irrational and delusional," with the Fed facing impossible choices between controlling asset inflation and supporting economic growth.

MARKETS: S&P500 Breaks 6,100: ‘Dead Cat Bounce’ Or New Bull Market?

Chris Vermeulen, chief market strategist at The Technical Traders, maintained long positions across equity markets despite expressing skepticism about sustainability as major indices approached record levels following an Israel-Iran ceasefire.

"We're long the markets," Vermeulen said, describing positions in QQQ, S&P 500, and Bitcoin. "When the charts are showing strength, you need to follow the charts, not what you think or feel."

The S&P 500 approached its February high of 6,150, while the NASDAQ achieved new all-time highs. Vermeulen warned this could represent a "double top" or "fake breakout" designed to trap investors. "The market probably needs to hold up for a week to say okay, it's holding that level," he explained.

Oil prices remained volatile following Middle East strikes, but Vermeulen predicted continued weakness. "The trend is down. I believe we're going to be stuck in this lower quadrant for quite some time," he said, forecasting eventual moves into the $50s despite recent spikes above $70.

Gold consolidated near $3,300 after testing $3,500, with Vermeulen targeting $3,750. Silver surged independently, suggesting a broader momentum in precious metals. "Gold, from a technical standpoint, is in an uptrend; it's in a long-term bull market," he noted.

Bitcoin displayed "strong bull flag patterns" with potential targets around $134,000 to $135,000, though Vermeulen cautioned that it would likely follow broader market weakness.

COMMODITIES: Economic Earthquake: Why ‘Big’ Bill Shakes Up Everything

E.B. Tucker, founder of the Tucker Letter, argued that gold's massive rally to $3,400 has already priced in upcoming Federal Reserve easing and fiscal expansion, predicting sideways action ahead.

"I think this move from 2000 to 3,400, that's your move," Tucker explained, noting gold typically moves before events that would logically drive it higher. He expects two Fed rate cuts to normalize the yield curve and incentivize development spending.

Tucker criticized the mining industry's failure to capitalize on gold's 60% surge in value. "AI comes in and gets big, AI companies get bigger, gold gets big, gold companies get smaller," he said, describing the sector as fundamentally broken with excessive executive compensation and poor shareholder returns.

Despite attending the Bitcoin Vegas conference as a skeptic, Tucker increased his Bitcoin holdings during the event. He compared the energy difference between somber gold conferences and Bitcoin's elaborate entertainment spectacle.

Tucker's most bullish outlook centers on infrastructure building components, calling it "an unbelievable time to own certain components that are needed to build stuff in the US" amid massive consolidation and acquisition activity in overlooked sectors.

MARKETS: Are Markets On Verge Of Imploding? Trader Reveals Key Signals

Jason Shapiro, founder of Crowded Market Report, predicted continued market upside despite recent volatility from Middle East conflicts and trade tensions.

"I think the market still has upside to go," Shapiro said, citing positioning data showing investors remain underweight compared to previous highs. He relies heavily on the Commitment of Traders' reports, which index positioning from 0 to 100, where readings above 95 indicate excessive optimism.

Silver recently hit extremely long positioning levels, while gold paradoxically saw speculators selling during its rally to new highs. "They're less long positioning in gold than they were 3 months ago," Shapiro explained, calling this counterintuitive behavior bullish for the metal.

Oil entered a bull phase on May 5th, well before the Middle East escalation, when OPEC announced an increase in production. "The market bottomed on that day, which was a negative news day," he noted.

Shapiro emphasized artificial intelligence investments as the center of the market. "The money that's being invested into this space is not stopping," he said, highlighting energy, nuclear, and uranium sectors.

The position trader executes only two to three trades monthly, warning against overtrading. "People love the action; they want to catch every tick," he said, identifying this as traders' biggest mistake.

ECONOMY: Personal Incomes Plummet: What’s Behind The $109-Billion Decline?

Bob Elliott, CEO and CIO of Unlimited, outlined a troubling divergence between soaring markets and deteriorating economic fundamentals, drawing parallels to pre-financial crisis conditions.

"It reminds me personally of the 07-08 period," Elliott said, noting how real economy data suggested recession in late 2007 while stocks remained near highs through May 2008. Current conditions indicate that household demand has been negative on a real basis since the start of the year, while the S&P 500 approaches record levels.

Elliott highlighted frozen hiring as a key concern, historically preceding layoffs by 6-12 months. "While employers are keeping workers they have on payroll, they're not hiring anyone," he explained, noting this creates compounding effects of slower wage and employment growth.

Personal income data revealed a concerning weakness, with real consumption declining amid persistent inflation pressures. Elliott expects continued dollar weakness as foreign asset managers reduce overweight US positions.

Gold's recent decline reflects unwinding geopolitical premiums rather than fundamental concerns about dollar debasement. The Federal Reserve faces a challenging position with core PCE at 2.7%, well above the target, limiting easing options despite economic deceleration.

CRYPTO: Bitcoin ‘Tidal Wave’ Approaching As It Becomes World’s Reserve Asset

Simon Gerovich, president of Metaplanet, defended his company's 600,000-yen Bitcoin premium while outlining a never-sell accumulation strategy inspired by MicroStrategy's playbook.

"Medium to long-term Bitcoin treasury companies will outperform Bitcoin because they have this ability to grow their Bitcoin per share," Gerovich explained, citing Metaplanet's 190% BTC yield increase this year.

The company pivoted from struggling hospitality operations during the COVID-19 pandemic after Japanese retail investors faced personal income taxes of up to 55% on direct Bitcoin purchases. Metaplanet provides tax-efficient exposure through equity wrapper structures.

Gerovich described current market conditions as "phase one" accumulation lasting three to seven years, followed by "phase two" when Bitcoin reaches millions of dollars and companies leverage pristine balance sheets for banking services.

The executive emphasized permanent commitment to Bitcoin-only treasury policies. "No one should ever doubt that Metaplanet would buy anything other than Bitcoin," he said, dismissing companies that trade their holdings.

Metaplanet plans to convert its remaining hotel into a "Bitcoin hotel" featuring art museums and educational facilities to promote adoption across Japan.

CRYPTO: Bitcoin vs. Real Estate: Grant and Gary Cardone Twins Settle Debate

Twin entrepreneurs Grant and Gary Cardone presented contrasting investment philosophies during a wide-ranging interview that covered Bitcoin, real estate, and wealth-building strategies.

Grant Cardone, who built a billion-dollar real estate empire, surprised audiences by dismissing homeownership. "Owning a home is a horrible, horrible, horrible investment," he said. "The house could triple; you never hear the wife going, 'Let's sell it and make our 300%.' That never happens. It's not an investment."

The brothers, who grew up middle-class in Louisiana after their father died when they were ten, took divergent career paths. Gary worked for seventeen years in corporate oil and gas while Grant pursued independent entrepreneurship. Both achieved substantial success through extreme focus and dedication.

Their money philosophy centers on avoiding traditional savings. "You cannot save money," Grant explained, advocating constant investment over emergency funds. "People should not save, people should invest, not save."

Gary emerged as the Bitcoin advocate, while Grant maintains heavy real estate exposure but increasingly incorporates Bitcoin. "Bitcoin is the greatest investment risk-adjusted and energy-adjusted," Gary said, noting he never receives maintenance calls about digital assets.

Grant's "Undercover Billionaire" experience demonstrated his core principle: "I never spent a penny" during the ninety-day challenge, instead securing funding from others while building a $5.5 million marketing company.

What To Watch

Tuesday, July 8 -

Consumer credit

Wednesday, July 9 -

Wholesale inventories

Minutes of Fed’s May FOMC meeting

Thursday, July 10 -

Initial jobless claims

Friday, July 11 -

Monthly US federal budget