TABLE OF CONTENTS

MARKET RECAP

MARKETS: 'Social Security Default': How To Protect Against Coming Storm

ECONOMY: Can't Avoid Great Depression; How Long Will It Last?

MARKETS: America’s Debt: ‘Out Of Control’ Or Overblown?

MARKETS: Bond Market 'Tug Of War' Signals Economic Disaster Ahead

CRYPTO: Money System Lie: ‘Riots In Streets’ If People Knew

WHAT TO WATCH

MARKET RECAP

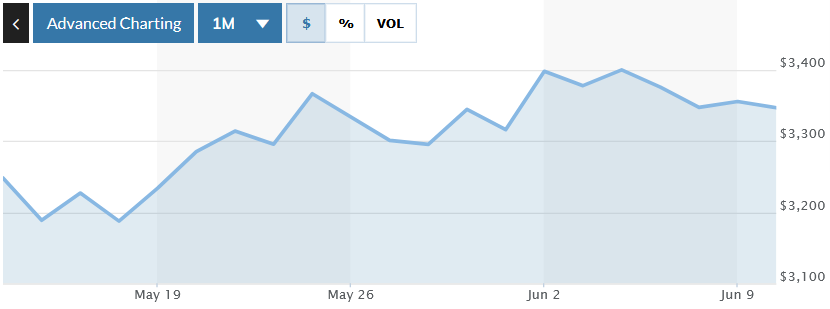

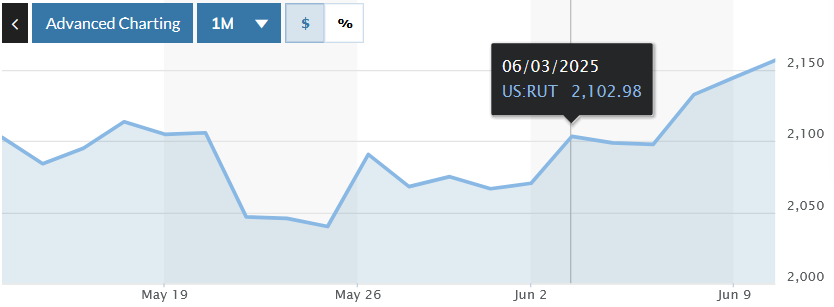

June 2-10.

Recent News.

U.S. markets navigated heightened volatility amid trade tensions, political drama, and mixed economic signals. The period began with renewed China-U.S. trade disputes sending futures lower before stocks in consecutive days. Mid-week turbulence peaked when a public feud between President Trump and Elon Musk sent Tesla plummeting 14%, erasing over $150 billion in market value.

Markets surged last Friday on a better-than-expected jobs report showing 139,000 new positions and a constructive Trump-Xi phone call, with the S&P 500 breaking above 6,000 for the first time since February. All major indices posted weekly gains despite the volatility.

However, Tuesday, June 10th’s World Bank report delivered sobering news, slashing 2025 global growth forecasts to 2.3%—the weakest pace since 2008 outside recessions. The report cited trade tensions and policy uncertainty, warning that developing economies face unprecedented growth challenges. Despite these headwinds, markets showed resilience as investors focused on diplomatic progress and AI-driven growth potential.

Subscribe now

Gareth Soloway predicted a significant market correction ahead despite the S&P 500's recovery to 6,000 points. The chief market strategist at Verified Investing cited historical resistance levels and economic headwinds as primary concerns during a recent market analysis.

Soloway noted that while headline economic numbers appear stable, underlying cracks are emerging in the labor market. Jobless claims jumped to 247,000 last week from 220,000 in the previous months, signaling potential weakness ahead.

The analyst identified key resistance levels using logarithmic charts dating back to 1929. "Every time we have hit it, we have had a major pullback, whether it was the Great Depression, the dot-com collapse, or even this recent drop of 20 percent," Soloway said regarding the long-term trend line.

China-US trade talks in London provided temporary market support, with investors hoping for tariff stability. However, Soloway maintained that baseline tariffs of 10 percent globally and 30 percent on Chinese goods would persist under the Trump administration.

He predicted the Federal Reserve would deliver three rate cuts by year-end if inflation remains contained. He favored foreign stocks, particularly Brazil and China, over domestic equities for the remainder of the year, citing valuation disparities and potential policy improvements.

Market Movements

The following assets experienced dramatic swings in price this past week. Data are up-to-date as of June 6 at approximately 4pm EST.

AMZN - up 5.79%

GOOG - up 7.33%

TSLA - down 5.28%

TSM - up 7.54

LLY - up 7.55%

DXY - down .34%

Bitcoin - up 4.02%

Gold - up .72%

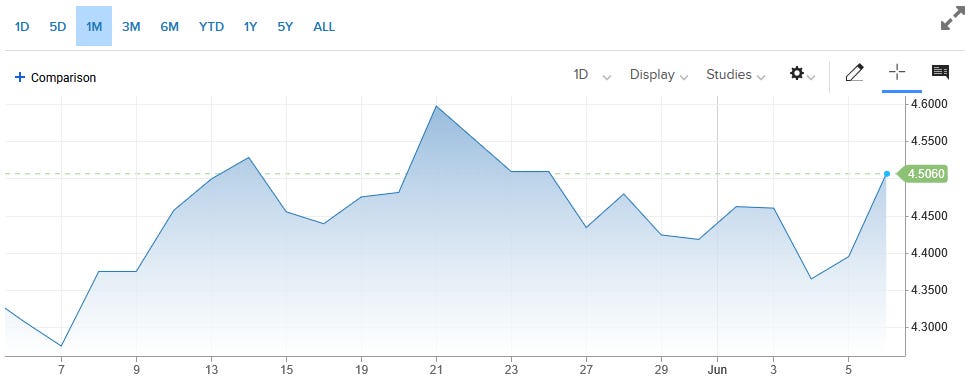

10-year Treasury Yield - up .76%

S&P 500 [SPX] - up 2.35%

Russell 2000 [RUT] - up 4.17%

MARKETS: 'Social Security Default': How To Protect Against Coming Storm

Yan Van Eck warned that 2025 represents a fiscal "year of reckoning" for American markets, predicting significant budget deficit reduction despite recent market euphoria. Speaking amid the S&P 500's strongest May performance since 1990, Van Eck explained that current market calm resembles "the calm in the middle of a hurricane."

The investment chief emphasized America's unsustainable debt trajectory, noting that Social Security is projected to face insolvency in the coming years. "Americans are on an unsustainable debt path," Van Eck said, adding that failure to address fiscal imbalances could trigger bond market vigilantes driving ten-year yields to "something scary.” This echoes historical parallels to the 1970s stagflation period when fiscal recklessness ultimately forced painful adjustments.

Van Eck positioned Bitcoin and gold as essential portfolio hedges against potential dollar debasement, drawing comparisons to the post-Bretton Woods era when gold soared. He predicted that Bitcoin would be the best-performing asset of 2025, citing its fixed supply characteristics. The firm launched new ETF offerings targeting private equity managers (GPZ) and the nuclear energy sector, capitalizing on Trump administration policies that favor atomic power development.

Despite market optimism pricing in economic boom scenarios, Van Eck expects the administration will pursue aggressive deficit reduction, potentially risking slower second-half growth but enabling Federal Reserve rate cuts through fiscal-monetary coordination.

ECONOMY: Can't Avoid Great Depression; How Long Will It Last?

Ron Paul delivered an assessment of contemporary fiscal policy, denouncing tariffs as "taxes that go back on the people who live in the country" while questioning the sustainability of current government spending trajectories. Speaking amid debates over the Trump administration's economic approach, Paul dismissed claims that protective tariffs generate genuine economic benefits, arguing they represent "the opposite of free market choice."

The three-time presidential nominee expressed skepticism regarding the Department of Government Efficiency's claimed $175 billion in savings following Elon Musk's departure from the initiative. "Sometimes those cuts never pan out because it might require court reviews," Paul explained, noting that emergency spending typically negates proposed reductions. His analysis of the administration's budget proposals revealed persistent structural problems, observing that despite proposed cuts, "the federal government will still spend about $1.7 trillion next year in its discretionary budget."

"They cannot pay the debt, so they have to liquidate the debt by paying it off with counterfeit money," he said, drawing parallels to the 1921 depression when markets were permitted to clear naturally. This historical precedent, Paul argued, demonstrated superior adjustment mechanisms compared to contemporary interventionist policies.

MARKETS: America’s Debt: ‘Out Of Control’ Or Overblown?

Thomas Mayer warned of an emerging clash between fiscal recklessness and monetary discipline, as government debt costs surge amid rising bond yields. Speaking after global markets experienced significant volatility, Mayer explained that "the politicians live in the old world where issuing debt was for free, but the market is in the new world where debt has a price again."

The economist predicted continued American market outperformance despite recent corrections, citing superior productivity growth that distinguishes the United States from stagnating European economies. US productivity surged post-pandemic through structural economic changes. "The big question is will the central bank stay its course, fight inflation and let bond yields rise, force the government to change its fiscal policy culture," Mayer said, referencing the Federal Reserve's resistance to political pressure.

Mayer recommended portfolio allocations favoring stocks over bonds, noting the end of a forty-year bond bull market. He suggested maintaining core equity positions while adding gold as a hedge against inflation and geopolitical risks. The 30-year Treasury yield's rise above 5% reflects investor assessments of risk premiums rather than growth expectations, echoing concerns about fiscal sustainability that parallel historical debt crises. European markets benefited from a marginal capital reallocation, though Mayer emphasized that no credible alternative exists to the US dollar's dominance.

MARKETS: Bond Market 'Tug Of War' Signals Economic Disaster Ahead

Steve Hanke predicted a late-2025 recession, citing sluggish monetary growth as the primary driver. Despite inflation declining to 2.3 percent, bond yields have surged above 5 percent on 30-year Treasuries. Hanke explained this paradox through what he termed "regime uncertainty" under the Trump administration.

"We have a tug of war going on," Hanke said. "Inflation coming down should be pulling bond yields down, but that's being overwhelmed by regime uncertainty." He compared current conditions to Franklin Roosevelt's New Deal era, when policy upheaval prolonged the Great Depression by discouraging investment.

The professor dismissed concerns about tariff-driven inflation, noting that trade represents only 15 percent of U.S. economic activity. Current average tariff rates stand at 18 percent, up from 3 percent previously. "Tariffs will cause some items to move around relative to other things," Hanke explained, "but overall inflation is driven by changes in the money supply."

M2 money supply growth remains anemic at 4.1 percent, well below Hanke's target rate of 6 percent for achieving 2 percent inflation. He criticized Trump's $2 trillion Gulf deals as uncertain and warned that massive fiscal deficits would further pressure bond markets.

CRYPTO: Money System Lie: ‘Riots In Streets’ If People Knew

Marco Santori outlined the accelerating dynamics of nation-state cryptocurrency adoption, predicting a fundamental structural transformation across traditional financial institutions. Speaking amid regulatory clarity under the Trump administration, Santori explained how the "Bitcoin game theory" evolved unexpectedly, with the United States moving the largest domino to the front rather than allowing smaller nations to initiate the cascade.

"When we need it, it is going to be hard to get that, which is why we have that strategic reserve," Santori explained, drawing parallels to emergency commodity accumulation protocols. This mirrors Cold War resource hoarding strategies when scarcity concerns drove national security policy.

Santori predicted that crypto-native exchanges will inevitably be absorbed by traditional financial behemoths, citing superior revenue metrics compared to legacy payment processors. The ByBit hack exposed structural vulnerabilities inherent in bearer asset systems, highlighting trade-offs between permissionless innovation and security protocols that cannot replicate traditional financial safeguards.

His transition from centralized Kraken leadership to decentralized Wallet Connect governance reflects broader industry philosophical shifts toward self-custody infrastructure. Despite retail market pessimism following four years of regulatory hostility, institutional enthusiasm suggests a foundational evolution in market structure. Santori characterized memecoins as potentially significant cultural phenomena since the emergence of MTV, highlighting democratized global content creation and financialization capabilities.

Subscribe now

WHAT TO WATCH

Wednesday, June 11:

Consumer price index

ORCL earnings

Core CPI

Thursday, June 12:

Initial Jobless claims

ADBE earnings

Core PPI

Share