Putin Threatens Nukes Against NATO, Is Nuclear War Inevitable?

TABLE OF CONTENTS

Market Recap: Ray McGovern on whether Russia will nuke Ukraine

ECONOMY: This is how a Great Depression could happen, says Peter Grandich

CRYPTO: Bitcoin will rally after crashing in January, predicts Ran Neuner

PUBLIC POLICY: Darrell Bricker on Canada’s immigration crisis

MARKET RECAP

Latest News. On Sunday, November 17th, The White House gave Ukraine permission to use U.S.-made long-range missiles to strike Russia, an unprecedented move that risks escalating the Ukraine war.

The Kremlin responded by updating its nuclear doctrine, stating that an attack from a non-nuclear state – like Ukraine – which is backed by a nuclear power will be treated as a joint assault on Russia.

Following this, Ukraine launched American ATACMS (Army Tactical Missile Systems) into Russia, and also used British-made Storm Shadow missiles. The Russian Defence Ministry claimed that it intercepted most of these missiles before they hit their destinations.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.

Markets responded with an exit out of risk assets. Stocks fell on Tuesday; the Dow Jones opened down 0.8 percent, and the broader S&P lost 0.4 percent. Global bond yields fell.

On Thursday, U.S. and other Western embassies in Kiev announced that they were closing, in preparation for a major Russian assault. That same day, Putin announced that Russia had fired an Intercontinental Ballistic Missile (ICBM) into Ukraine.

Will this latest round of escalation lead to a hot war between the United States and Russia, or is The Kremlin’s threat a bluff?

Joining us to discuss these topics was Ray McGovern, former CIA officer and Director of The National Intelligence Estimates under President Ronald Reagan. McGovern prepared President Reagan’s daily security briefings.

McGovern said that Putin is “winning” in Ukraine, and does not see U.S.-supplied missiles as a game-changer. Rather, he said that The White House’s latest moves were about domestic politics.

“They’re doing this because they want to go out into the Western sunset, right after the administration is over, saying, look, we gave the Ukrainians everything they asked for… and it’s not our fault they [the Ukrainians] are falling apart,” said McGovern. “I think he [Putin] is going to attrit… until a new administration comes in, and then he’s going to be able to deal from a position of strength.”

McGovern characterized the authorization of ATACMS as a “mini coup,” and said it was orchestrated by Secretary of State Antony Blinken and National Security Advisor Jake Sullivan without President Biden's direct involvement or Pentagon consent.

McGovern predicted that ATACMS will not alter the war’s trajectory significantly. Their limited range (190 miles) and the small number of missiles make them ineffective.

“[Putin] has got the upper hand,” said McGovern. “Is he going to allow himself to be provoked by pin-pricks?”

McGovern predicted that Putin will wait until Trump gets into office, and then negotiate an end to the Ukraine conflict.

Market Movements

From November 15 to November 22, the following assets experienced dramatic swings in price. Data are up-to-date as of November 22 at 9pm ET (approximate).

MicroStrategy Inc. — up 23.8 percent.

Peloton Interactive — up 23.1 percent.

Dogecoin — up ~20 percent.

Target Corporation — down 17.8 percent.

Cocoa — up 6.8 percent.

The following major assets experienced the following price movements during the same time interval.

DXY — up 0.07 percent.

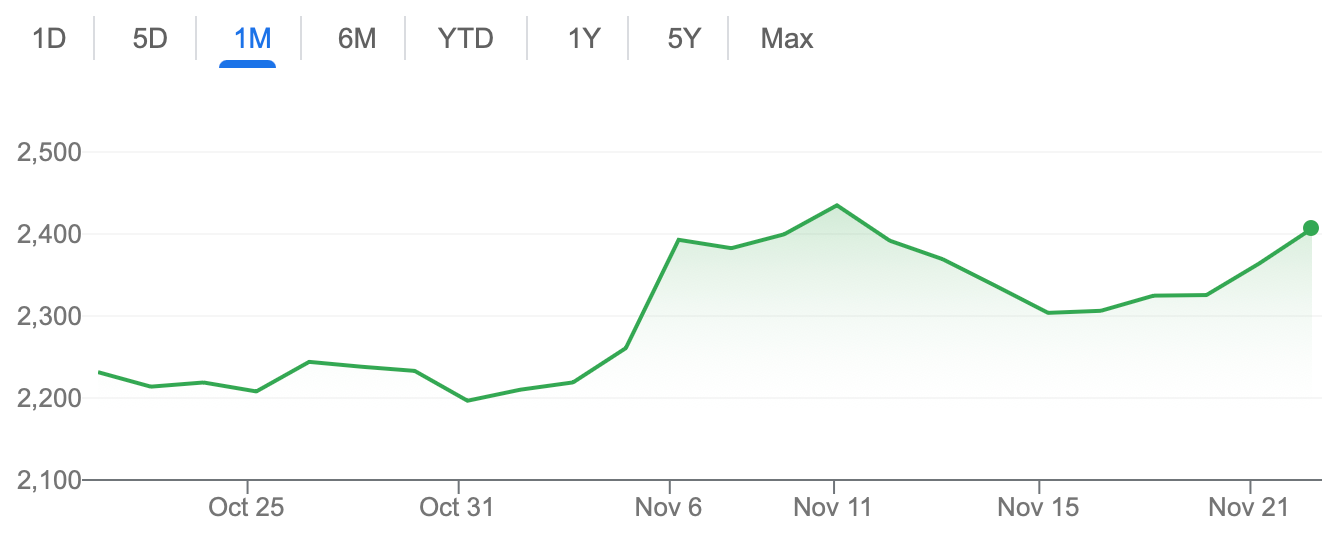

Bitcoin — up 12.6 percent

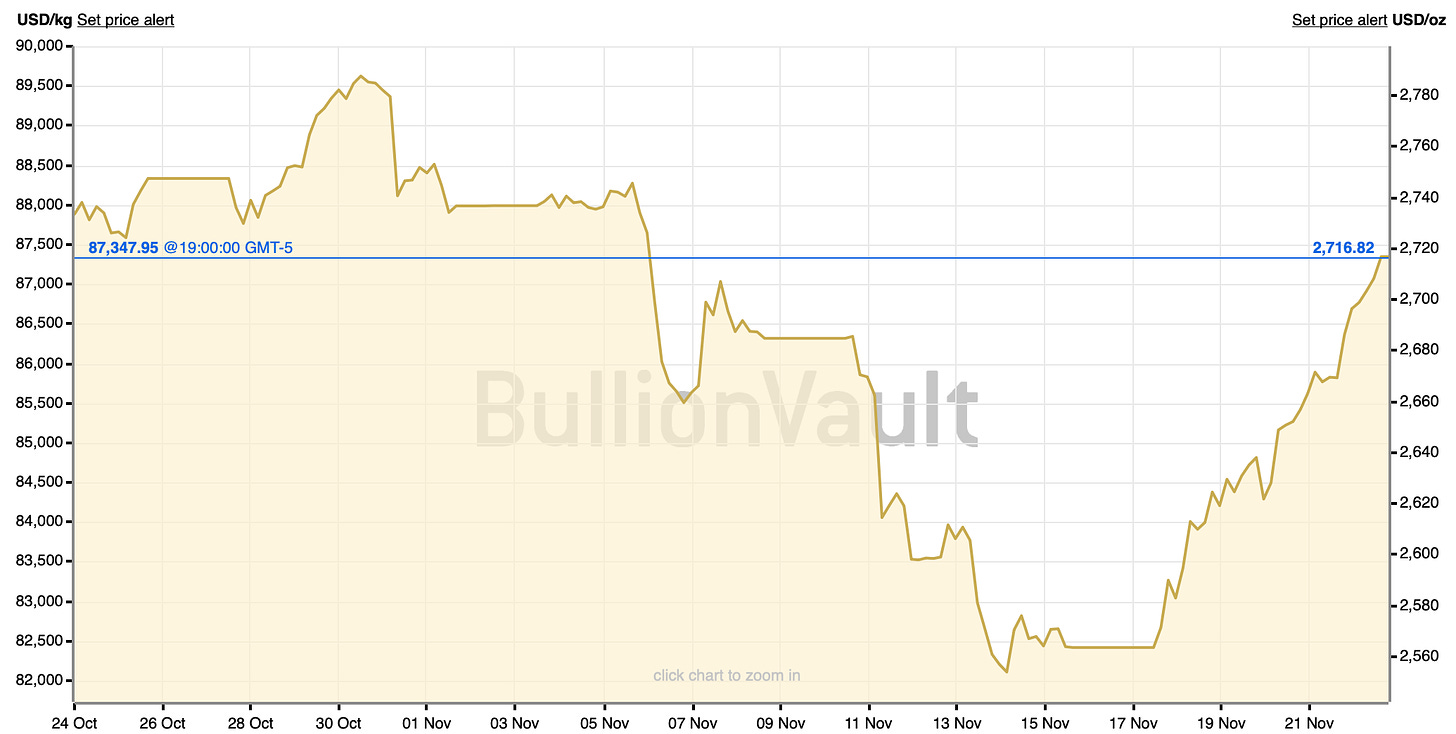

Gold — up 6 percent.

10-year Treasury yield — down 0.03 percent.

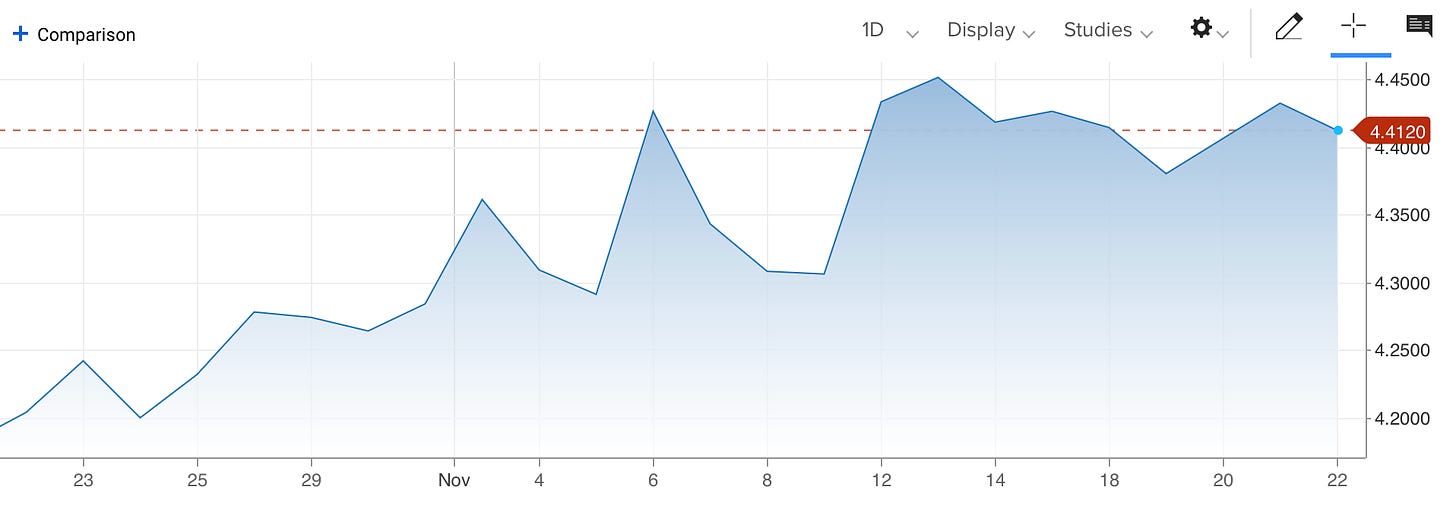

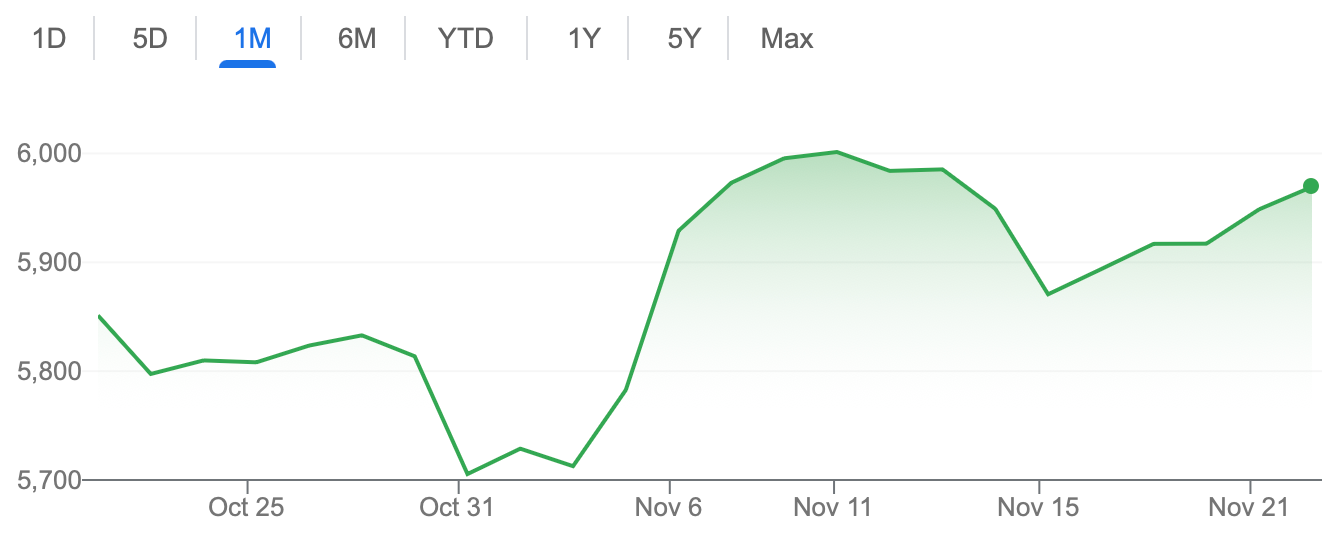

S&P 500 — up 1.7 percent.

Russell 2000 — up 4.5 percent.

USD/yuan — up 0.02 percent.

EQUITIES:

8,000 S&P TARGET BY 2026

Ed Yardeni, November 19, 2024

Ed Yardeni, President of Yardeni Research, returned to the show to provide his outlook on markets, and to extend his previously bullish call.

Yardeni was confident in a continued rally for U.S. equities, due to the resurgence of “animal spirits” under President Donald Trump. He mentioned Trump’s corporate tax reductions, from 21% to 15%, and deregulation as catalysts for market growth.

“We’ve raised our [S&P 500] outlook for the end of this year to 6,100, for next year at 7,000, and the year after that 8,000,” said Yardeni. “Those are actually very consistent with an improvement in our earnings outlook, based on a lower corporate tax rate, deregulation, and continuing strength in the U.S. economy.”

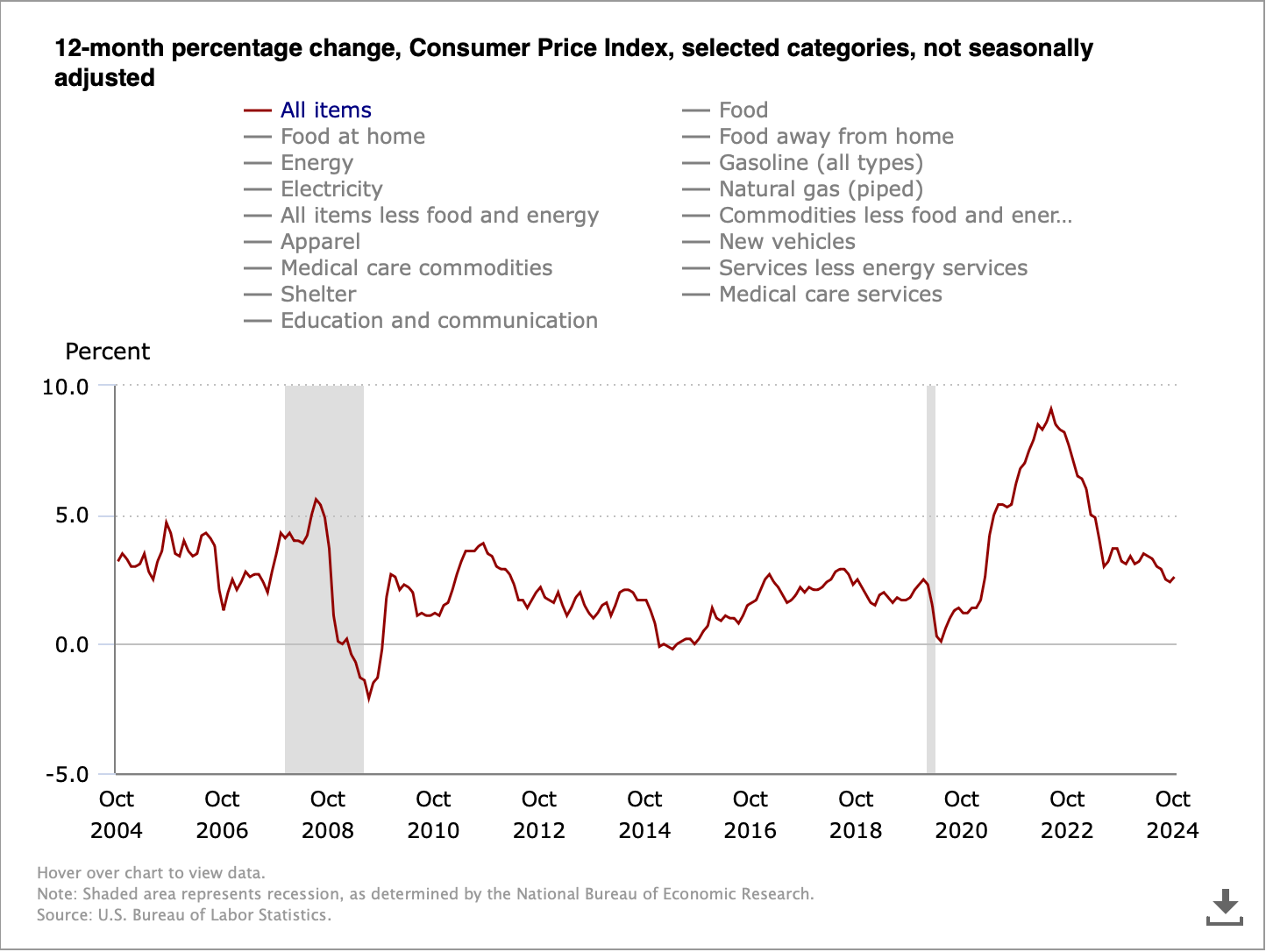

Yardeni addressed the risks from tariffs, comparing the United States’s escalation in the trade war with China to the Smoot-Hawley Tariff Act of 1930, which economists claim worsened the Great Depression.

“If next year we get something like the Smoot-Hawley tariff, then we could get a depression, or we could first get inflation that causes the Fed to tighten, and that causes a recession or something worse,” said Yardeni.

Yet Yardeni dismissed concerns about an imminent recession, saying that Trump is a “dealmaker” who is merely using the threat of tariffs to negotiate with China.

He pointed to strong consumer spending, particularly by Baby Boomers with substantial wealth. He even suggested that a declining savings rate could fuel further economic growth.

“The Baby Boomers have $79 trillion in net worth,” said Yardeni. “They’re retiring and they’re spending that money”

When it came to favoured sectors, Yardeni said he prefers technology and communication services, which together account for 40 percent of the S&P 500. These sectors have been top performers during the current bull market.

He was less enthusiastic about bonds, expecting yields to stabilize between 4 percent and 5 percent.

“I think you’ll earn the coupon, but you’re not going to make much money on the capital side, in capital gains,” he said.

ECONOMY:

WHAT WILL TRIGGER ANOTHER GREAT DEPRESSION?

Peter Grandich, November 18, 2024

Peter Grandich, Founder of Grandich & Co, returned to the show to discuss prospects for the U.S. economy following the Trump election victory.

Grandich was optimistic about Trump’s proposed reforms, including tax cuts and government efficiency measures. He also praised Trump’s stance on ending U.S. involvement in Ukraine and NATO funding imbalances.

“America has always had to fund so much more of the responsibility [for NATO],” said Grandich. “Western Europe has a lot of issues, and quite frankly it’s time for them to spend more of their own money defending their main interests.”

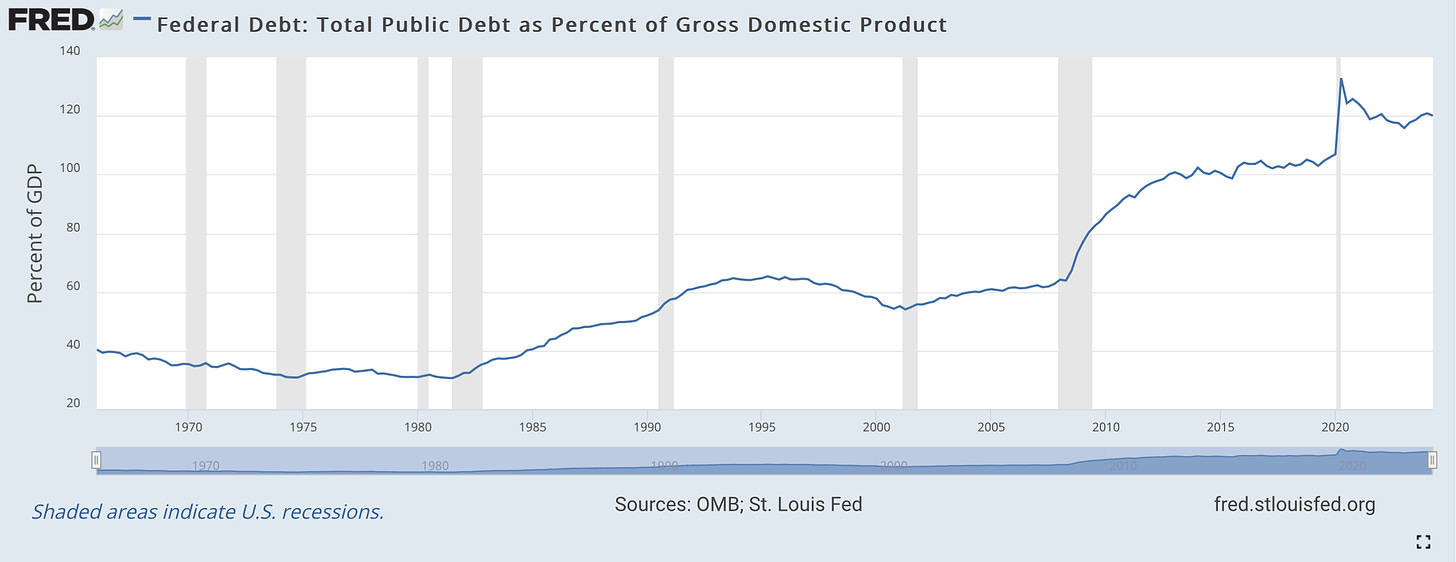

When it came to the U.S. national debt, which recently surpassed $36 trillion, Grandich criticized the lack of fiscal discipline across administrations and was skeptical about Trump’s ability to tackle the deficit.

“It is going to become more and more difficult to service this debt, especially as we continue to grow multi-trillion dollar yearly deficits” he said. “When we start to get to $50 trillion and we only have a 5 percent interest, we’re going to have a yearly interest payment of $2.5 trillion.”

On precious metals, Grandich said that central bank buying and BRICS-related speculation had fueled a gold rally earlier this year. However, he saw limited upside in the near term due to easing central bank demand and the strong U.S. dollar.

“I don’t think gold has much chance to get back to the previous highs of this year until we get to 2025,” said Grandich.

The dollar's strength, driven by rising long-term rates, has further pressured gold prices. Grandich did not expect the dollar to surge significantly higher, but he warned of volatility stemming from potential trade wars and protectionist policies.

Grandich said that rising long-term interest rates could have a more profound impact on the economy than other factors. He said that 25 percent of Americans are using credit cards for basic needs.

“If interest rates don’t go lower and keep going higher, they’re going to have even less to go forward on,” said Grandich.

He predicted that 10-year Treasury yields could exceed 5 percent in the coming quarters, intensifying pressure on both consumers and the broader economy.

CRYPTO:

BITCOIN CRASH BY JANUARY, FOLLOWED BY RALLY

Ran Neuner, November 21, 2024

Ran Neuner, Host of Crypto Banter, joined the show to discuss the state of the crypto markets.

Bitcoin is up over 40 percent in the past month, and Neuner said it has the potential to reach $100,000 in the near term.

“You’ve got this perfect storm of bullish news for Bitcoin,” Neuner explained, pointing to the launch of Bitcoin options, and institutional players like MicroStrategy raising funds to purchase Bitcoin.

However, Neuner predicted a correction by January, characterizing it as part of the market’s natural rhythm.

“In 2016 and 2017, we had five corrections in the run-up, which were all over 30 percent” he said “I’m trying to get my portfolio into 30 percent cash for when the inevitable dip comes.”

He attributed much of Bitcoin’s recent performance to the recent U.S. election.

“We’ve gone from an administration that ran an anti-crypto army… to one that’s running a pro-crypto army,” he said. “It feels like all the puzzle pieces have fallen for the most bullish four years ahead for crypto.”

He mentioned President-elect Trump’s willingness to meet with industry leaders like Coinbase CEO Brian Armstrong, as well as SEC Chair nominees with pro-crypto stances.

Neuner added that while Trump’s proposed Bitcoin strategic reserve is “far-fetched,” it is also “the most exciting thing that I’ve ever heard.”

Although Bitcoin is thriving, Neuner said that altcoins, including Ethereum, have under-performed.

“Bitcoin goes up a lot and alt coins go up a little,” he remarked. “It’s a weird relationship that they have at the beginning of a cycle. It’s nothing to get excited about, or stressed about.”

However, he criticized Ethereum’s lagging performance, citing the rise of competitors like Solana.

“Solana can do everything that you can do on ETH much faster and at a fraction of the cost,” Neuner argued. “I don’t really see any reason to be holding ETH, other than the fact that… Coinbase runs the predominant Layer Two on Ethereum, called the Base chain.”

CRYPTO:

WHEN BITCOIN HITS $100K

Ben Cowen, November 18, 2024

Ben Cowen, founder of Into the Cryptoverse, joined us to share his insights on Bitcoin's current performance, market dominance, and the broader cryptocurrency ecosystem.

Cowen addressed the much-anticipated milestone of Bitcoin reaching $100,000, emphasizing its psychological and market impact.

“It'll make headlines,” he said. “Whenever it hits $100K, there likely will be some form of a selloff.”

Cowen's analysis centered on Bitcoin's market dominance, which he had forecasted to hit 60 percent of the crypto market cap —a prediction that recently materialized.

“Bitcoin dominance spends three years going up and one year going down,” he explained, citing historical patterns. “I don't think it will go all the way back up to [its previous peak of] 73 percent because of the stablecoin market cap.”

He explained that the stablecoin market cap is much higher than it was before, and is likely to remain high.

Cowen compared Bitcoin’s current price movements to historical cycles, noting similarities with 2019. He attributed some of Bitcoin's current resilience to improving global liquidity, despite the Federal Reserve's ongoing quantitative tightening (QT).

Addressing the altcoin market, Cowen pointed out that Ethereum (ETH) and other altcoins have lagged behind Bitcoin during this cycle. Ethereum's performance, Cowen said, hinges on monetary policy.

“[ETH] does outperform Bitcoin in a QE market, with the Fed printing money,” he said. “But in QT markets, it underperforms Bitcoin.”

He also highlighted XRP’s recent 131 percent rally, attributing it to a classic double-bottom formation on its Bitcoin pair.

“The way to be successful in crypto is to value your portfolio in satoshi rather than U.S. dollars” Cowen said. “So every time you take a trade on alt coins, by taking some of those profits back to Bitcoin, it helps to preserve the long-term value.”

GOLD:

GOLD WILL SHATTER RECORDS IN 2025

Jeff Christian, November 23, 2024

Jeff Christian, managing partner of CPM Group, returned to discuss the trajectory of gold, silver, and industrial metals following Donald Trump's re-election.

Gold has fallen by $200 from its highs, a slide that began before the election but intensified afterward. Christian attributes this drop not to “economic euphoria” from Trump's win but rather to profit-taking and broader sell-offs across commodities.

“Gold, silver, aluminum, copper, platinum, palladium, oil, and natural gas all fell sharply starting October 31st,” he explained.

Despite rising inflation expectations, gold prices have not followed suit like they usually do. In particular, 10-year Treasury yields, which track inflation expectations, have not moved inversely with gold prices.

“I don’t know that the 10-year is rising on inflation expectations,” he said. “I think it might be rising on a broader set of economic concerns.”

He pointed to recession risks and fiscal deficits as drivers behind the 10-year’s rise.

Despite their recent correction, Christian said that he has a bullish outlook for precious metals.

“We’re looking for gold prices to average around $2,700 over the next year, with potentially higher prices in 2026,” he said, while adding that “we think that we are within 24 months of a peak in gold prices.”

Silver is expected to track gold, with investment demand playing a critical role in driving prices.

“A record average silver price above $35 an ounce is possible in the next few years,” he projected.

Industrial demand remains a headwind for silver, tied closely to broader economic conditions.

PUBLIC POLICY:

CANADA’S IMMIGRATION CRISIS

Darrell Bricker, November 22, 2024

Darrell Bricker, Global CEO of Ipsos Public Affairs, returned to the show to analyze Canada’s most pressing issues. The discussion covered immigration, housing, healthcare, and the broader economic outlook.

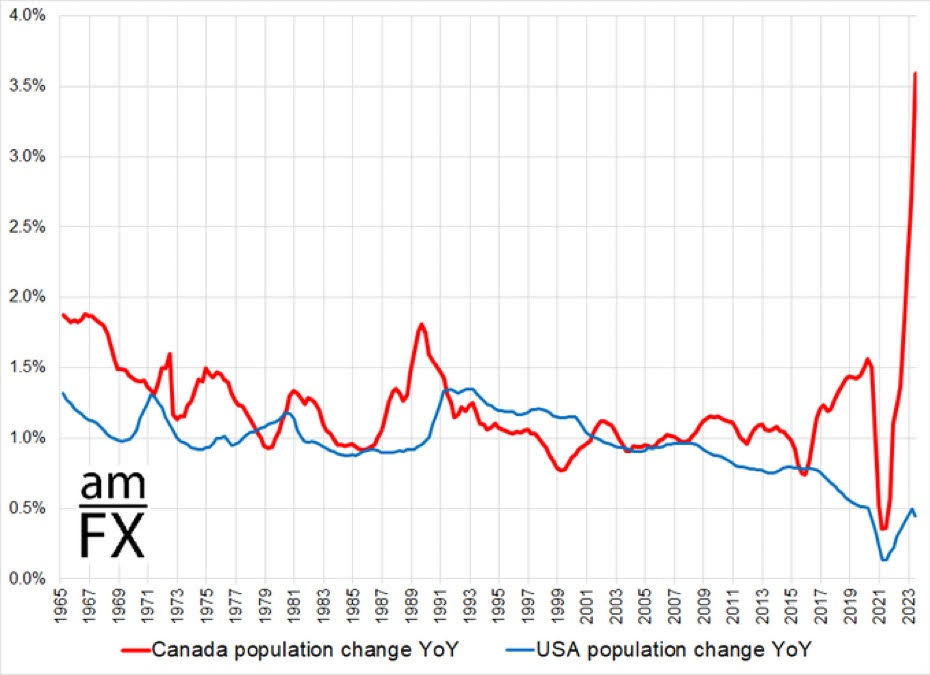

Bricker highlighted growing public concern over immigration, which has become the fastest-rising issue in Canada.

Canada’s population growth rate in 2023 was 3.2 percent, five times higher than the OECD average; more than 90 percent of that was due to immigration.

“People [in Canada] are not happy with what’s happening with immigration,” he said. “Now when people say, ‘why am I having a hard time getting access to healthcare?,’ well immigration is a driver of that, so they feel.”

This has prompted Prime Minister Justin Trudeau to cut permanent immigration levels by 20 percent, alongside reductions in temporary worker and international student programs.

The potential for increased migration from the U.S., following Donald Trump’s election victory, has further intensified the debate. Bricker noted that even a modest influx—10 percent of the estimated 11 million illegal migrants in the U.S.—could strain Canada’s public services.

“Our system is really not capable of dealing with it,” he warned, citing challenges in healthcare, housing, and asylum processing.

The interview also touched on Canada’s ability to manage its long, undefended border with the U.S. amid potential surges in asylum claims. Bricker expressed skepticism about U.S. cooperation under a Trump administration.

“I don’t see that we’re going to get an awful lot of sympathy from Donald Trump on this question, because he just wants them [illegal immigrants] out,” he said.

He predicted that asylum claims would further overload Canada’s immigration system, adding, “You’ll be here for a long time before your case actually gets heard.”

Bricker stressed the need for long-term solutions to Canada’s demographic and economic challenges, saying that immigration is needed in the short- to medium-term to offset Canada’s declining birth rate.

WHAT TO WATCH

Tuesday, November 26, 2024

New Home Sales — This shows the number of sales of newly-built homes in the previous month.

Wednesday, November 27, 2024

PCE Index — The Personal Consumption Index (PCE) and Core PCE Index is the Federal Reserve’s preferred measure of the price level.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.