TABLE OF CONTENTS

Market Recap: Sheila Bair on how rising debt can trigger financial crisis

EQUITIES: Gareth Soloway on where stocks will reach their top

ECONOMY: Peter Schiff forecasts mounting inflation, bank failures

BONDS: Interest rates could surge, says Peter Boockvar

GOLD: Gary Wagner on whether the gold selloff will intensify

What to Watch

MARKET RECAP

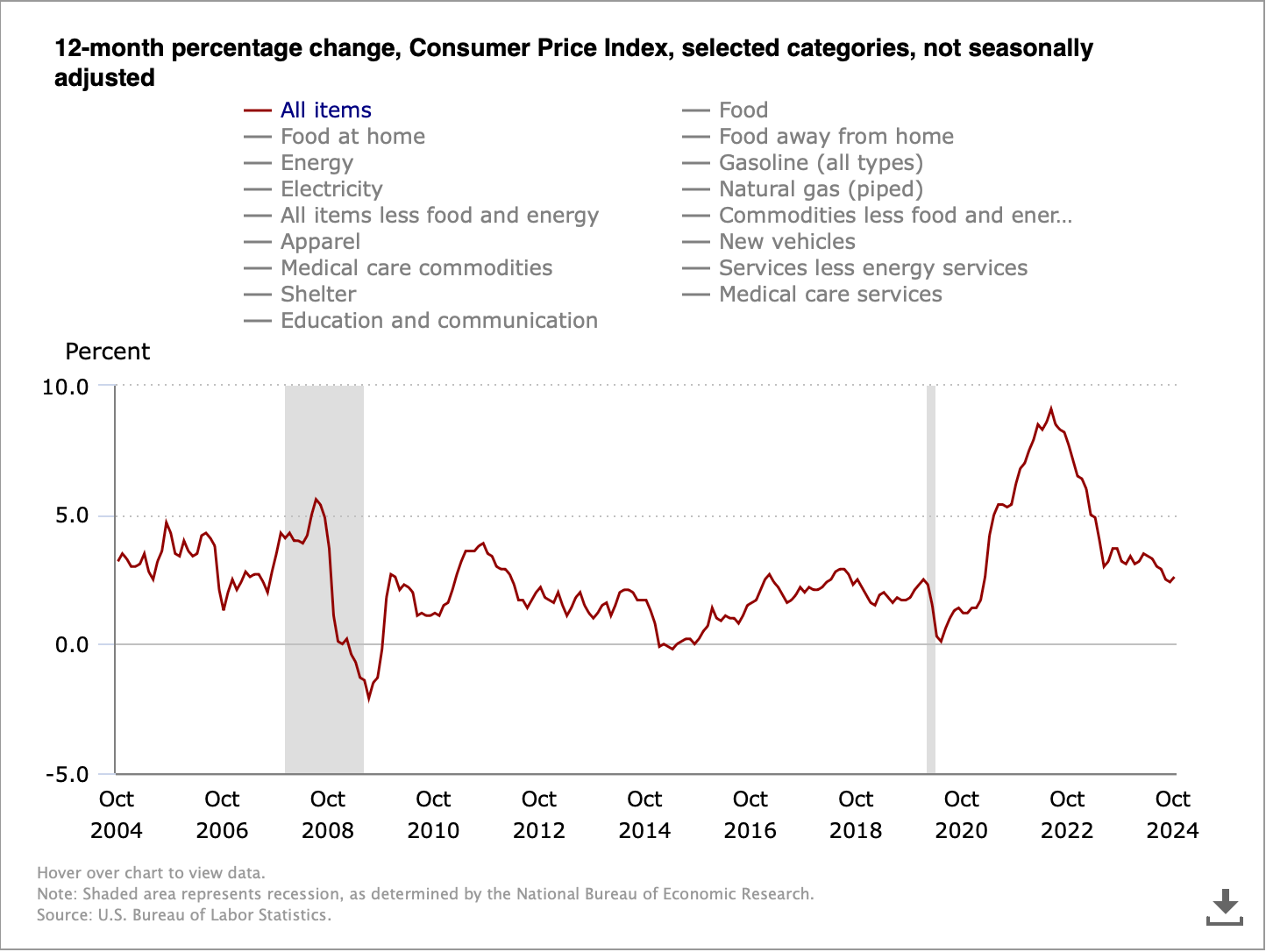

Latest News. CPI (Consumer Price Index) Inflation hit 2.6 percent in October on a year-over-year basis, in line with Dow Jones estimates. Core CPI inflation, which excludes food and energy, hit 3.3 percent in October on a 12-month basis.

Stock market futures rose after the news, while Treasury yields dropped.

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.

The CPI inflation reading for September was 2.4 percent, suggesting that inflation is accelerating.

In other news, President-elect Donald Trump’s cabinet is beginning to take shape, with major picks including Marco Rubio as Secretary of State, Peter Hegseth as Secretary of Defense, and Tulsi Gabbard as National Security Director.

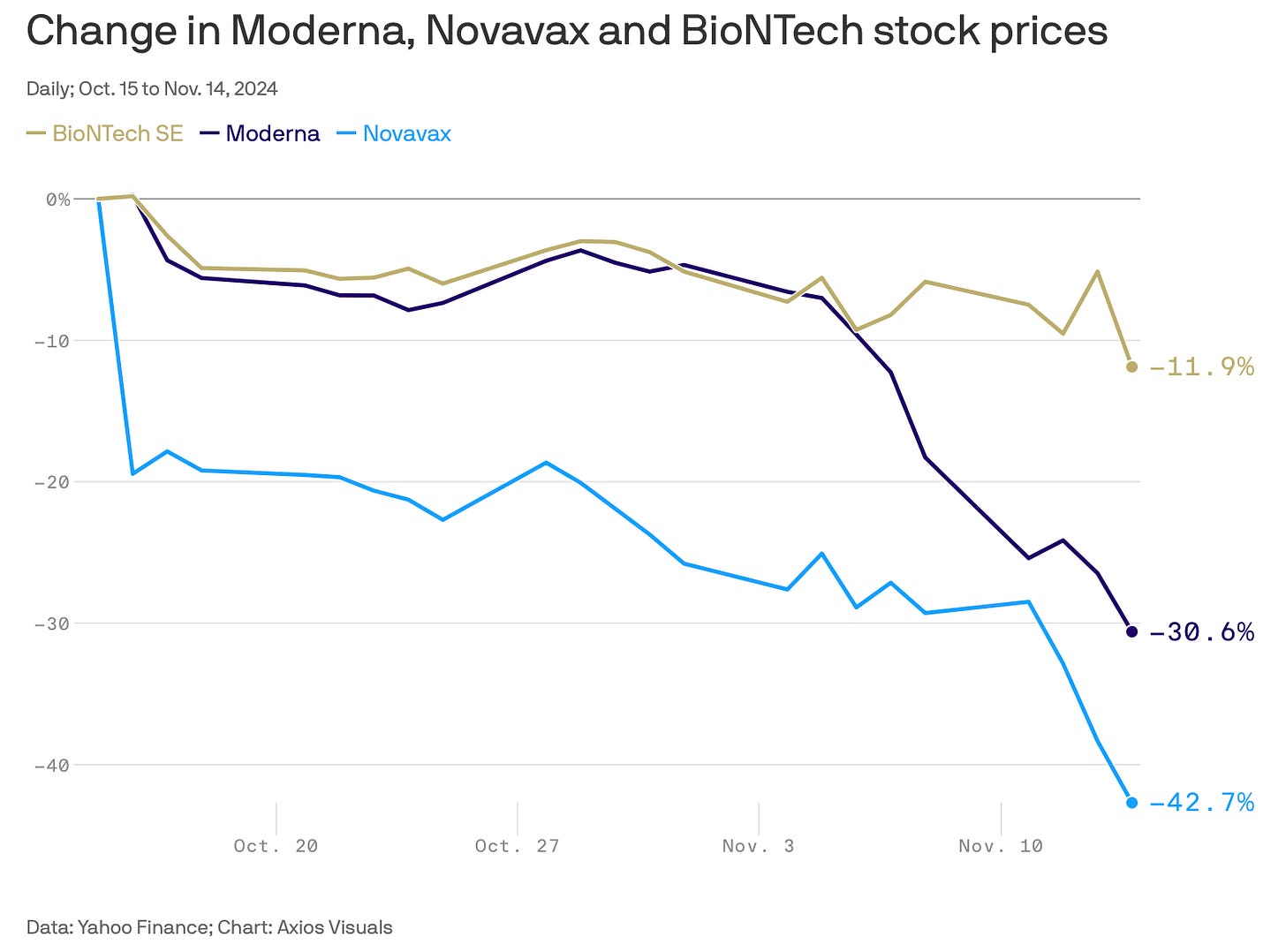

A surprise announcement on Thursday was Robert Kennedy Jr.’s appointment as Secretary of Health and Human Services (HHS), which caused pharmaceutical stocks to plummet, given Kennedy’s vaccine-skeptic views.

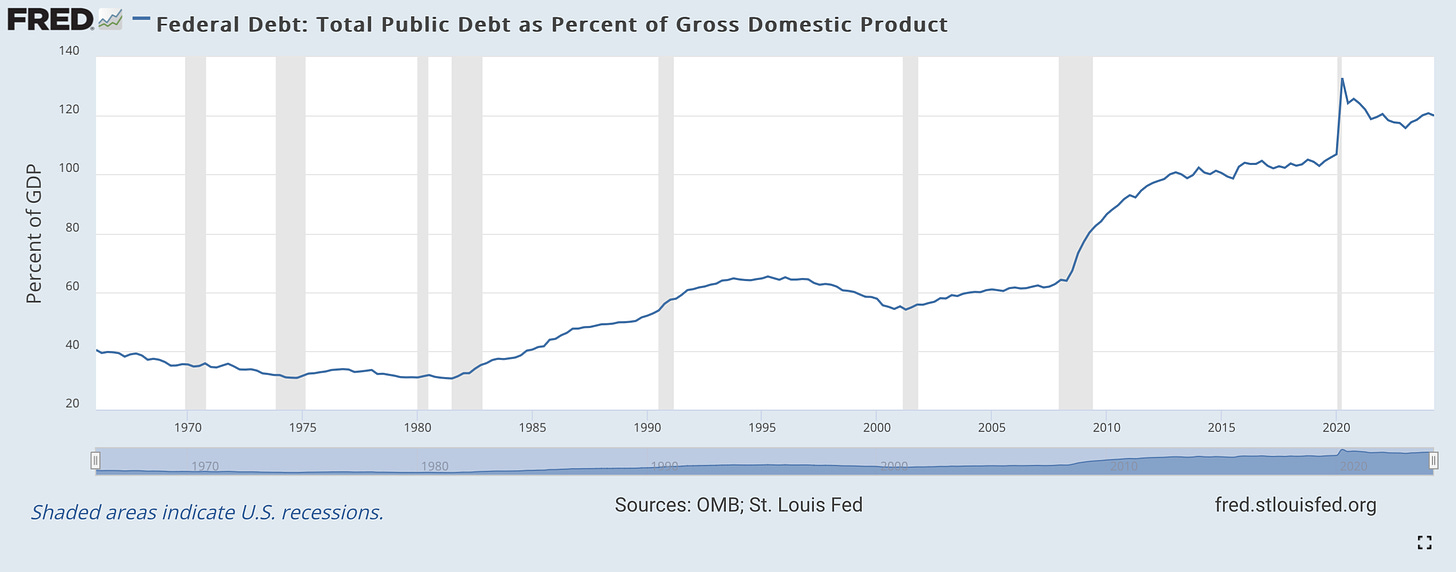

The new Trump administration will have to oversee a historically high U.S. debt of $36 trillion, with a debt-to-GDP ratio of 120 percent.

Failure to rein in this debt may result in a financial crisis and a loss in investor confidence, according our guest Sheila Bair, former FDIC (Federal Deposit Insurance Corporation) Chair and former Board Chair of Fannie Mae.

Bair said that excessive debt levels could erode investor confidence, leading to higher interest rates and significant economic pain.

“Make no mistake, if we continue on this path, investors will eventually lose confidence in our debt,” said Bair. “The change could be gradual or sudden, but the consequences will be painful no matter the pace.”

She said that the U.S. has long benefited from its status as the world's reserve currency, allowing the U.S. government to easily take on debt, but she warned that this advantage is not guaranteed indefinitely.

“We are the world's reserve currency,” said Bair. “That’s going to keep happening until it doesn’t.”

Addressing potential solutions, Bair called for maintaining moderate interest rates and emphasized that reducing debt relative to GDP is essential to regaining investor confidence.

Turning to the issue of inflation, Bear explained that it is driven by an imbalance between money supply and economic output, using the example of her children's book, Princess Penny and the Money Wizards, to illustrate how money printing causes inflation.

She also said that while low interest rates are politically popular and can temporarily boost borrowing, they often encourage risky financial behavior, asset bubbles, and economic instability.

“It’s a common misperception that low interest rates help the economy,” Bair explained. “The empirical research just isn’t there.”

Market Movements

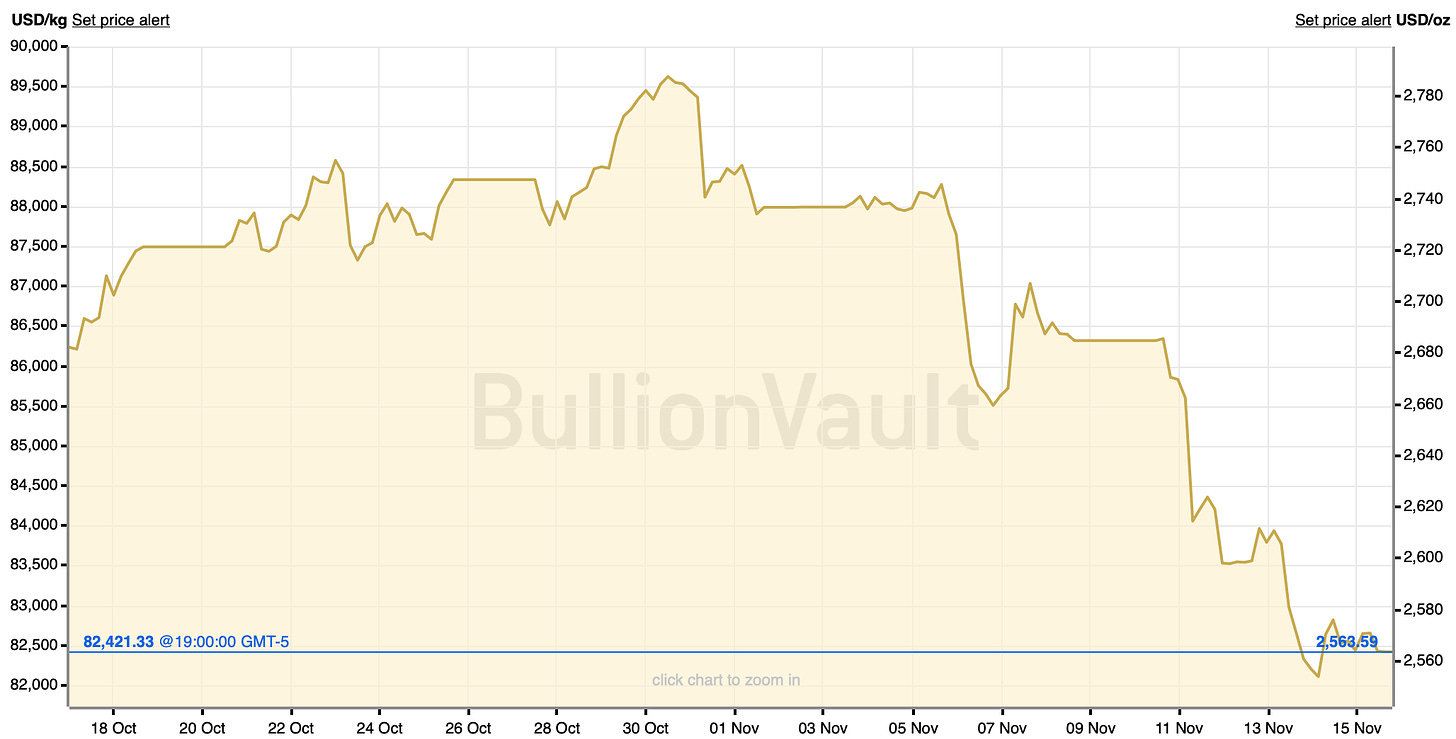

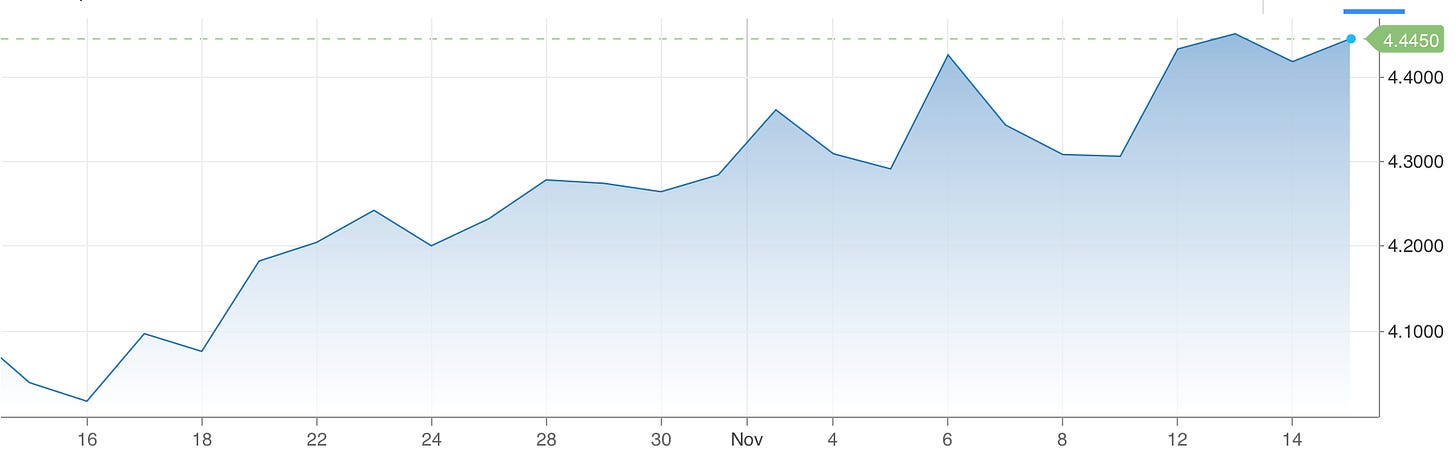

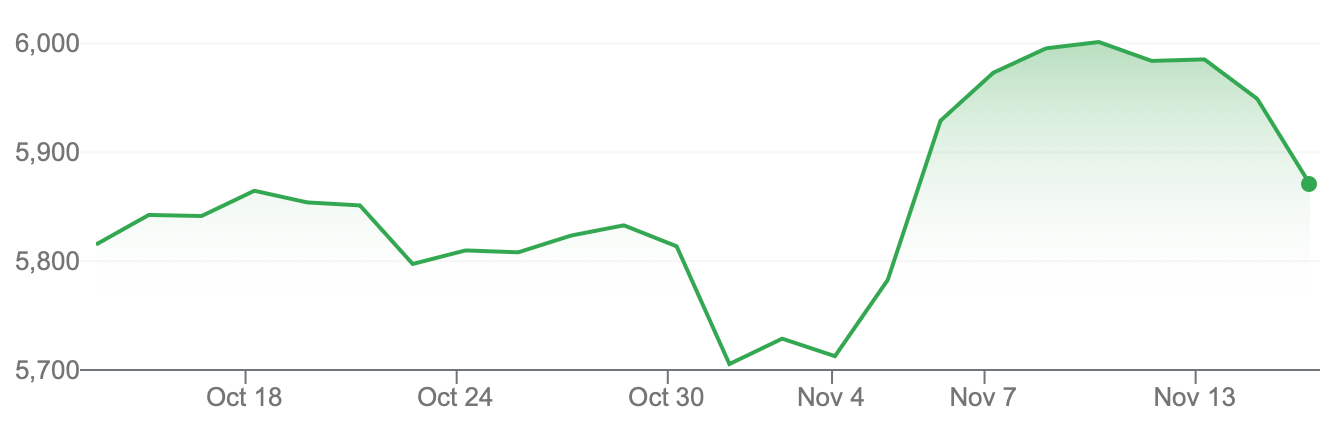

From November 8 to November 15, the following assets experienced dramatic swings in price. Data are up-to-date as of November 15 at 9pm ET (approximate).

MicroStrategy Inc. — up 26 percent.

Moderna — down 21.3 percent.

Dogecoin — up ~100 percent.

Walt Disney Co. — up 16.2 percent.

Copper — down 4.9 percent.

The following major assets experienced the following price movements during the same time interval.

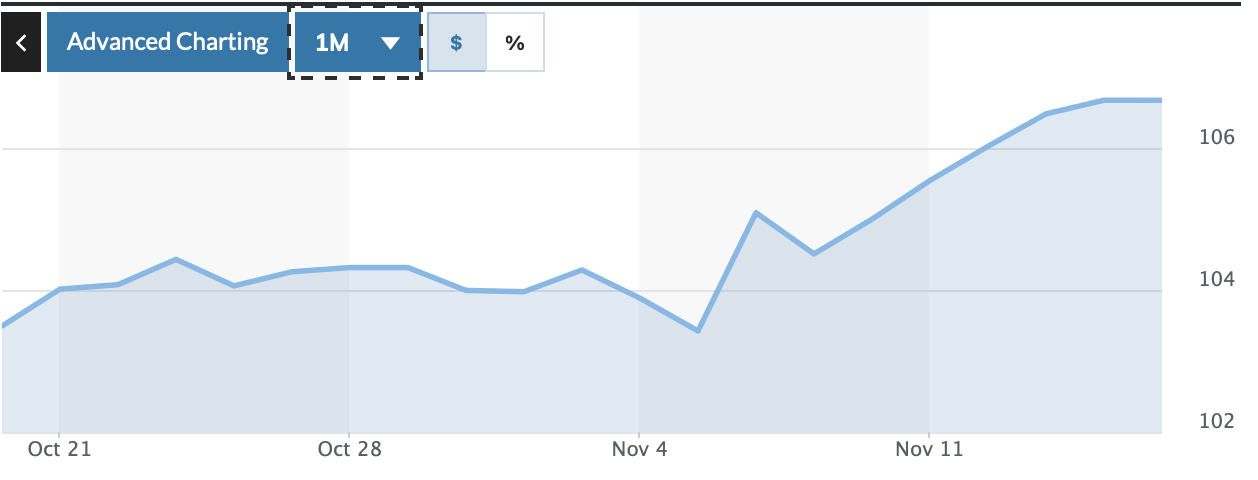

DXY — up 1.6 percent.

Bitcoin — up 20.6 percent.

Gold — down 4.6 percent.

10-year Treasury yield — up 3.1 percent.

S&P 500 — down 2.1 percent.

Russell 2000 — down 4 percent.

USD/yuan — up 0.8 percent.

EQUITIES:

THIS IS WHERE STOCKS WILL TOP

Gareth Soloway, November 11, 2024

We invited Gareth Soloway, Chief Market Strategist of VerifiedInvesting.com, to the show to give us his reaction to the recent rally in risk assets follow last week’s election.

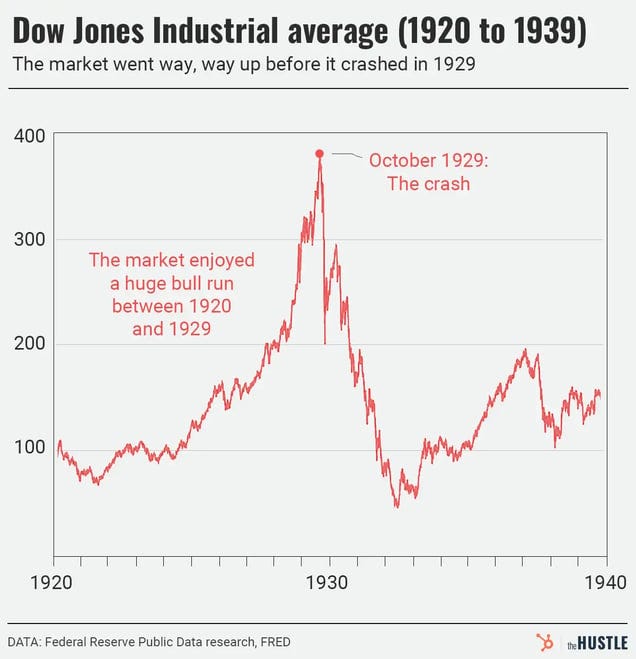

Soloway said that while the market's rally was expected due to Trump’s pro-business stance, the scale of the rally was surprising. He had a long-term target range of 6,000 to 6,100 points. This, according to Soloway, corresponds with the 1929 market high before The Great Depression.

“We are back to a trend line that goes back to 1929, almost a hundred years ago,” he said. “Think about what happened after each of these highs—it does make me a little bit concerned.”

When it comes to the economy, Soloway said that he was concerned about Trump’s new tariffs, which could raise the cost of goods and services, hence leading to more inflation. He said that retaliatory tariffs from other countries may worsen this problem.

“Tariffs can increase production in the U.S., but they also mean higher prices, which is inflationary,” said Soloway. “Don’t think that retaliation won’t come, especially with the level of tariffs that are going to be put on.”

He mentioned that while the Federal Reserve might want to cut rates to stimulate the economy, inflationary pressures from tariffs and other economic policies could limit their ability to do so.

“I do think you’re going to have that uptick in inflation over the next year or so, and that’s going to put the screws to the Fed,” he said.

Soloway maintained a cautious yet optimistic view on gold and bonds for 2025. He expected potential pullbacks in equities and Bitcoin, while anticipating that gold could regain its momentum.

ECONOMY:

INFLATION TO SURGE, BANKS WILL FAIL

Peter Schiff, November 12, 2024

Peter Schiff, Chief Market Strategist at Euro Pacific Asset Management, joined the show again to give us his economic outlook following Trump’s election to office.

Schiff said that while official GDP numbers may show growth, the reality is that this growth is inflated and not indicative of true economic health.

He said, “All these numbers are a function of inflation masquerading as growth. The real economy is weak.”

In particular, Schiff said that the U.S. is already experiencing stagflation, even if the Federal Reserve refuses to acknowledge it. He said that the Fed is in a difficult position to respond, given its limited monetary tools like rate cuts and quantitative easing.

Schiff also warned that the current higher interest rate environment, coupled with an increasing national debt, poses severe risks.

"We’re going to have much higher interest rates with much bigger debt," he said, predicting that this combination will push the U.S. towards greater economic instability.

Schiff said that the new Trump administration will not be able to effectively deal with rising debt levels, despite promises of a Department of Government Efficiency to combat wasteful spending.

“When Trump came to office [in his first term]... the annual deficit spending was about $650 billion officially,” said Schiff. “Now it’s well over $2 trillion a year.”

He also expressed concerns about the health of the banking system, emphasizing that banks are in a fragile state due to their exposure to low-yielding debt accumulated during a period of zero interest rates.

“The problem is the economy can't handle those higher rates,” said Schiff, warning about what would happen if Treasury yields rose to 6 percent. “A lot more banks would fail."

Schiff was bullish on gold despite recent declines post-Trump victory, arguing that the current market sentiment is mistaken.

He said, "Gold went up by about 40% during Trump's first term... I think it’s actually going to do a lot better despite what the markets are saying right now."

BONDS:

INTEREST RATES ABOUT TO SURGE

Peter Boockvar, November 10, 2024

We spoke again with Peter Boockvar, CIO of Bleakley Financial Group, about his outlook for various assets under the Trump economy.

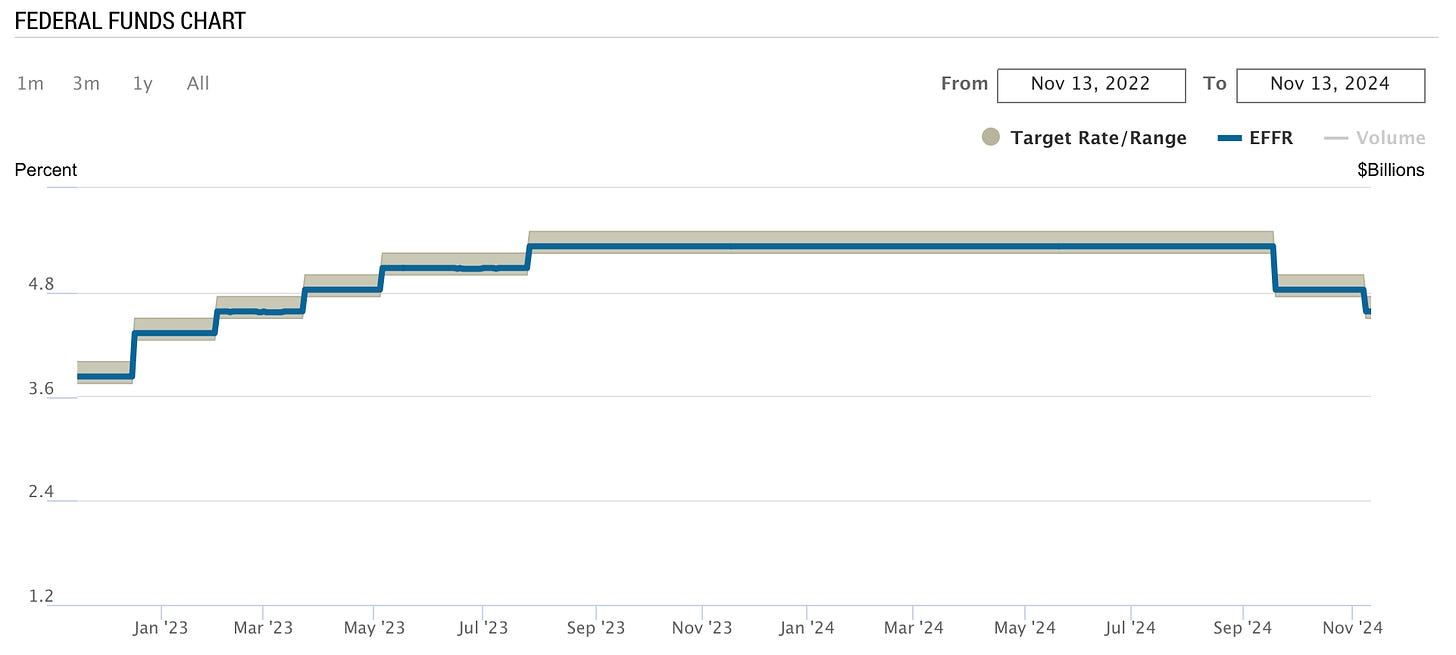

Boockvar said that the global bond market could experience an “unwind of an epic bubble.” He predicted that while the Federal Reserve (Fed) may continue to cut short-term rates, “longer-term interest rates across the yield curve are going to stay higher.”

In particular, he forecasted that the 10-year U.S. Treasury yield may re-test the 5 percent level due to worries about U.S. debt and deficits — or international factors, such as tariff battles.

He criticized the Fed for potentially misjudging the market's response to rate cuts, saying, “J. Powell in his press conference...was rather dismissive when someone asked him about this rise in long rates after you cut interest rates.”

Boockvar believed that this attitude could lead the Fed into “another mistake” if it fails to respond adequately to market signals, like the price of gold and the bond market's movements.

“A lot of what Powell tried to do...has sort of backfired and that's why I actually thought he should have done nothing at the November meeting,” said Boockvar.

The rise in the 10-year yield, Boockvar pointed out, was driven by a combination of inflation expectations and supply-demand dynamics in the bond market. This could reflect investors' growing concern over debt and deficit issues, not just in the U.S. but also observed in other sovereign bond markets, such as the U.K. and France.

GOLD:

WILL THE GOLD SELLOFF INTENSIFY?

Gary Wagner, November 13, 2024

Gary Wagner, Editor of TheGoldForecast.com, discussed the current state of the gold market following the election of Donald Trump as the 47th President of the United States.

Wagner said that Trump's win brought certainty to the markets, boosting equities and Bitcoin while causing a $200 decline in gold prices.

“Gold dropped $200 from the all-time record high due to the uncertainty premium being removed after Trump's election win,” say Wagner.

The strong performance of the U.S. dollar post-election also contributed to gold's downturn, as the two assets usually move in opposing directions.

Wagner said that Trump’s foreign policy, which would involve pacifying conflicts in Ukraine and The Middle East, would also put downward pressure on gold prices. He provided a technical analysis of gold's recent movements, identifying that it had likely entered a corrective phase after peaking at $2,800.

“I believe that $2,600, maybe $2,580, is the absolute floor of this current correction,” predicted Wagner, who added that “the fundamentals that propelled gold to $2,800 remain intact, suggesting we could see gold exceed that level after this correction.”

Wagner said that long-term investors would be wise to accumulate gold during this dip, with the expectation that prices could exceed $2,800 in the future. He also offered insights on silver, noting its high beta and recent price fluctuations that mirrored gold's movements.

“For long-term investors with a two- to three-year horizon, this pullback presents an excellent point to accumulate gold,” he said.

WHAT TO WATCH

Tuesday, November 19, 2024

Thursday, November 21, 2024

Thanks for reading The David Lin Report! Subscribe for free to receive new posts and support my work.